Week of February 6, 2026

The Week at a Glance:

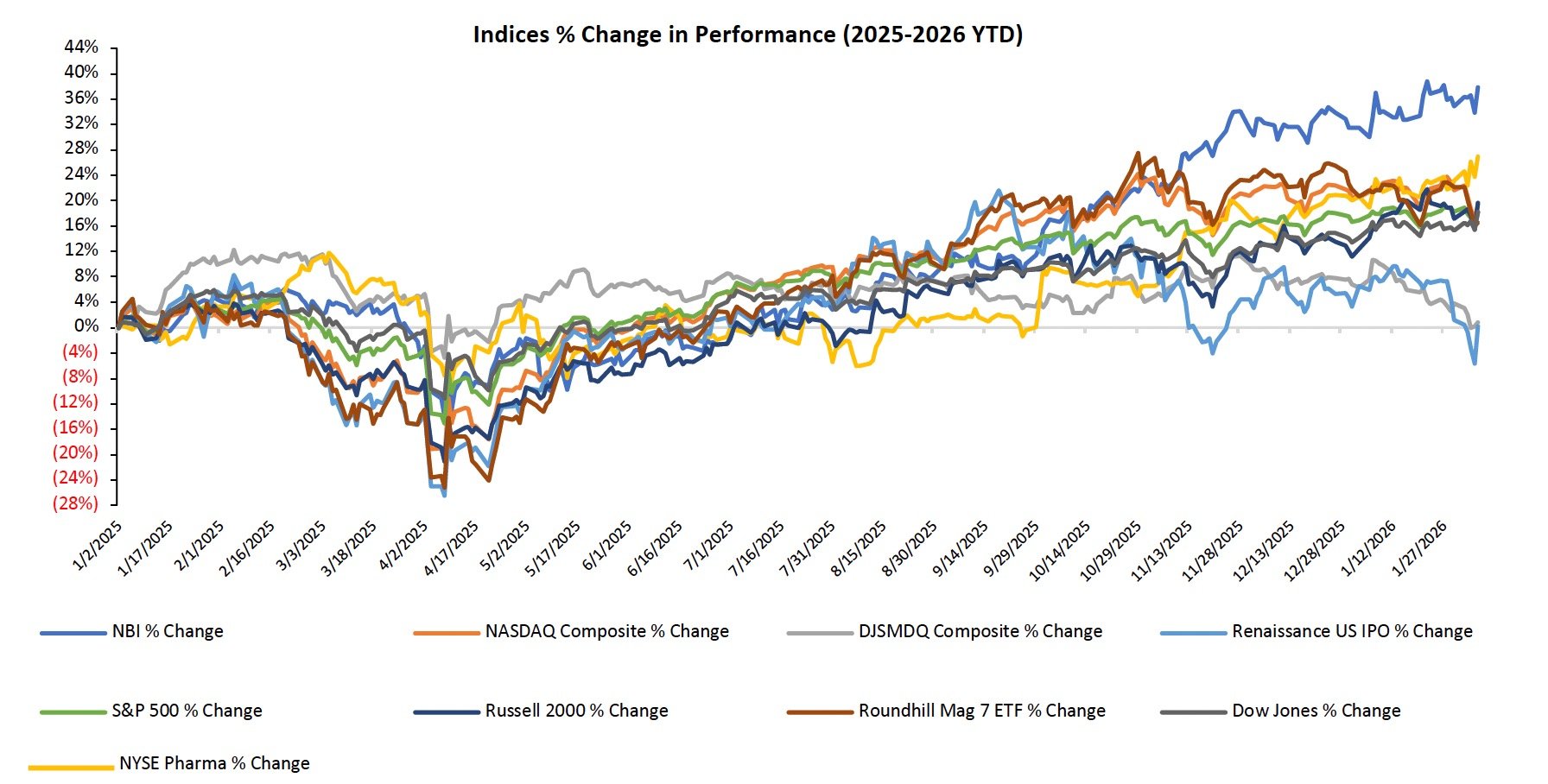

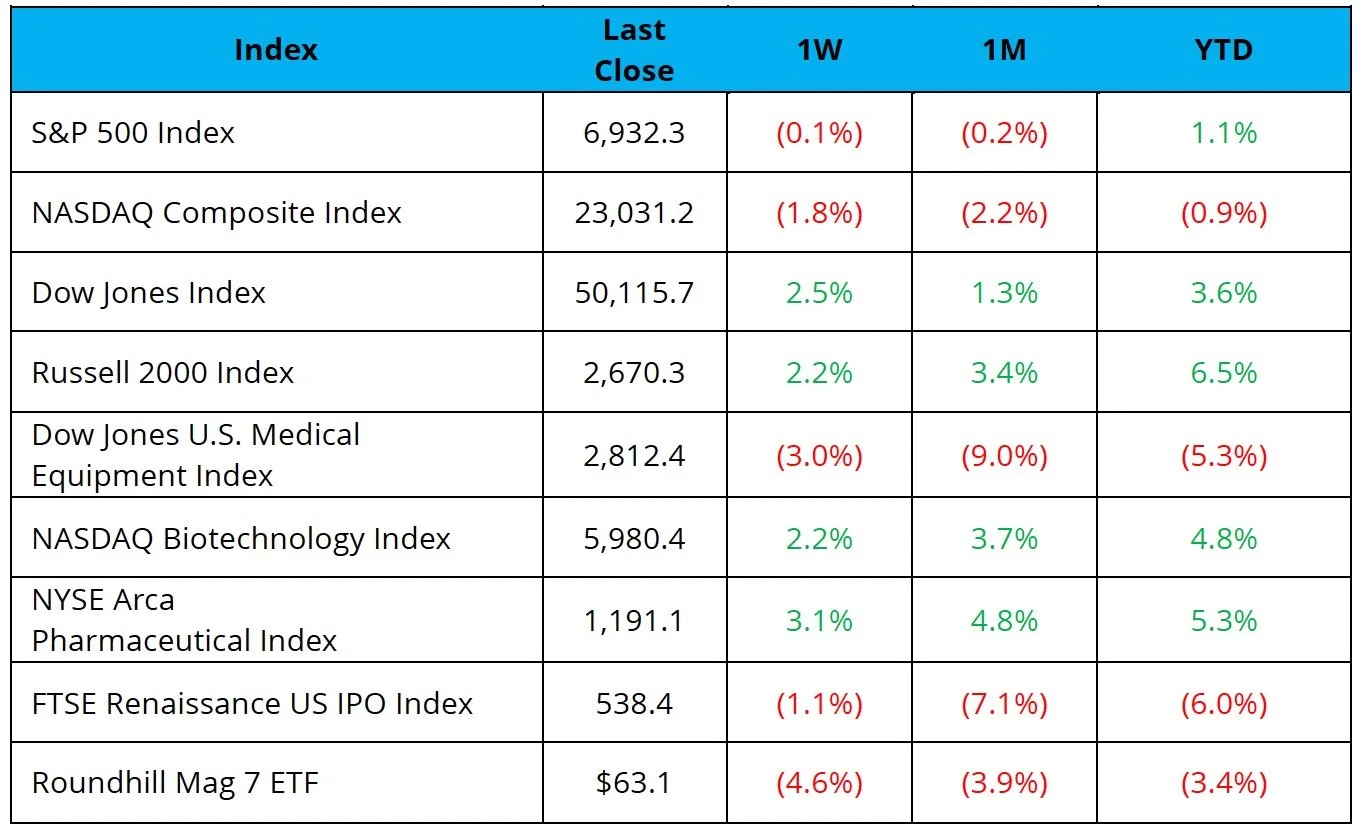

Capital Rotation Out of Tech Continues: The Nasdaq ended the week down 1.8% and is the worst-performing major index YTD, underscoring the rotation of capital out of tech and into sectors like healthcare that are viewed as undervalued relative to technology

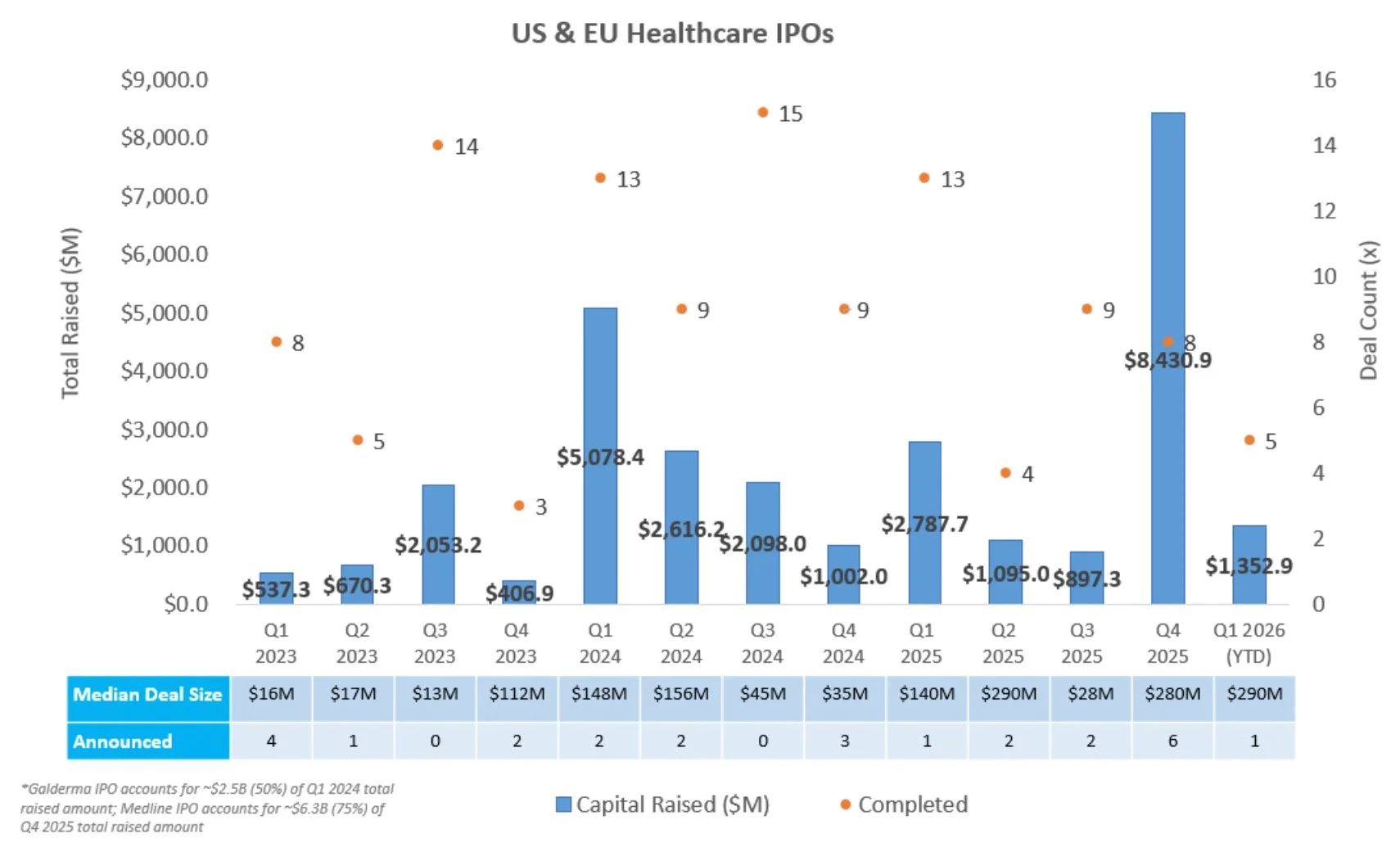

Clinical-Stage Biotech IPOs Are So Back: Four clinical-stage biotech companies (SpyGlass Pharma, Agomab Therapeutics, Eikon Therapeutics, Veradermics) went public last week raising an aggregate ~$987M, making it the best week for biotech IPOs since July 2021

Hims and Novo Drop the Mitts: Hims & Hers launched a cheaper, compounded version of Novo Nordisk’s new oral Wegovy weight-loss pill, prompting Novo to threaten legal action and the FDA to signal regulatory pushback, ultimately leading Hims to pause the offering amid safety, marketing, and compliance concerns

TrumpRx Goes Live: The White House launched TrumpRx.gov as a direct-to-consumer hub that routes patients to manufacturers/coupons for discounted prices on ~40+ drugs, but the true savings and overall impact remain uncertain

Markets Overview

The S&P 500 and Nasdaq were down 0.1% and 1.8%, respectively, while the Dow was up 2.5%

Despite reporting robust Q4 earnings growth of ~30% as of Friday, tech companies are seeing continued investor rotation out of the sector as markets reassess valuations

The NYSE Pharma Index and the NBI were up 3.1% and 2.2%, respectively

Notable changes in share price:

Roivant (NASDAQ: ROIV): Shares were up 19.5% on the week after the Company reported positive Phase 2 results for brepocitinib in cutaneous sarcoidosis, marking the first industry-sponsored placebo-controlled trial to readout positively in the indication

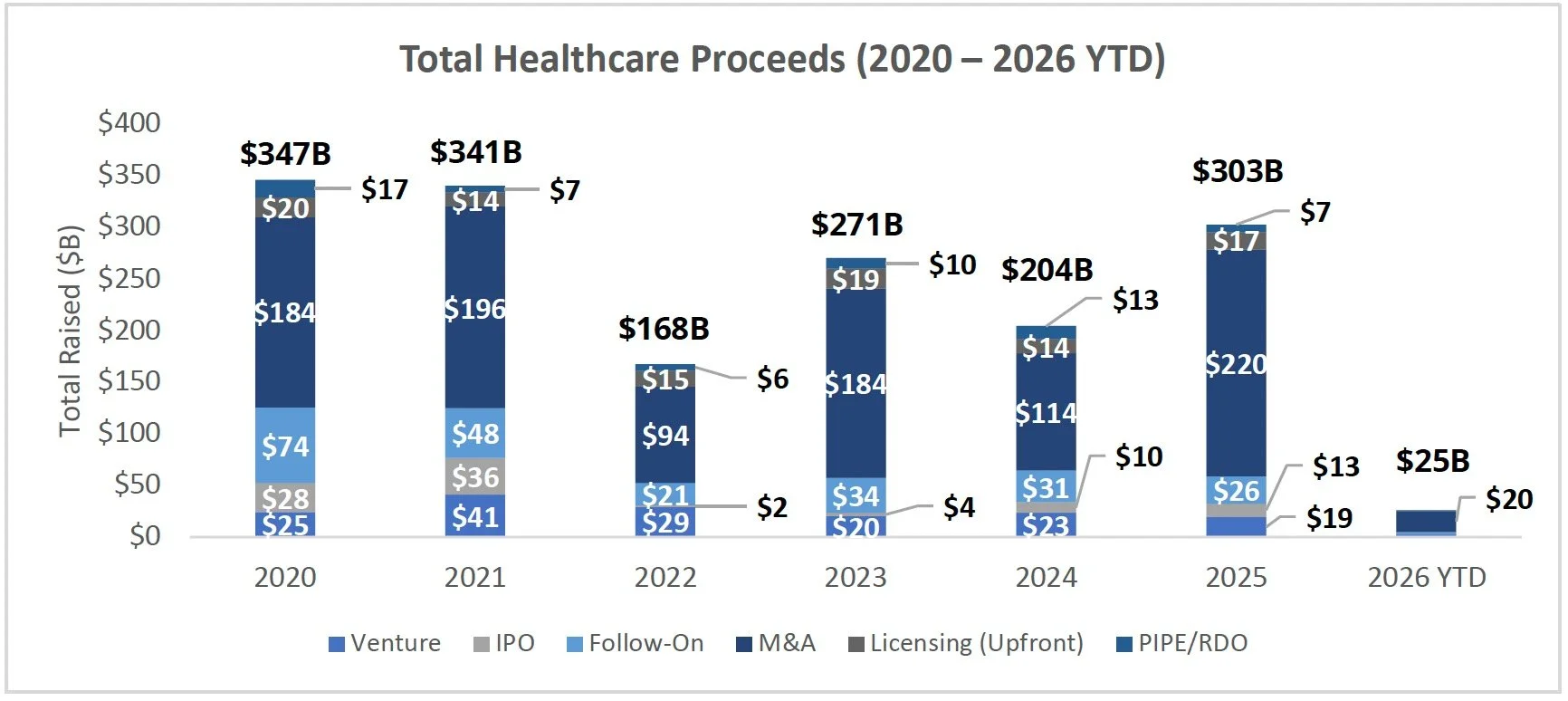

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

Four companies completed an IPO last week:

Eikon Therapeutics raised $381.2M to advance EIK1001, a systemically administered TLR-7/8 dual agonist, through Phase 2/3 registrational trials in combination with pembrolizumab (Keytruda) for advanced melanoma and stage 4 non-small cell lung cancer, alongside Phase 1/2 development of selective PARP1 inhibitors (EIK1003, EIK1004) and a WRN helicase inhibitor (EIK1005) for solid tumors

Veradermics raised $256.3M to advance VDPHL01, a proprietary extended-release oral formulation of minoxidil designed as the first non-hormonal oral therapeutic for hair regrowth, through multiple Phase 3 registrational trials and planned NDA submission for pattern hair loss (androgenetic alopecia) in women and men

Agomab Therapeutics raised $200.0M to advance ontunisertib (AGMB-129), an oral, gastrointestinal-restricted small molecule inhibitor of ALK5 (TGFβR1) with FDA Fast Track designation, into Phase 2b development for fibrostenosing Crohn's disease, an indication with no approved pharmacologic therapies, alongside advancement of AGMB-447, an inhaled lung-restricted ALK5 inhibitor, into Phase 2 for idiopathic pulmonary fibrosis

SpyGlass Pharma raised $150.0M to advance the BIM-IOL System, a novel drug-eluting intraocular lens featuring proprietary bimatoprost drug pads designed to deliver up to three years of sustained IOP-lowering therapy when implanted during routine cataract surgery, through two registrational Phase 3 trials for open-angle glaucoma and ocular hypertension

No companies filed an S1 intending to raise more than ~$100M

21 additional companies in the IPO queue are pursuing raises below $40M

IPOs priced in 2025 and 2026 have generated a median and average return of (1.7%) and 15.5% YTD, respectively, suggesting overall performance has been skewed by a small number of outsized winners. Notably, ~44% of newly public companies are trading above their offer price

After-Market Performance by Stage

Clinical-stage after-market performance (N=14): 29.6% (average), 5.4% (median)

Commercial-stage after-market performance (N=24): 12.4% (average), (4.6%) (median)

After-Market Performance by Sector

Biopharma (N=16): 15.5% (average), (0.1%) (median)

MedTech (N=23): 15.5% (average), (2.6%) (median)

Source: CapIQ

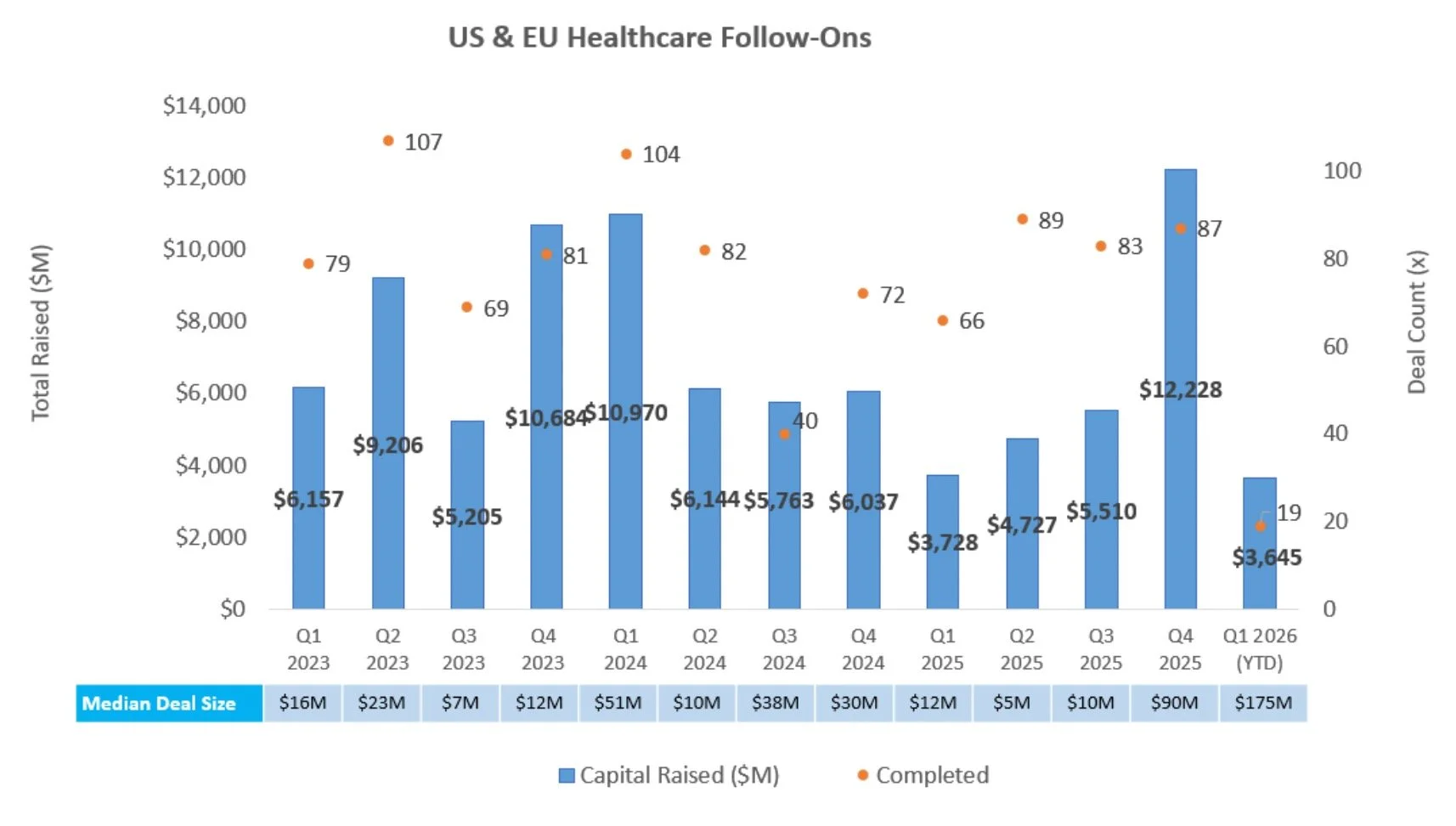

Follow-On Offering Markets:

There were two follow-on equity offerings totaling $166.6M last week, including:

Perspective Therapeutics (NYSE: CATX) raised ~$175M in a follow-on offering of common stock and pre-funded warrants to advance [²¹²Pb]VMT-α-NET, a next-generation targeted alpha therapy (TAT) directed at SSTR2-expressing neuroendocrine tumors, through its ongoing Phase 1/2a dose-finding and expansion study, alongside continued Phase 1/2a development of [²¹²Pb]VMT01 in combination with nivolumab for MC1R-positive metastatic melanoma and [²¹²Pb]PSV359 targeting FAP-α across multiple solid tumors, as well as expanded regional manufacturing buildout

Source: Biomedtracker

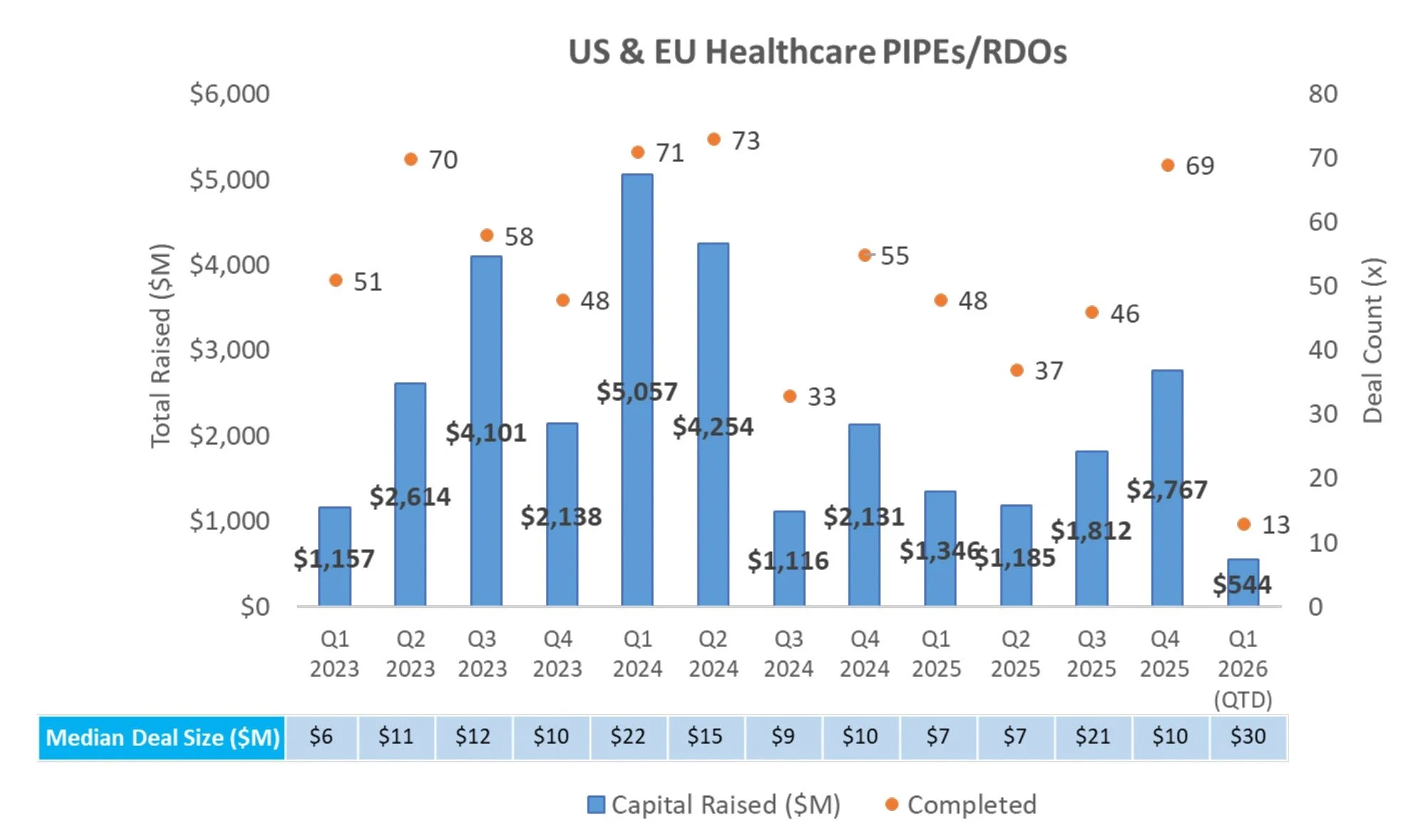

PIPE/RDO Markets:

There were three PIPEs/RDOs last week that raised an aggregate of $160.8M, including:

LB Pharmaceuticals (NASDAQ: LBRX) raised $100.0M to fund a Phase 2 trial for LB-102 as an adjunctive treatment for major depressive disorder, and for working capital and general corporate purposes

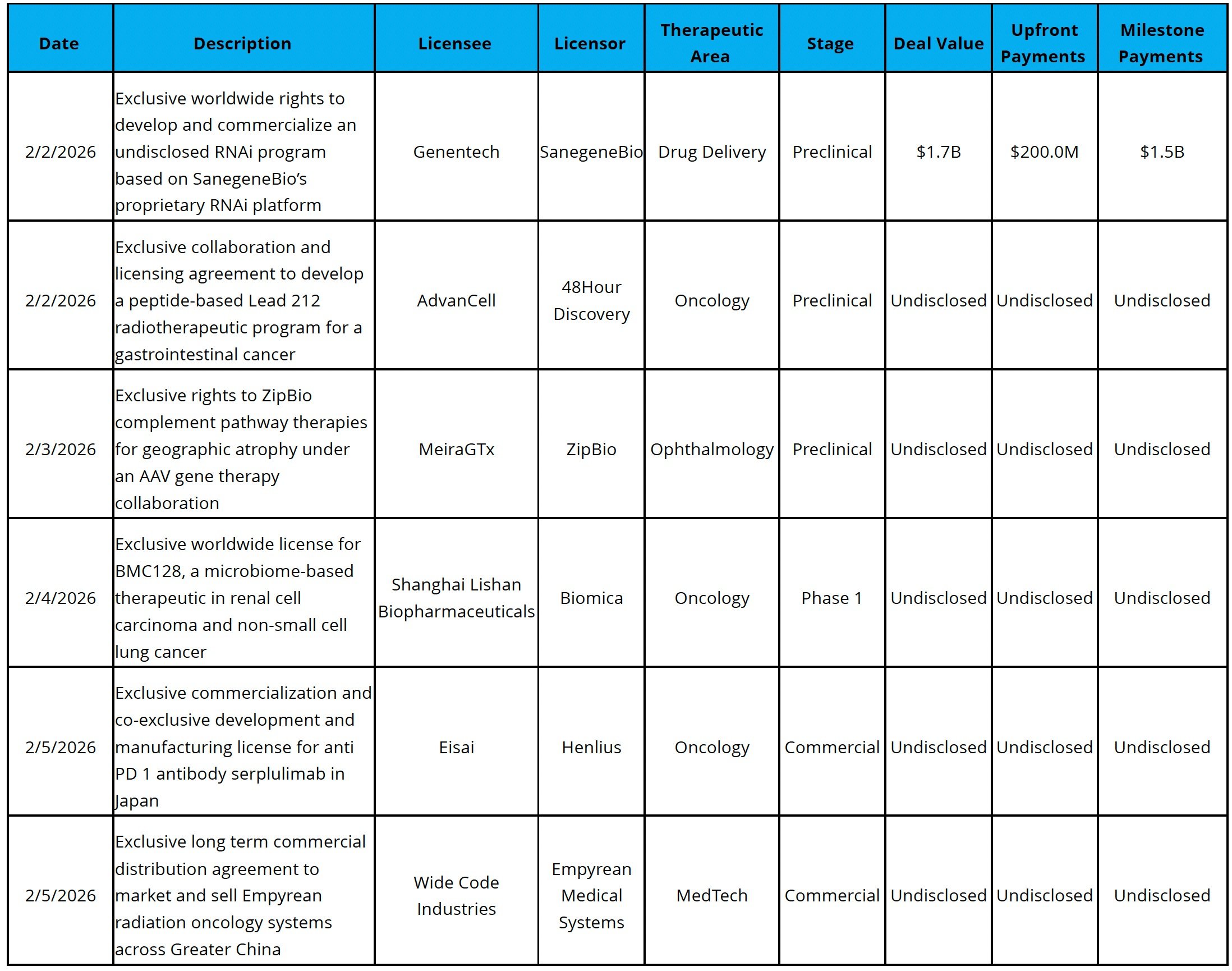

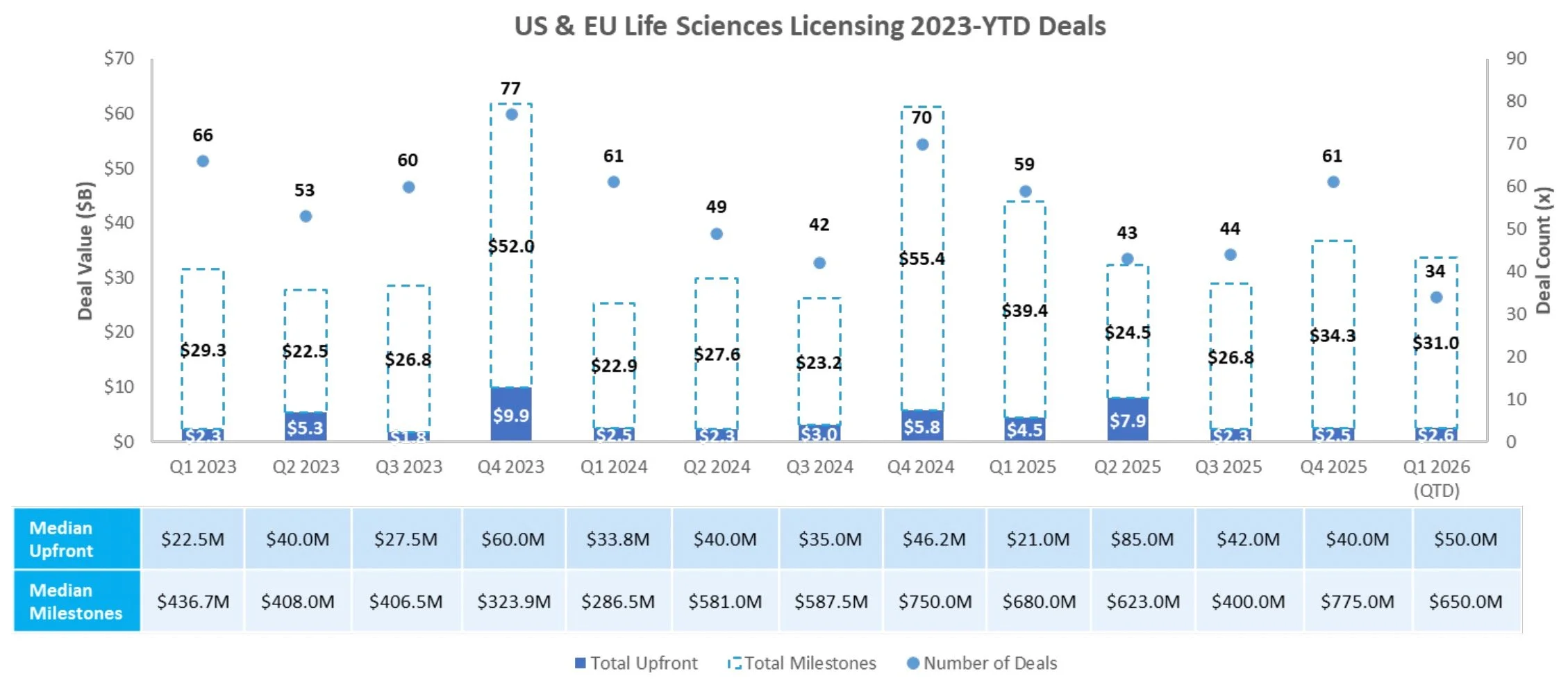

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

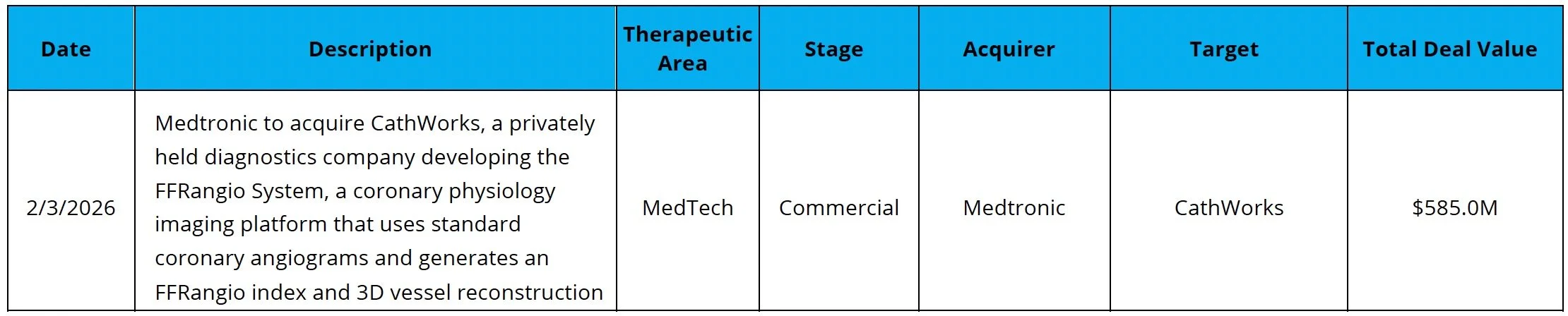

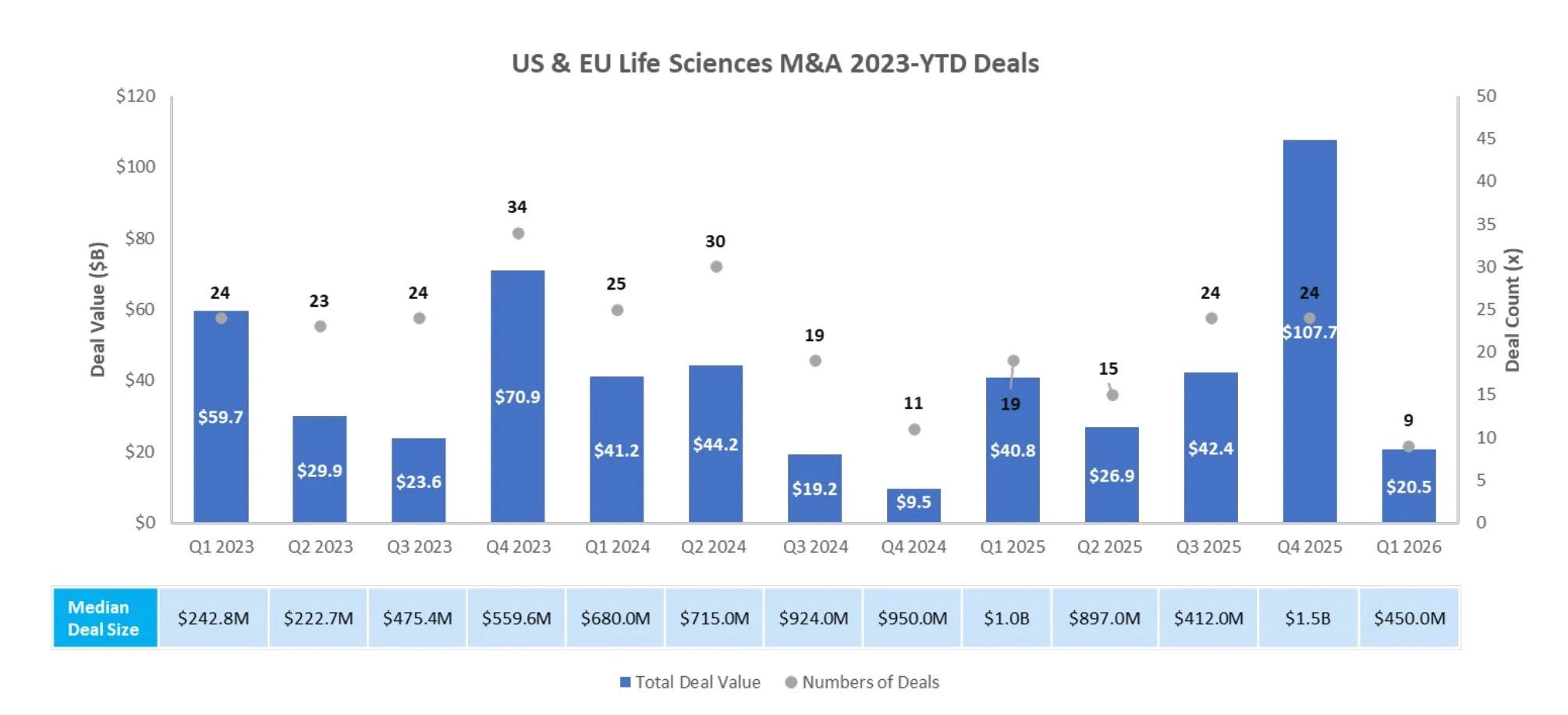

M & A

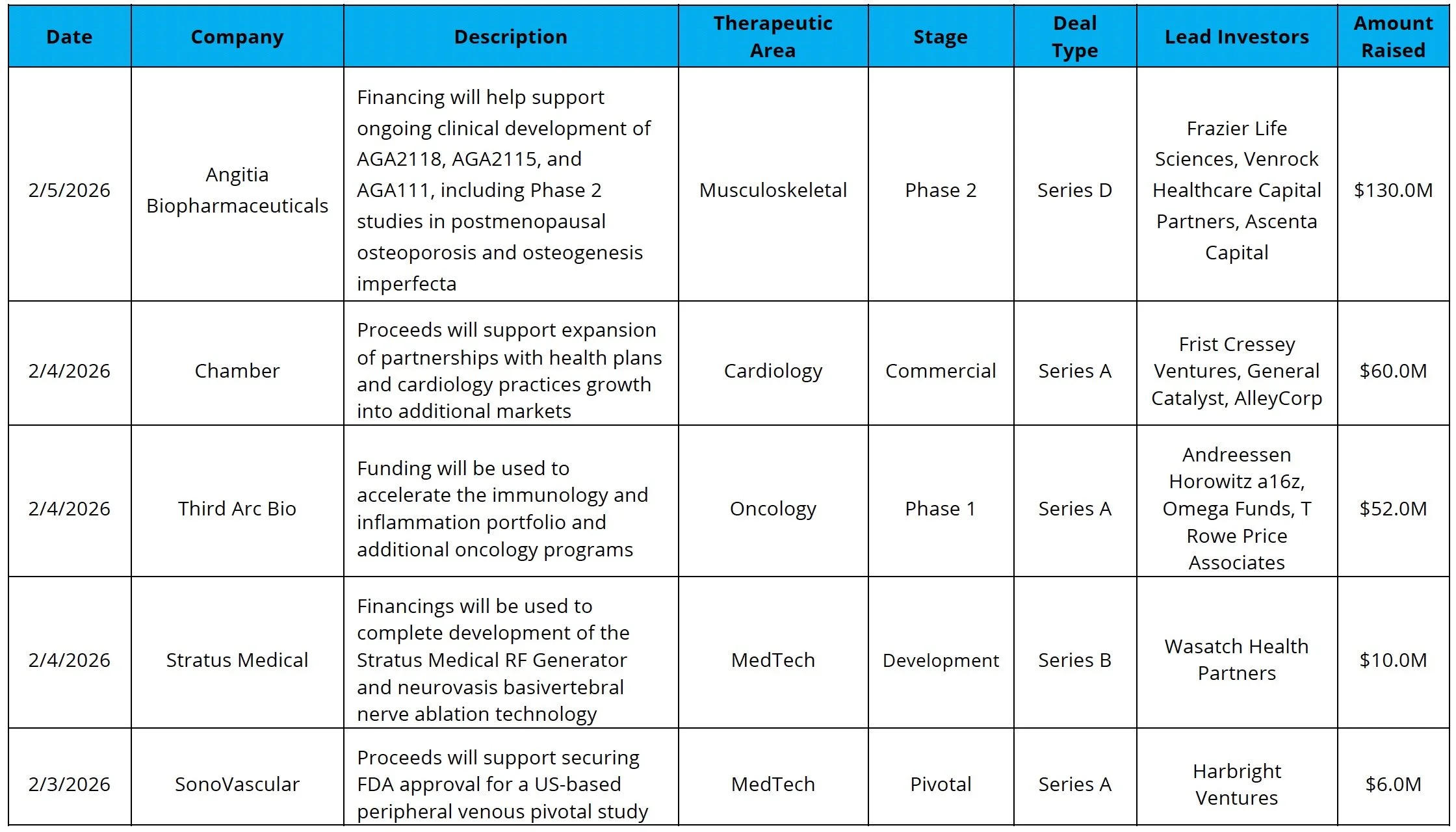

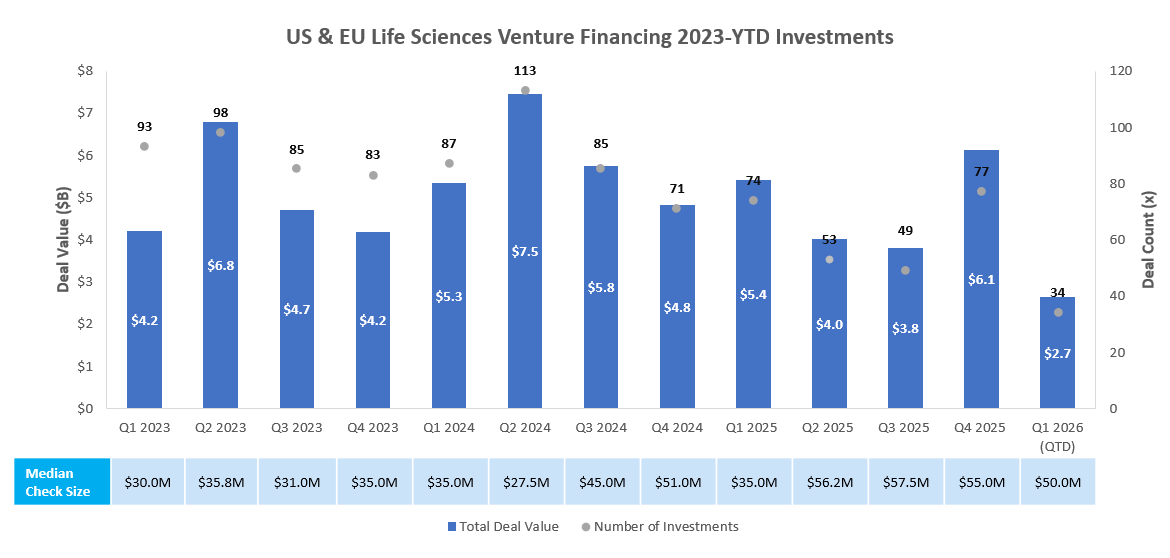

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speakers:

Day One: Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Day Two: Katrina Armstrong, Chief Executive Officer, Columbia University Irving Medical Center, Executive Vice President for Health and Biomedical Sciences for Columbia University

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

A MAP to the Future of Targeted Oncology

The latest in our series of healthcare analyst reports focuses on the mitogen-activated protein kinase (MAPK) pathway, one of the most commonly perturbed signaling pathways in human cancer. Flowing from RAS to RAF to MEK to EKR, the pathway is a master regulator of cell growth and survival. Therefore, the amplification of proteins or mutation of key signaling domains are a common hallmark of cancer.

HEALTHCARE MARKET REPORTS ARCHIVE

About DNB Carnegie | Back Bay

DNB Carnegie | Back Bay drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie | Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie | Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.