Week of January 23, 2026

The Week at a Glance:

Greenland Deal Partly Alleviated Market Concerns: On Thursday, President Trump said the US had reached a NATO-brokered “framework” on Greenland that he claimed would provide total and permanent US access, prompting him to drop tariff threats against Europe and rule out using force; equities rebounded on the headlines, while the dollar continued to weaken

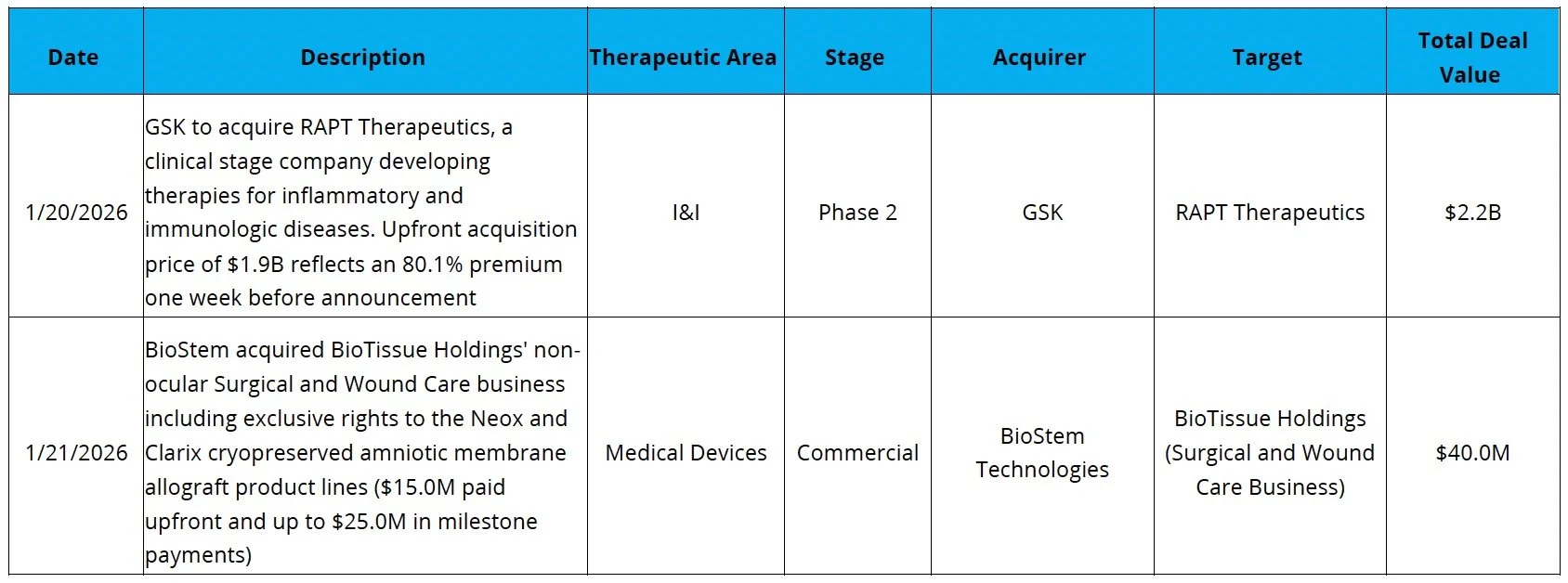

Clinical-Stage M&A Rebound Continues: GSK agreed to acquire RAPT for $2.2B, with $1.9B upfront, to secure ozureprubart (Phase 2, long-acting anti-IgE) in food allergy, signaling GSK’s push under new CEO Luke Miels to refresh its I&I pipeline ahead of looming patent expiries

Consensus Over-Pessimism is Amplifying Earnings Beats: Healthcare is clearing estimates partly because analysts revised forecasts down more aggressively than other sectors, lowering the hurdle, and the latest guidance mix supports that “reset” narrative as healthcare has the strongest skew toward positive FY EPS guidance (40 positive vs. 9 negative. Source: FactSet), helping explain the prior valuation drag, the current re-rate, and improving ECM and deal-making confidence

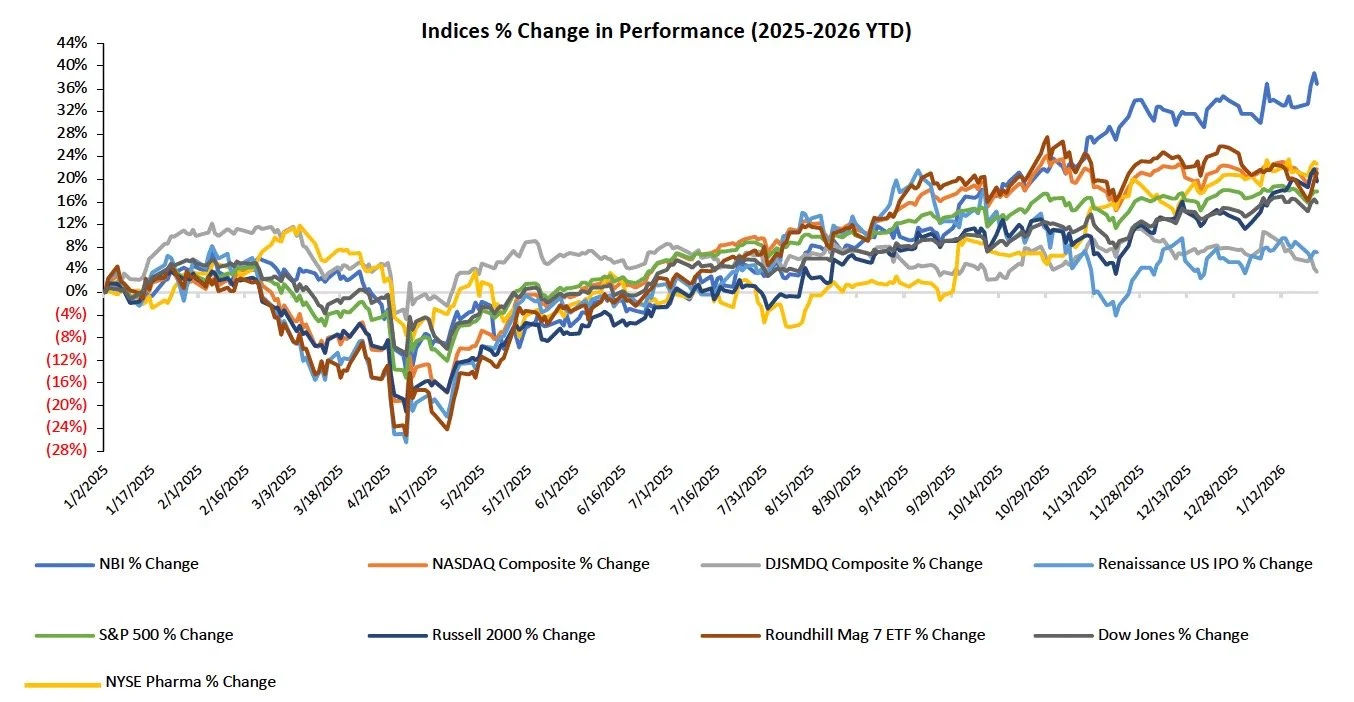

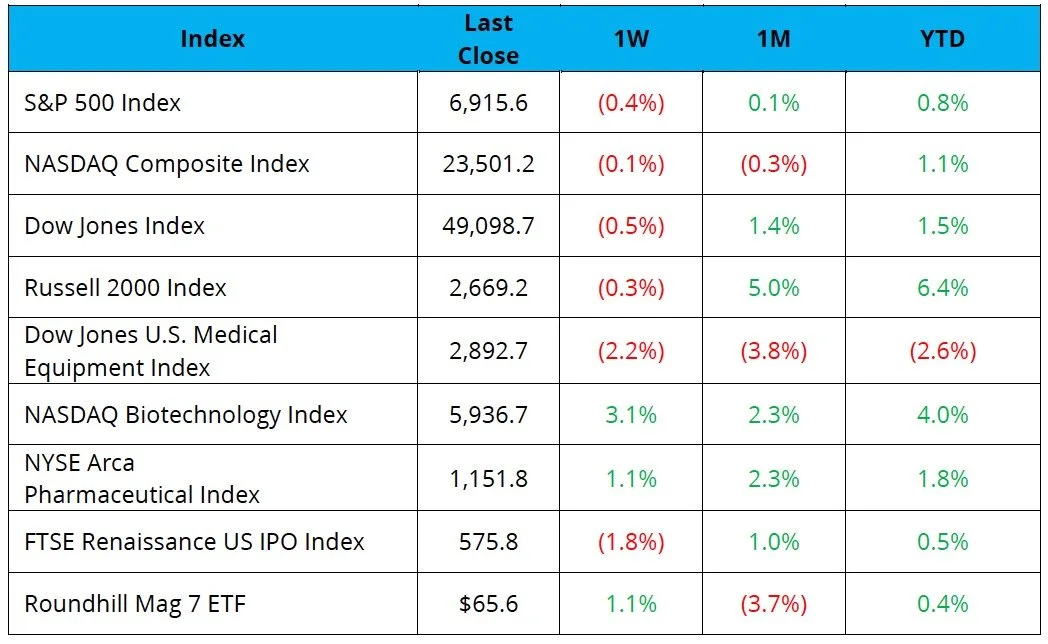

Markets Overview

The S&P 500, Nasdaq, and the Dow were down 0.4%, 0.1%, and 0.5%

Tariff threats and uncertainty around the Greenland talks drove volatility throughout the week. Major indices sold off after Trump announced a Europe tariff threat on Saturday, before later recovering after he said a deal had been struck with NATO

The NYSE Pharma Index and NBI were up 1.1% and 3.1%, respectively

Notable changes in share price:

Corvus Pharmaceuticals (NASDAQ: CRVS): Shares rose 251.5% after the Company released strong data from their oral ITK inhibitor in Phase 1 for atopic dermatitis

Lisata Therapeutics (NASDAQ: LSTA): Shares jumped 94.8% after the Company agreed to be acquired by Kuva Labs for $4.00 per share plus two $1.00 CVRs, with the deal focused on certepetide, an iRGD cyclic peptide

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

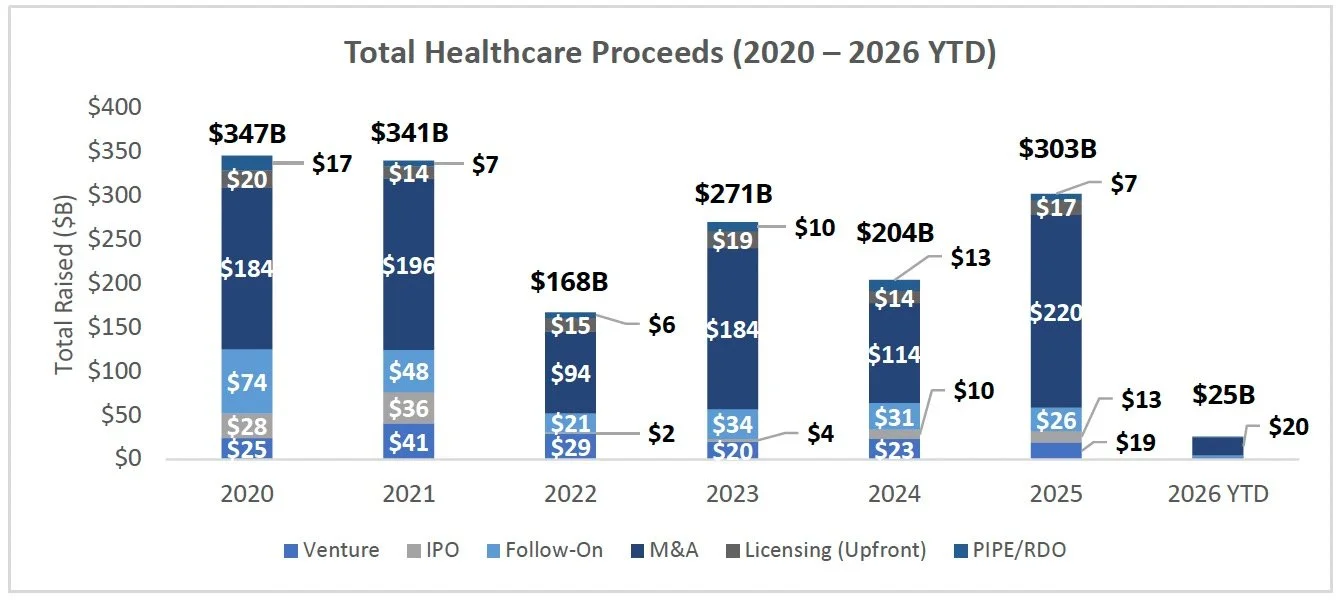

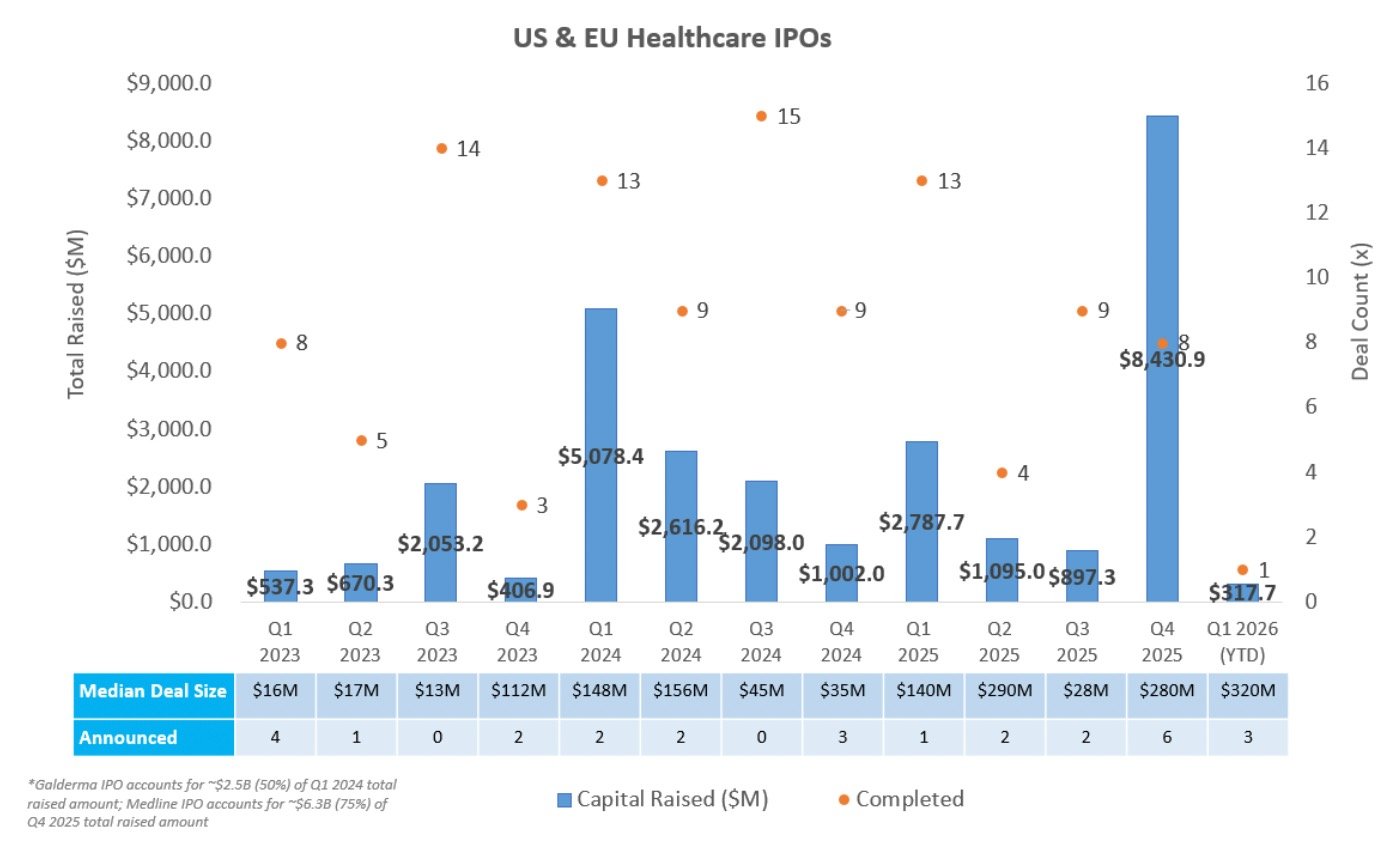

IPO Markets:

No companies completed an IPO last week.

One company announced plans to publicly list:

AgomAb Therapeutics plans to raise ~$100.0M to advance its fibrosis pipeline, including ontunisertib (AGMB-129), an oral gut-restricted ALK5 inhibitor in Phase 2a for fibrostenosing Crohn's disease, and AGMB-447, an inhaled ALK5 inhibitor in Phase 1 for idiopathic pulmonary fibrosis (IPF)

Three companies in the IPO queue are targeting raises at or above ~$100M

1/16/2026

AgomAb Therapeutics ~$100.0 Intended Raised

1/16/2026

SpyGlass Pharma ~$100.0 Intended Raised

1/9/2026

Eikon Therapeutics ~$300.0 Intended Raised

Twenty additional companies in the IPO queue are pursuing raises below $40M, with one additional company (MiniMed Group) not yet disclosing its intended raise amount

IPOs priced in 2025 have generated a median and average return of 5.8% and 24.3%, respectively, suggesting overall performance has been skewed by a small number of outsized winners. Notably, ~60% of newly public companies are trading above their offer price

Source: CapIQ

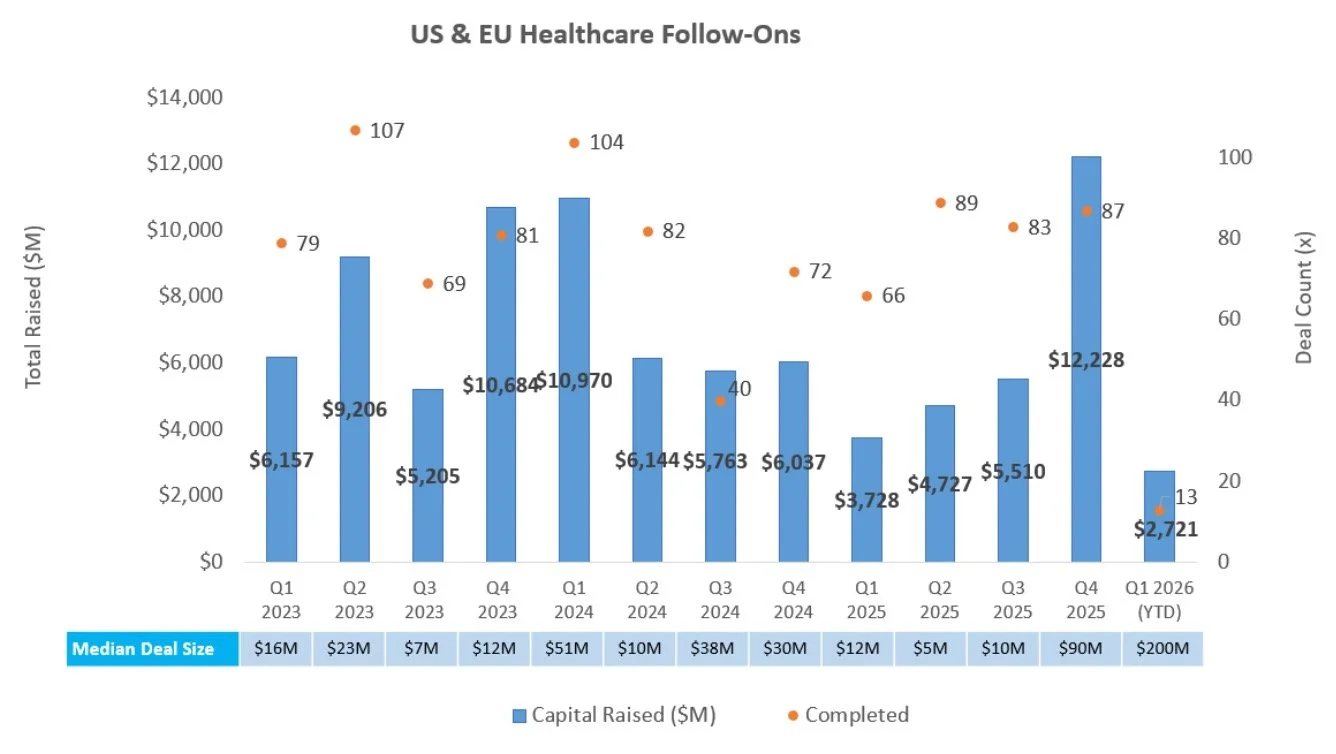

Follow-On Offering Markets:

There were five follow-on equity offerings totaling $670.5M last week, including:

Erasca, Inc. (NASDAQ: ERAS) raised $225.0M to support clinical development of its RAS/MAPK pathway-targeting oncology portfolio, including ERAS-0015 (potential best-in-class pan-RAS molecular glue) in Phase 1 for RAS-mutant solid tumors, ERAS-4001 (potential first-in-class pan-KRAS inhibitor) in Phase 1 for KRAS-mutant solid tumors, and naporafenib (pan-RAF inhibitor) in development for NRAS-mutant melanoma

Corvus Pharmaceuticals, Inc. (NASDAQ: CRVS) raised $201.2M to support clinical development of its ITK inhibitor portfolio, including soquelitinib in a registrational Phase 3 trial for relapsed/refractory peripheral T-cell lymphoma, and Phase 2 trials in atopic dermatitis, hidradenitis suppurativa, and asthma

Axogen, Inc. (NASDAQ: AXGN) raised $124.0M to support debt payoff and commercialization of its peripheral nerve repair portfolio, including recently FDA-approved Avance (acellular nerve allograft) for sensory, mixed, and motor peripheral nerve discontinuities

BioAge Labs, Inc. (NASDAQ: BIOA) raised $115.0M to support clinical development of its metabolic disease and aging pipeline, including BGE-102 (oral NLRP3 inhibitor) in Phase 1 for cardiovascular risk and retinal diseases including diabetic macular edema, as well as APJ agonists in preclinical development for obesity

Source: Biomedtracker

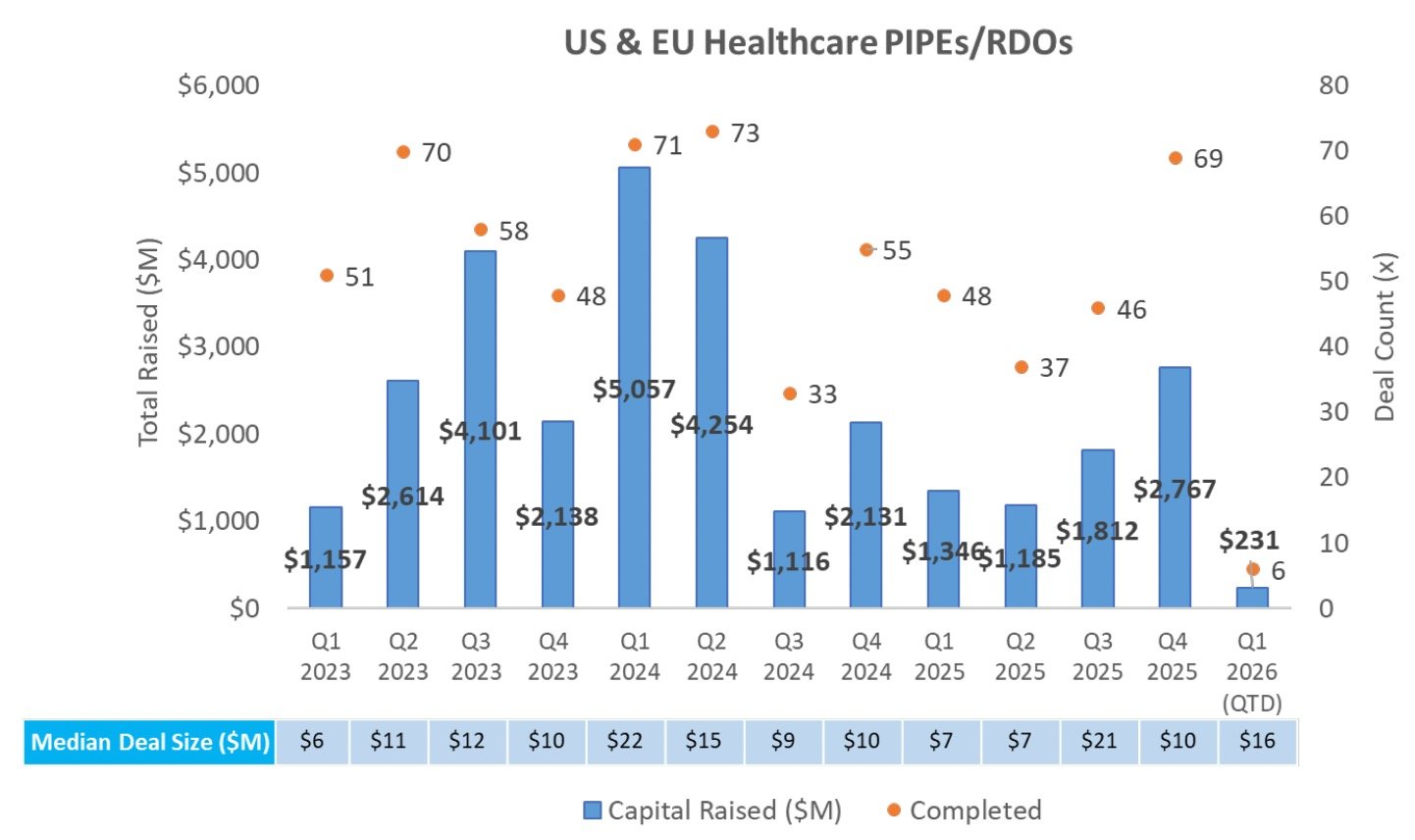

PIPE/RDO Markets:

There was one PIPE last week that raised $5.9M

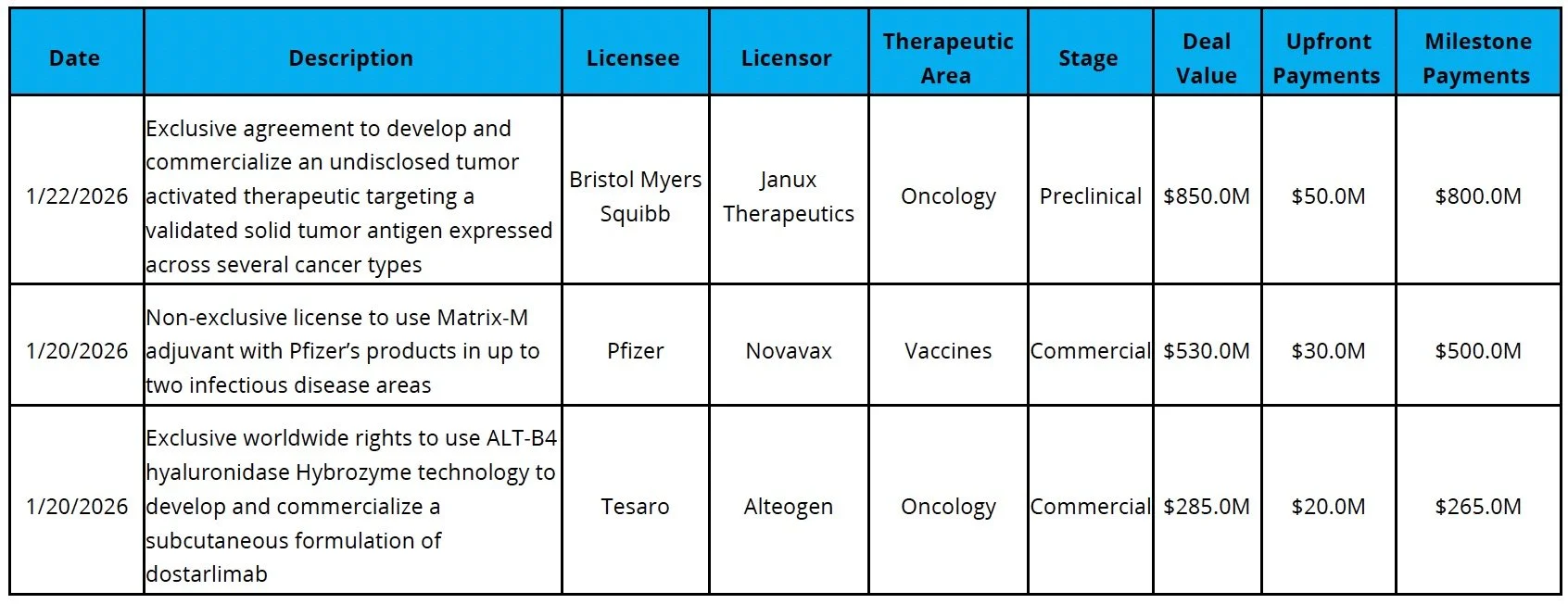

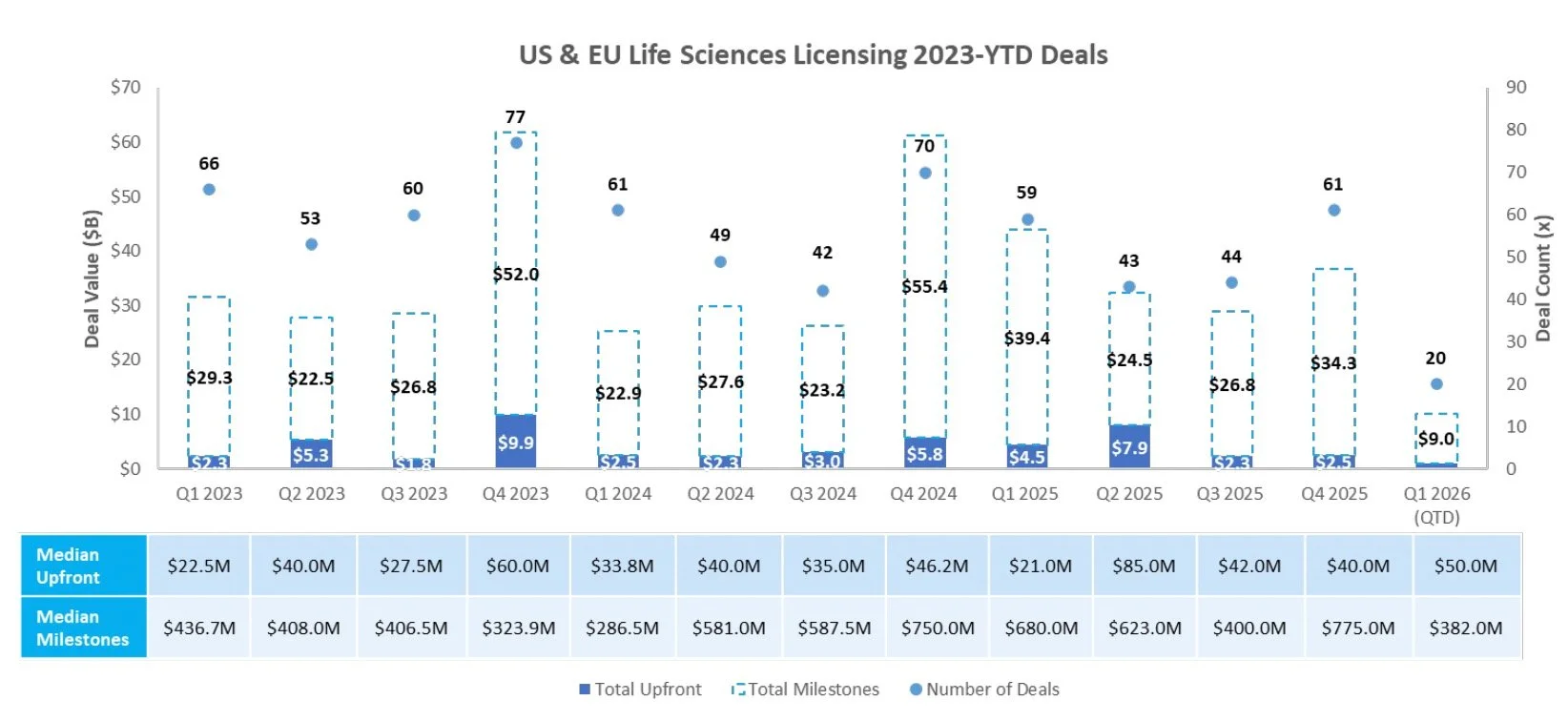

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

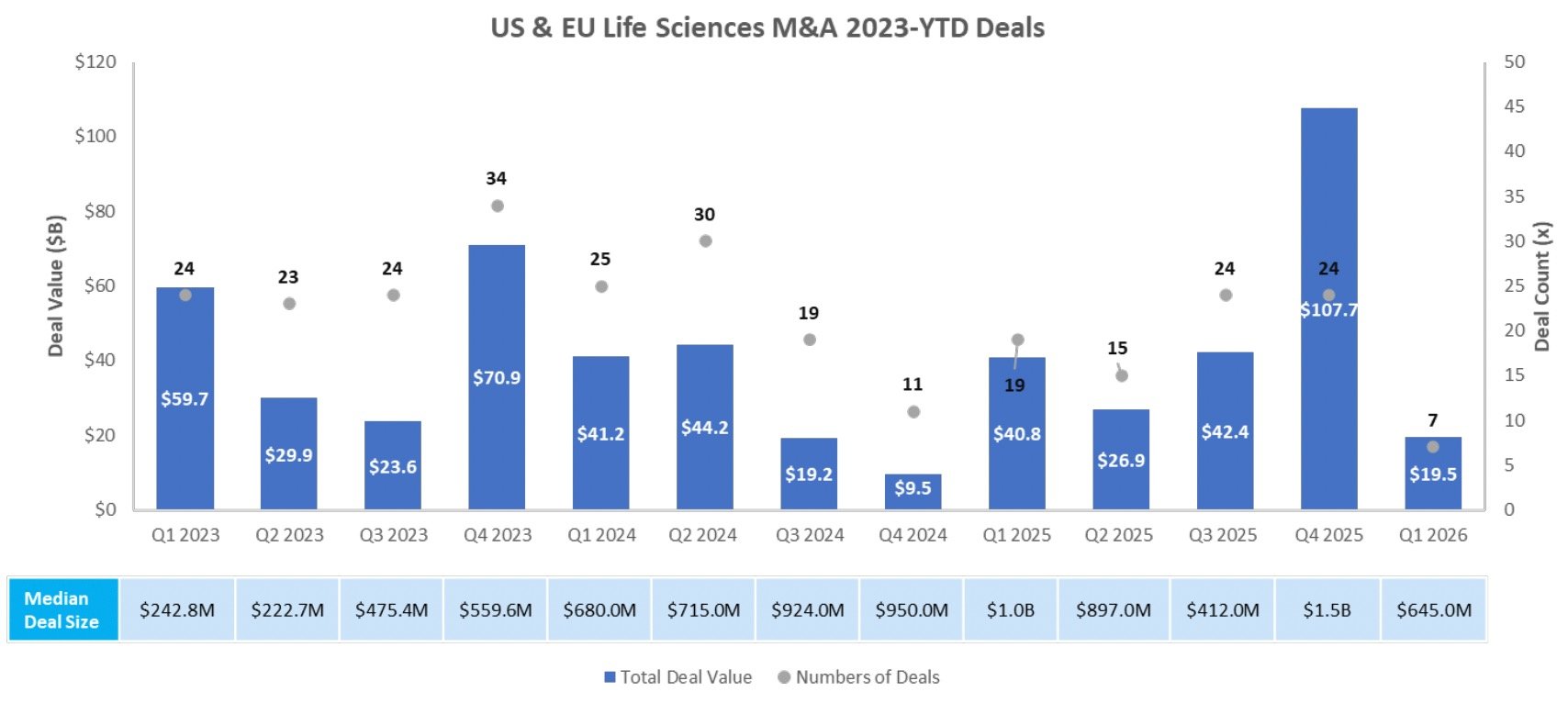

M & A

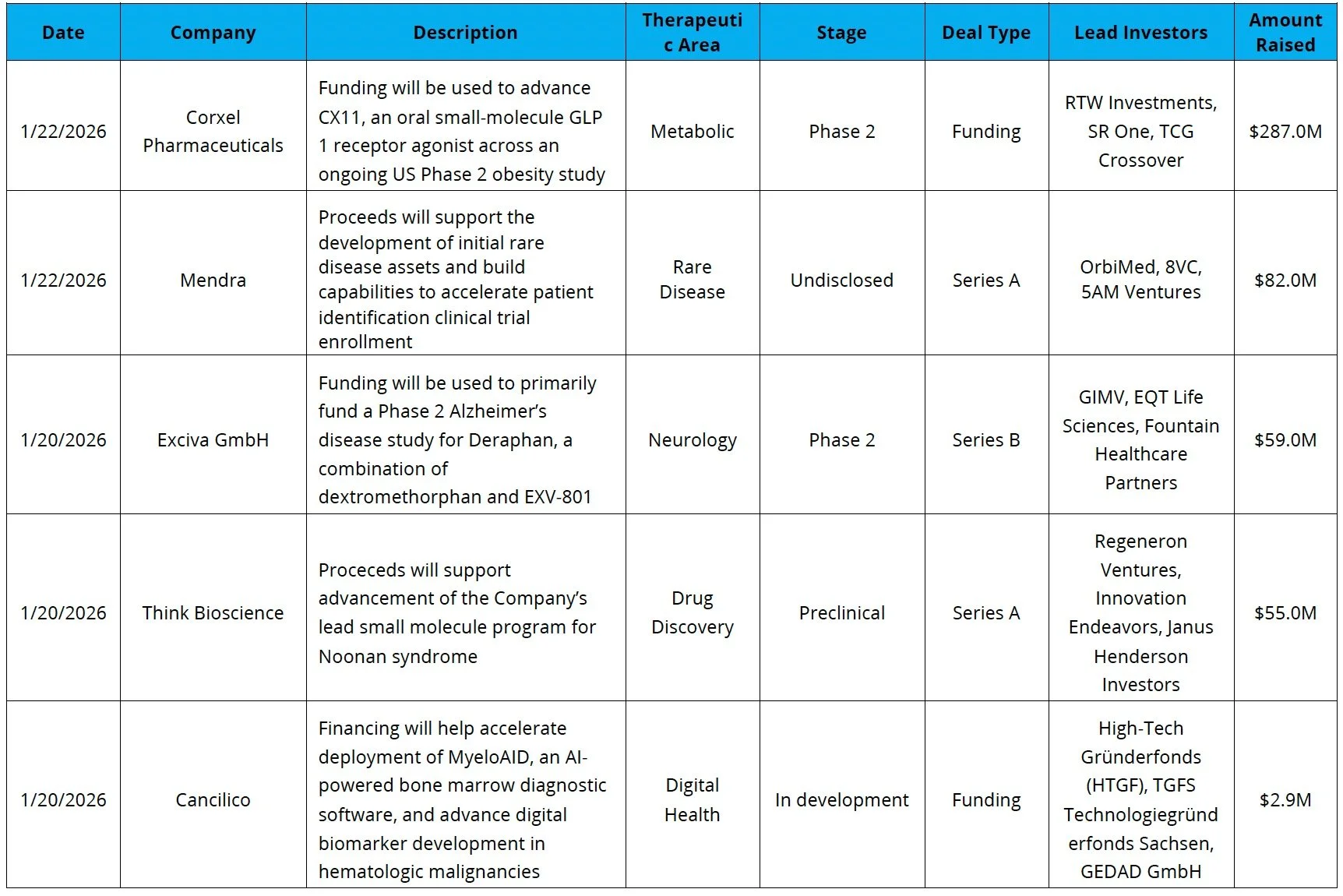

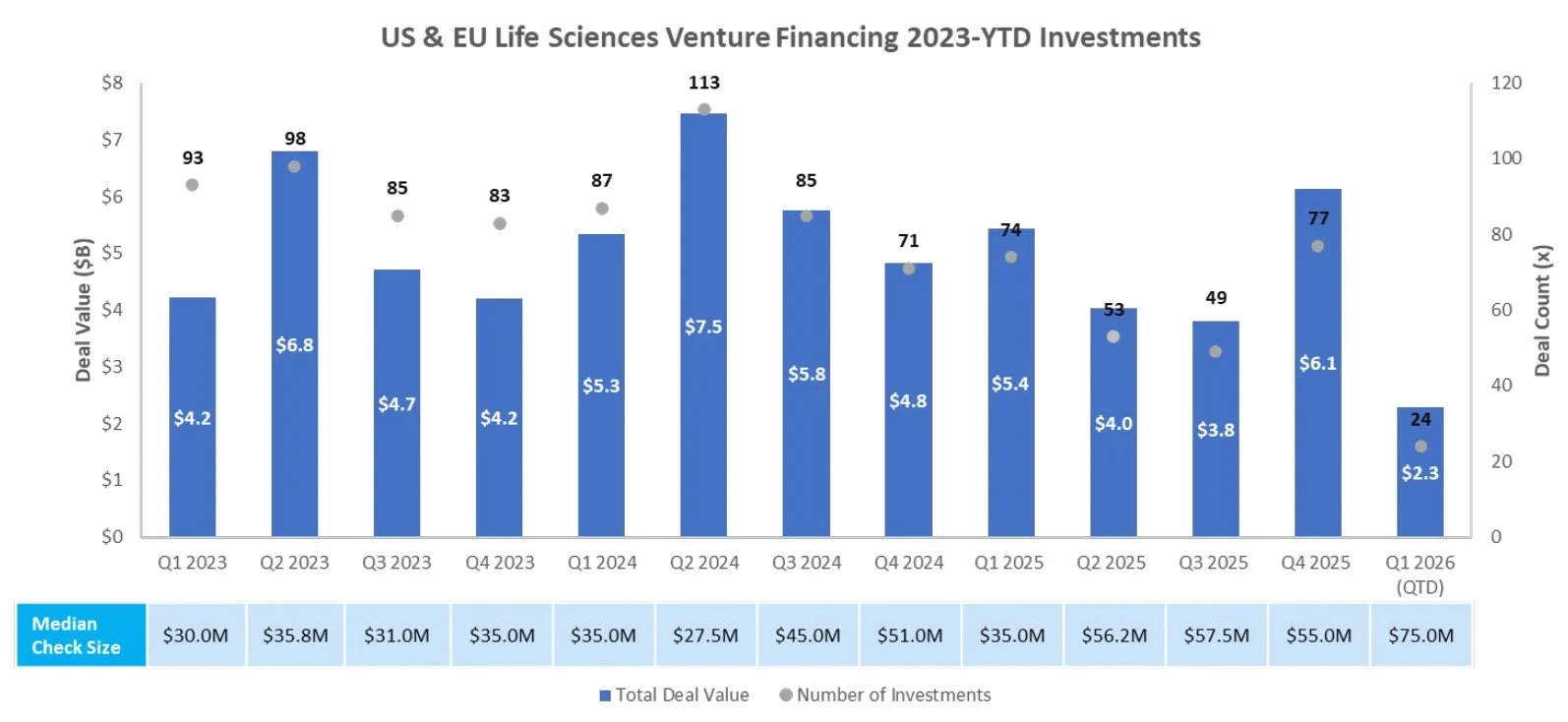

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is now open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speakers:

Day One: Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Day Two: Katrina Armstrong, Chief Executive Officer, Columbia University Irving Medical Center, Executive Vice President for Health and Biomedical Sciences for Columbia University

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available, focusing on the rapid growth of bispecific or multispecific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About DNB Carnegie | Back Bay

DNB Carnegie | Back Bay drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie | Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie | Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.