Week of June 13, 2025

The Week at a Glance:

New Geopolitical Conflict Results in Losses: The three major US indices finished the week with minor losses brought on by the escalating conflict between Israel and Iran

Vaccine Pannel Restructuring: The HHS removed all 17 members of the CDC’s Advisor Committee on Immunization Practices and announced eight new members, citing that a “clean sweep is needed to re-establish public confidence in vaccine science”

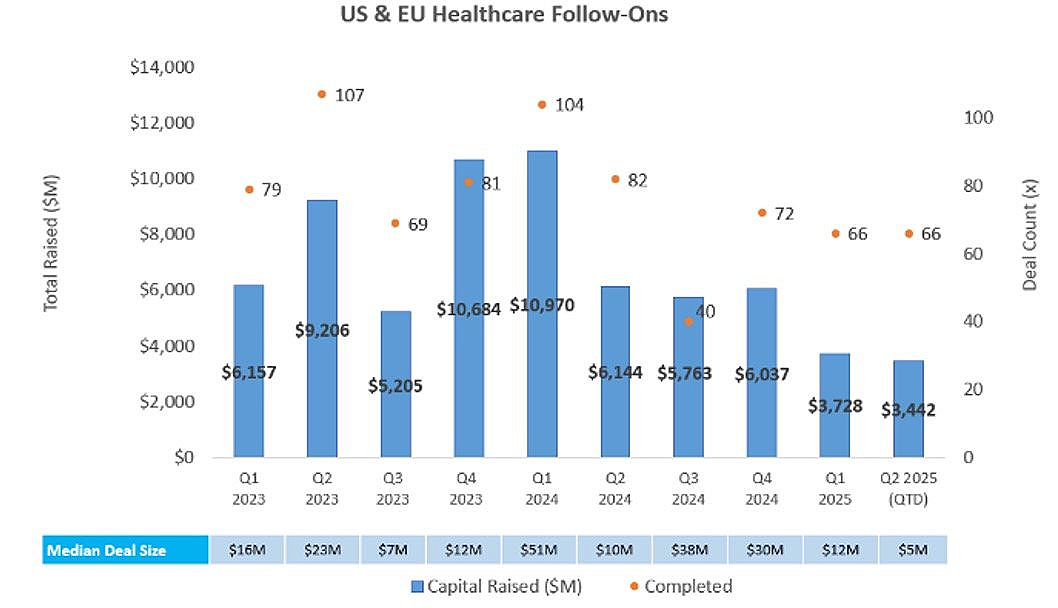

Meaningful Follow-On Activity: While Q2 2025 YTD has been one of the worst quarters for follow-ons over the past two years, last week saw a flurry of activity with $1.4B in proceeds raised, largely thanks to Insmed’s $750.0M offering

BioNTech Deal Activity Continues: Just a couple weeks after BioNTech inked the largest licensing deal YTD with BMS ($11.1B) for its PD-L1 x VEGF asset, BioNTech has made a move to build its oncology pipeline by acquiring mRNA-based cancer immunotherapy and infectious disease company CureVac for $1.3B

“Vital Signs” Update: Our investment banking team released an update to “Vital Signs: A Pulse Check on the Healthcare Market” to include key regulatory and healthcare market activity that has transpired since the article’s original release mid-May. View the report here.

Markets Overview

The S&P 500, Nasdaq, and Dow ended the week down 0.4%, 0.6%, and 1.3%, respectively

Oil prices raised 14% on Thursday night, hitting over $74 a barrel before pulling back, due to the air and drone attacks between Israel and Iran

The Consumer Price Index (CPI) inched up 0.1% month over month in May, slightly lower than analyst estimates of 0.2%; however, investors warn that the full impact of tariffs on inflation have yet to manifest

Healthcare indices outperformed the broader market last week with the NBI and NYSE Pharma Index up 0.7% and 3.0%, respectively

Notable changes in share price:

Insmed (NASDAQ: INSM): Shares ended the week up 33.6% following a positive Phase 2 readout in pulmonary arterial hypertension (PAH)

CureVac (NASDAQ: CVAC): Stock finished up 24.1% on the news that BioNTech will acquire the Company for $1.3B in an all-stock deal

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed IPOs or filed to go public last week.

20 companies in total remain in the queue, of which only two intend to raise more than $30.0M in proceeds

Of these, eight companies filed between Q4 2024 and today

Year-to-date, companies that have gone public in 2025 have delivered an average return of -5.4% and a median return of -2.4%

Source: CapIQ

Follow-On Offering Markets:

There were 16 follow-on offerings last week totaling $1.4B, with four deals over $30.0M:

Insmed (NASDAQ: INSM) raised $750.0M in a follow-on equity offering to continue commercialization and development of medicines for serious pulmonary and rare diseases, such as nontuberculous mycobacterial lung disease and pulmonary arterial hypertension

BrightSpring Health Services (NASDAQ: BTSG) raised $304.50M in a follow-on equity offering to continue expanding its network of community-based healthcare services, including home health, rehab, hospice, and pharmacy operations

Enliven Therapeutics (NASDAQ: ELVN) raised $165.0 in a follow-on equity offering to continue development of its pipeline of next-generation kinase inhibitors for high-incidence cancers such as chronic myeloid leukemia, NSCLC, and HER2+ breast and colorectal cancer

Cabaletta Bio (NASDAQ: CABA) raised ~$78.40M in a follow-on equity offering to continue developing engineered T-cell therapies for patients with autoimmune diseases, such as dermatomyositis, anti-synthetase syndrome, and immune-mediated necrotizing myopathy

Source: Biomedtracker

PIPE/RDO Markets:

There were four PIPEs/RDOs the past week totaling $121.4M in proceeds, with the majority from ADC Therapeutics’ $100M PIPE to fund further development and commercialization of CD-19 targeted ADC Zynlonta

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obsesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.