Week of January 16, 2026

The Week at a Glance:

PD-1/VEGF and China in-licensing remains a dominant theme: AbbVie signed an exclusive ex-China licensing deal with RemeGen for its Phase 2 PD-1/VEGF bispecific antibody RC148, paying $650M upfront plus up to ~$5B in milestones to further expand its oncology pipeline

Commercial MedTech M&A activity continues: Boston Scientific agreed to acquire Penumbra in a ~$14.5B cash-and-stock transaction to expand its vascular and neurovascular device footprint and deepen exposure to the fast-growing thrombectomy market

Questions around Fed independence are reignited: The Department of Justice is investigating the Federal Reserve Chair Jerome Powell over renovations to the Fed’s headquarters, which has reignited concerns surrounding Fed independence

Transatlantic tensions come back into focus: President Trump threatened new tariffs on eight European countries, 10% starting Feb. 1, rising to 25% by June 1, unless a deal is reached for the US to purchase Greenland, prompting sharp pushback from Denmark/Europe and sparking protests in Greenland

Investors, join us at the 10th Annual NAHC in NYC: DNB Carnegie | Back Bay is pleased to present more than 25 compelling Nordic-US healthcare companies at our annual healthcare equity event, The Nordic-American Healthcare Conference, March 25-26, 2026, in NYC. Registration is now open and meetings are being booked. Find out more, here.

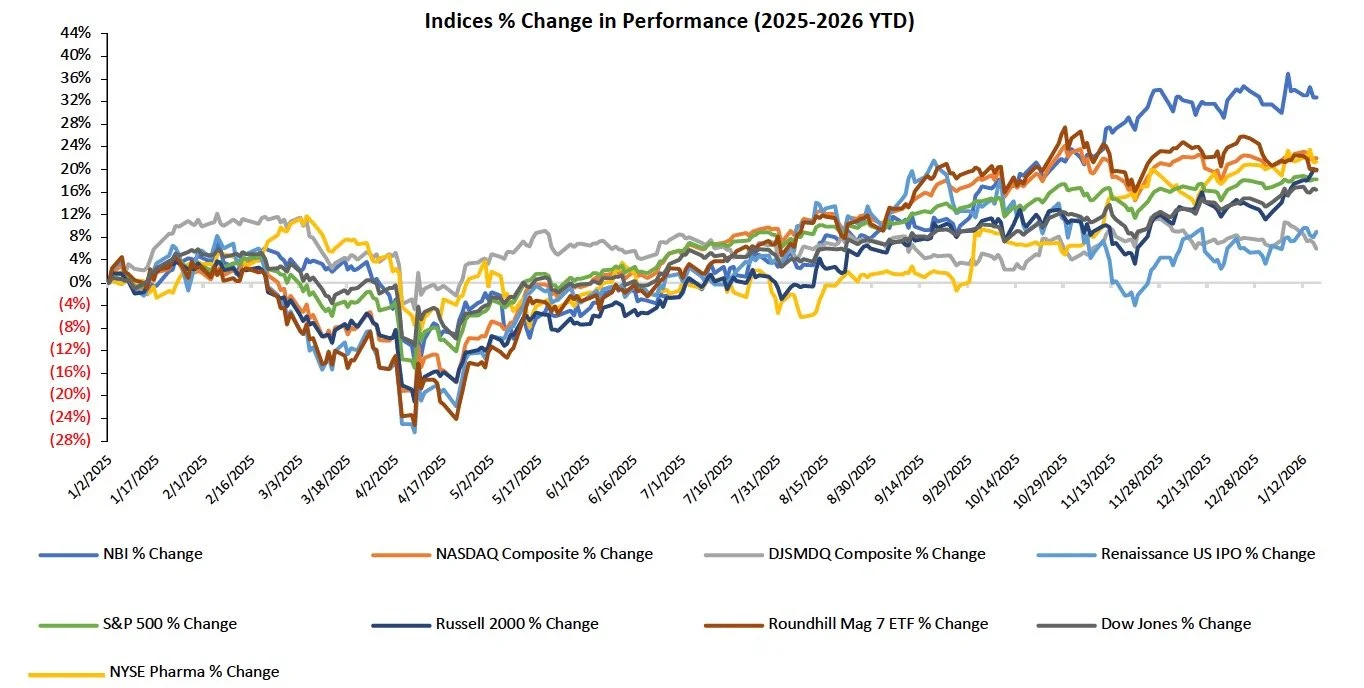

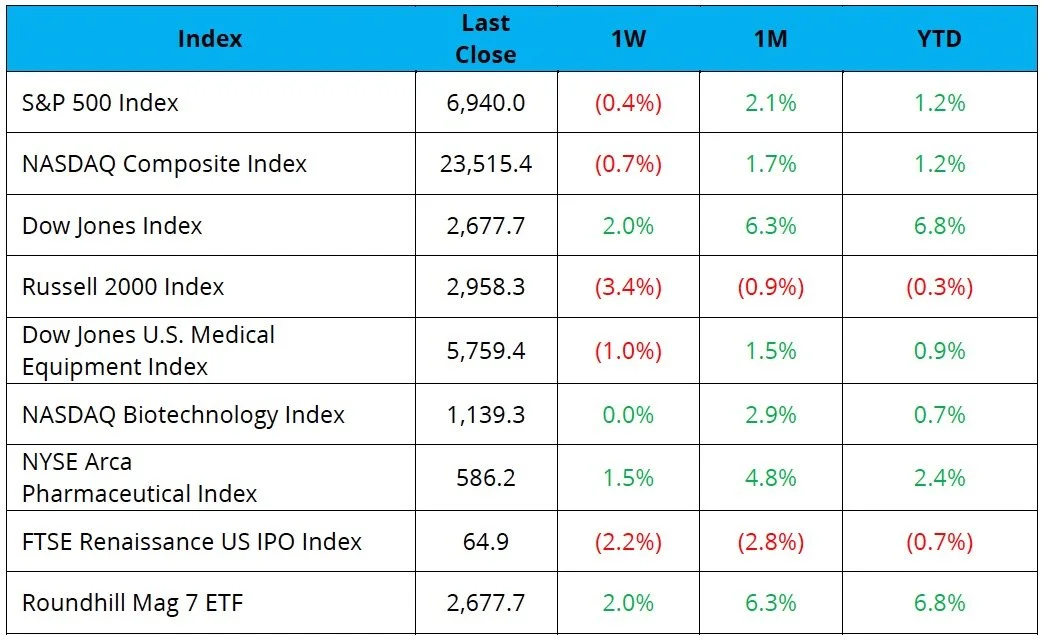

Markets Overview

The S&P 500 and Nasdaq were down 0.4% and 0.7%, while the Dow was up 2.0%

Early earnings underscore a strong start to 2026: the six largest banks posted a record $593B in revenue, while TSMC delivered a bullish near-term outlook; additional large-cap results are expected in the coming weeks

The NYSE Pharma Index was up 1.5%, while the NBI was flat on the week

Notable changes in share price:

ImmunityBio (NASDAQ: IBRX): Shares rose 135.9% after the Company released strong earnings and positive clinical data from their 1L BCG naïve NMIBC program and cell therapy program in Waldenström Non-Hodgkin lymphoma

Sources: Pitchbook, Biomedtracker, and CapIQ

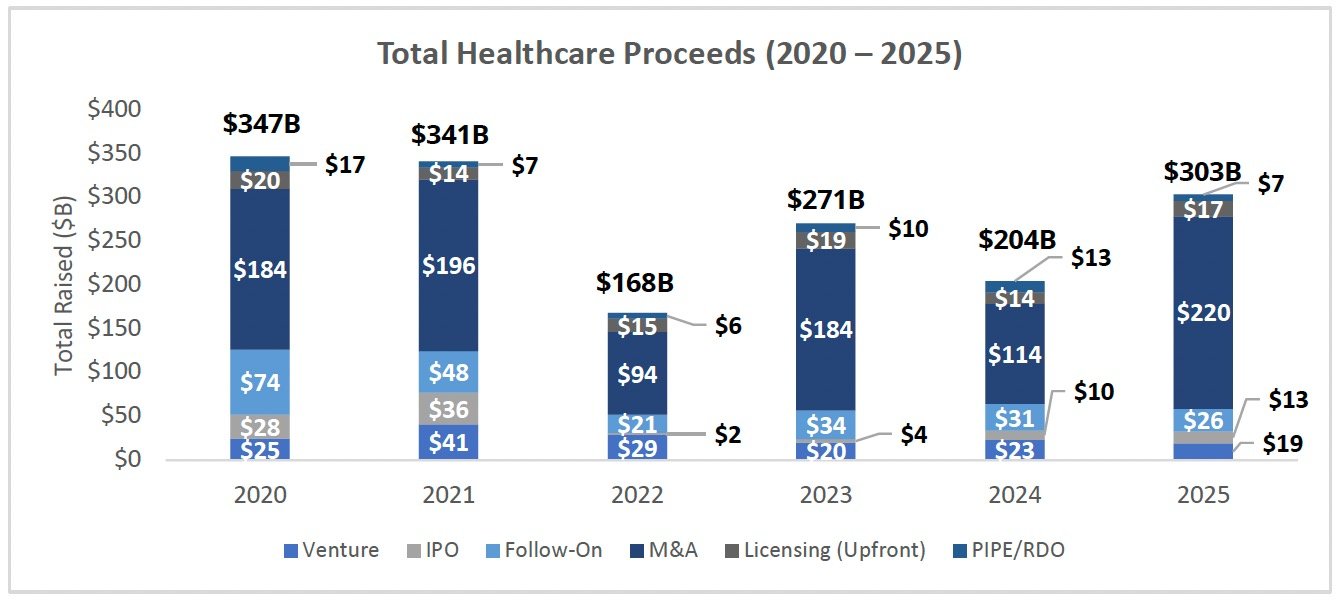

Equity Markets

Source: CapIQ

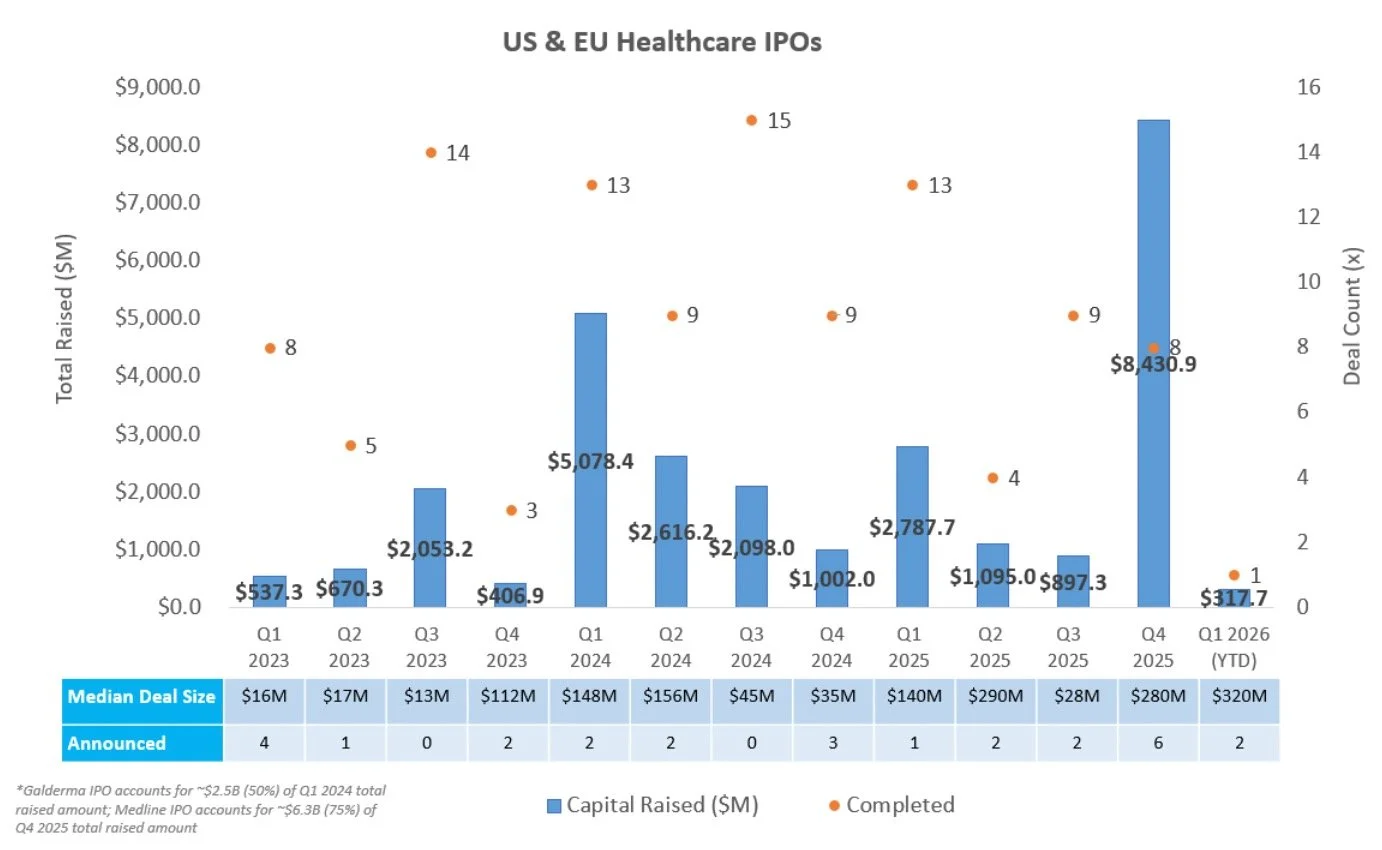

IPO Markets:

No companies completed an IPO last week.

One company announced plans to publicly list:

SpyGlass Pharma plans to raise ~$100.0M to advance clinical development and fund pre-commercial activities for the BIM-IOL System, an intraocular implanted lens for sustained release bimatoprost (prostaglandin analog) currently being studied in Phase 3 registrational trials for open-angle glaucoma and ocular hypertension

Two companies in the IPO queue are targeting raises at or above ~$100M:

1/16/2026

SpyGlass Pharma ~$100.0 Intended Raised

1/9/2026

Eikon Therapeutics ~$300.0 Intended Raised

Twenty additional companies in the IPO queue are pursuing raises below $40M, with one additional company (MiniMed Group) not yet disclosing its intended raise amount

IPOs priced in 2025 have generated a median and average return of 2.9% and 22.9%, respectively suggesting overall performance has been skewed by a small number of outsized winners. Notably, ~60% of newly public companies are trading above their offer price

Source: CapIQ

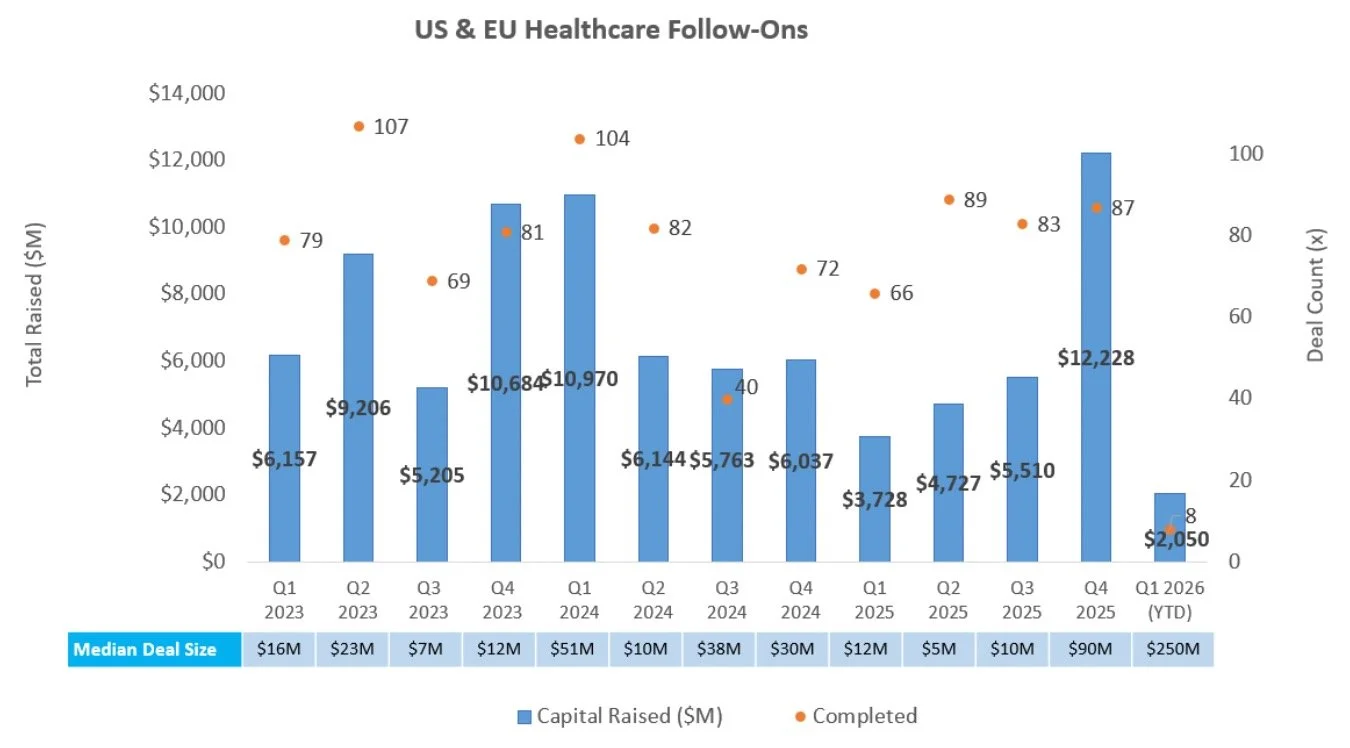

Follow-On Offering Markets:

There were no follow-on equity offerings last week.

Source: Biomedtracker

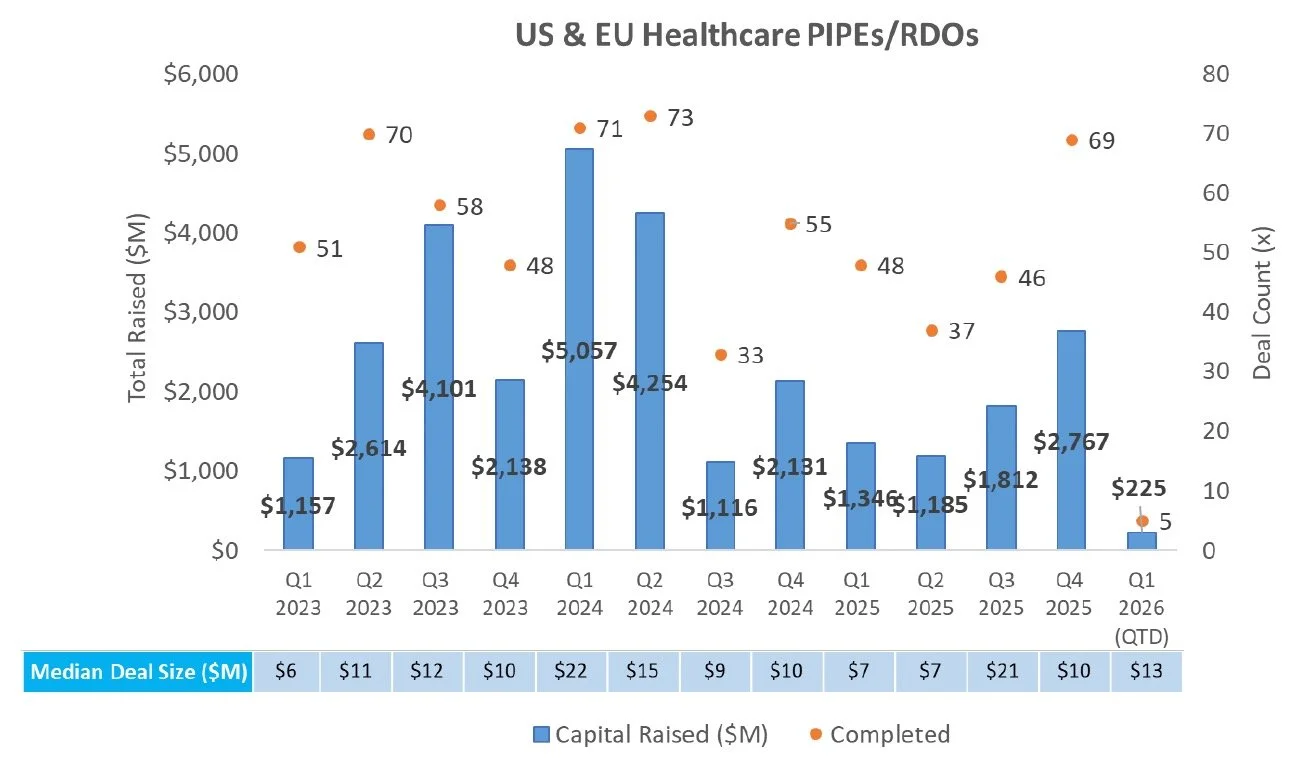

PIPE/RDO Markets:

There were two PIPE/RDOs last week totaling ~$65.0M

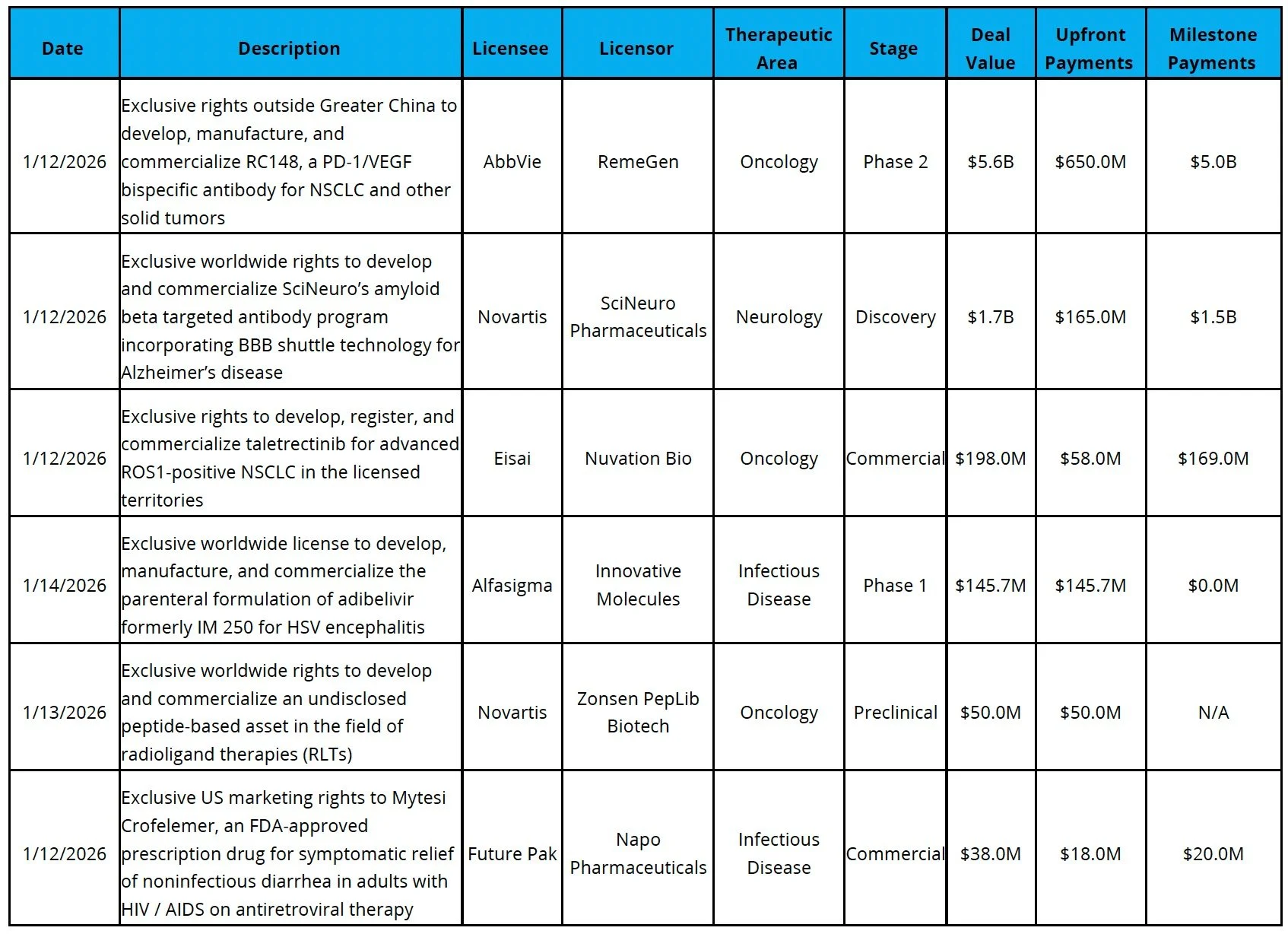

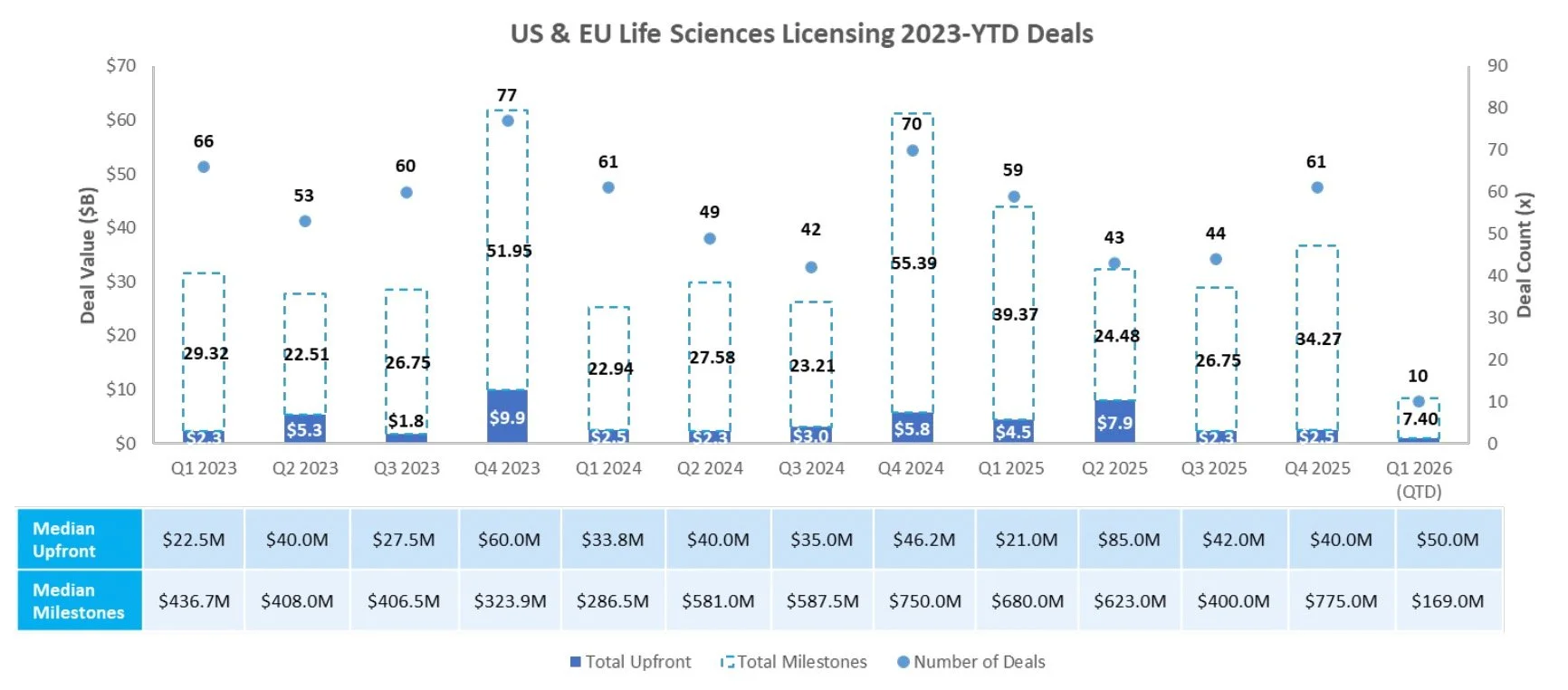

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

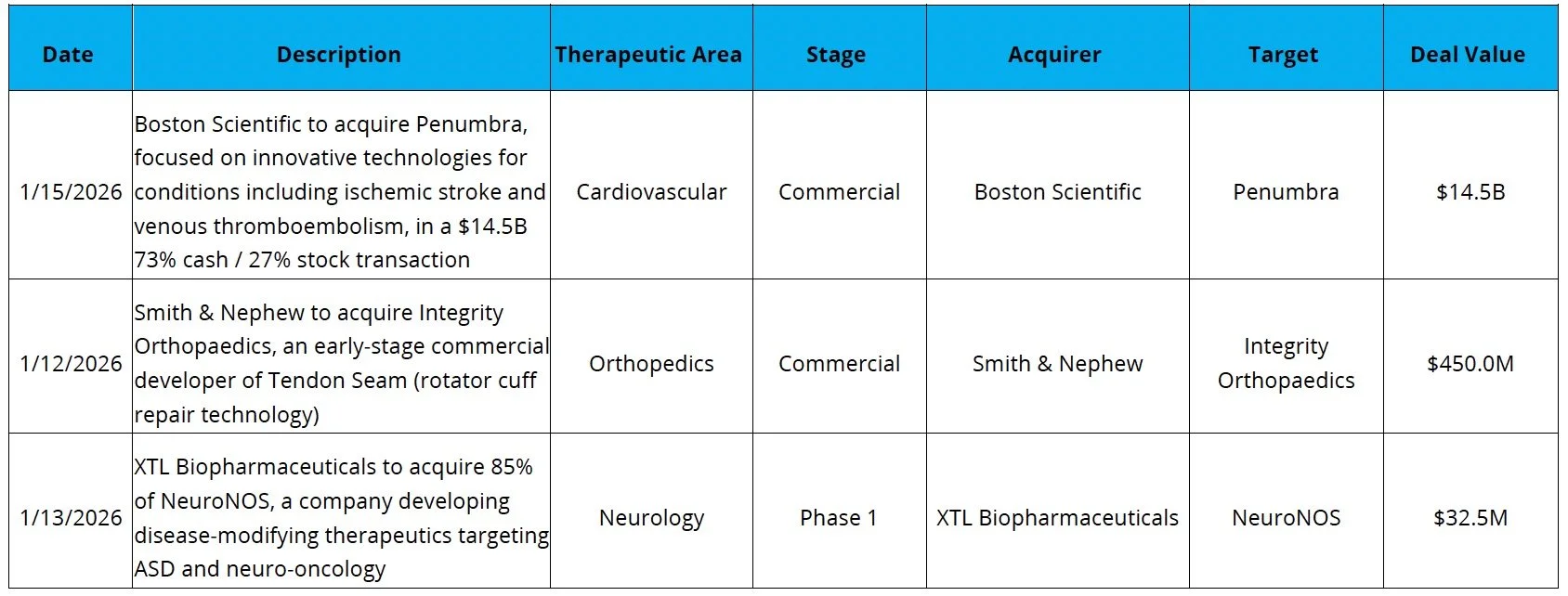

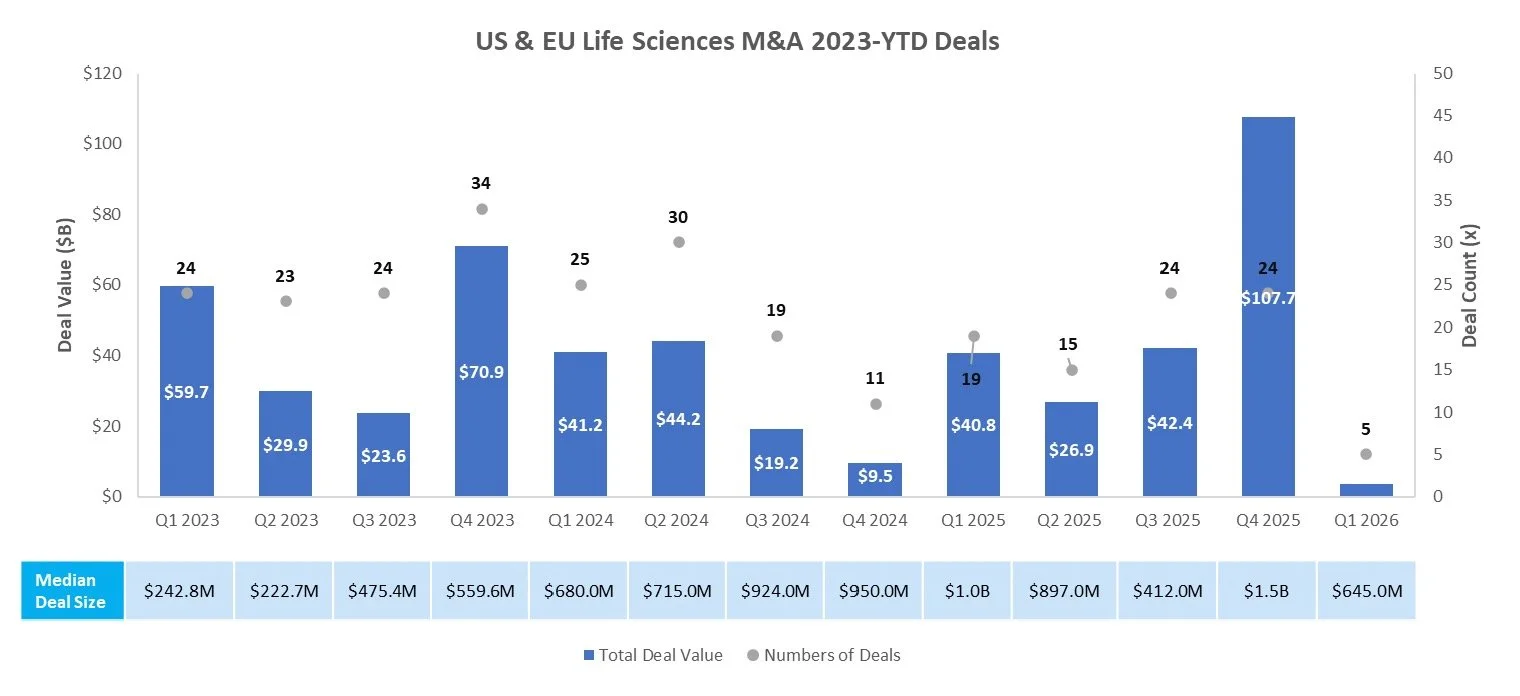

M & A

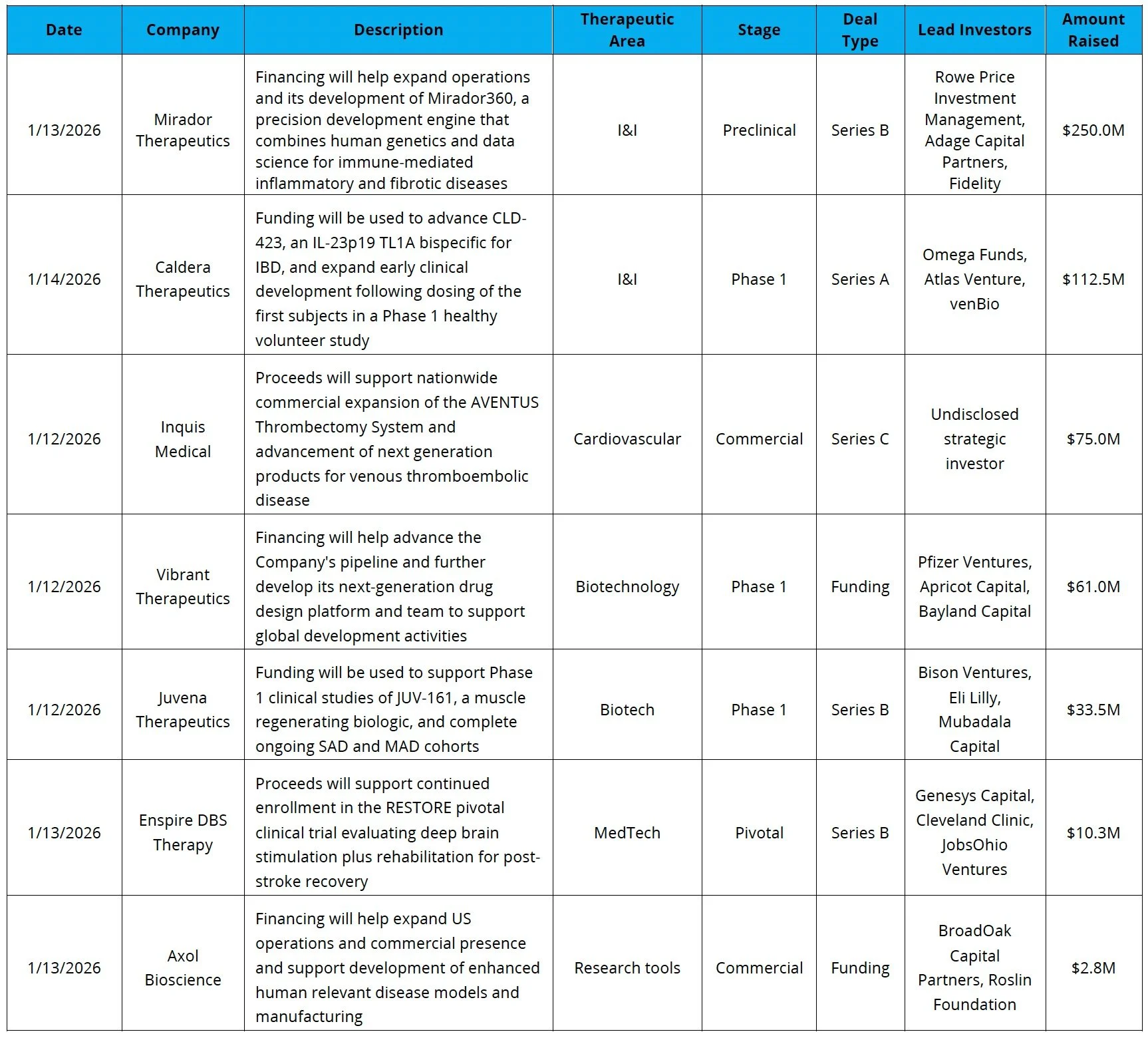

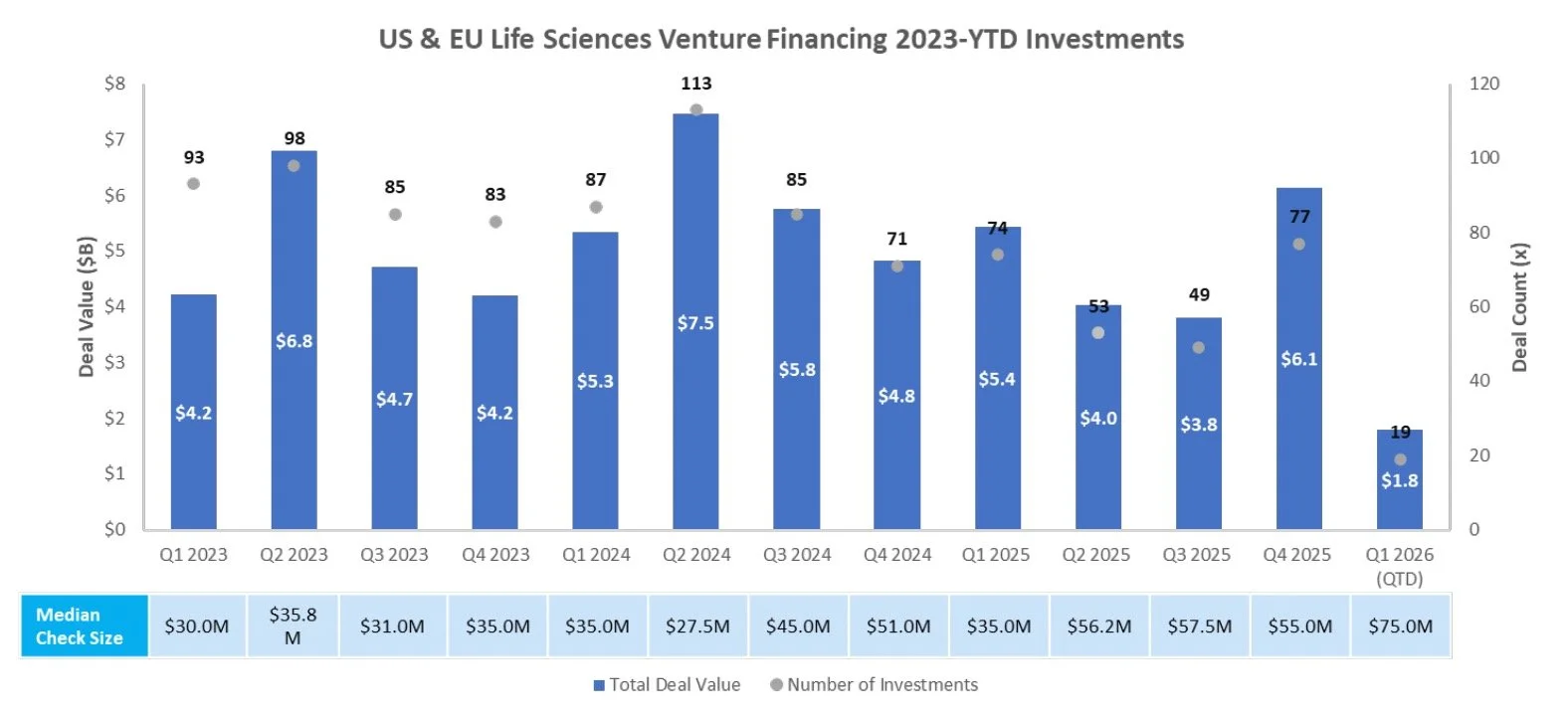

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is now open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speakers:

Day One: Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Day Two: Katrina Armstrong, Chief Executive Officer, Columbia University Irving Medical Center, Executive Vice President for Health and Biomedical Sciences for Columbia University

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available, focusing on the rapid growth of bispecific or multispecific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About DNB Carnegie | Back Bay

DNB Carnegie | Back Bay drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie | Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie | Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.