Week of November 7, 2025

The Week at a Glance:

AI Bubble Concerns Grow: The Nasdaq was down 3% amid growing concerns over elevated AI valuations, signaling a potential capital rotation out of tech and into other sectors.

The Pfizer-Novo Showdown: After Novo raised its offer for Metsera to approximately $10 billion on Tuesday, Pfizer matched the revised offer by Friday, leading Metsera to enter into a merger agreement with Pfizer

Regulatory Uncertainty Returns: The FDA and CBER Director Vinay Prasad have reignited uncertainty surrounding regulatory decision-making, as uniQure and Biohaven faced scrutiny over clinical trial designs using external controls, designs that had previously been approved under the prior administration.

IPO Momentum Builds: BillionToOne raised $273.1M to support continued commercial and R&D growth initiatives, while Evommune raised $150M to fund its lead asset in Phase 2 targeting I&I indications. BillionToOne’s listing reflects a continued trend of commercial MedTech players entering the public markets, while Evommune’s listing is the third clinical-stage biotech IPO in H2, following LB Pharmaceuticals’ and MapLight’s recent listings.

White House Obesity Deals: The White House announced an agreement with Eli Lilly and Novo Nordisk that aims to lower US prices for GLP-1 weight-loss drugs (such as Wegovy and Zepbound) and expand coverage under programs like Medicare for obesity treatment. While the deal seems advantageous for Medicare beneficiaries, the implications for uninsured patients, Medicaid recipients, and those with commercial insurance are still uncertain.

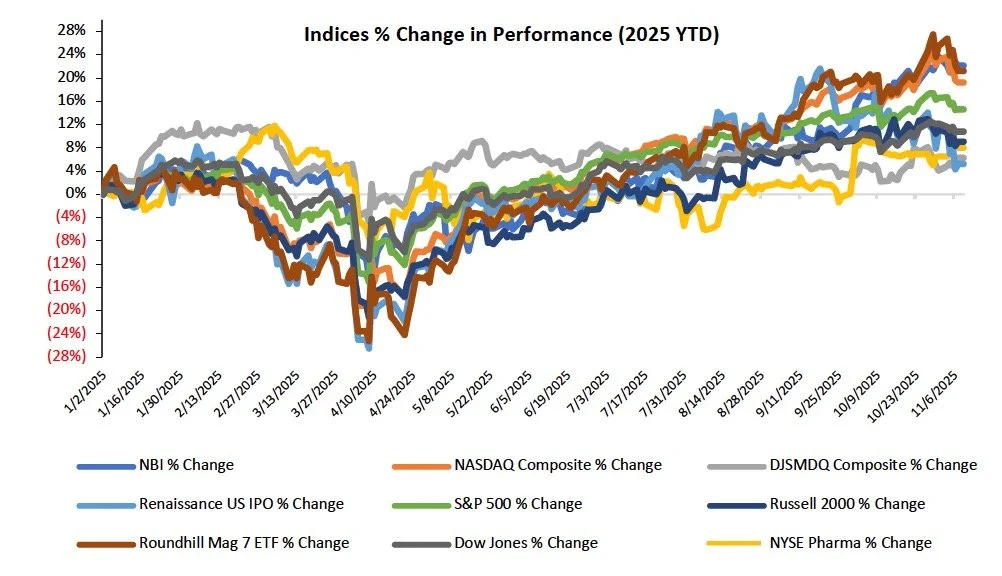

Markets Overview

The S&P 500, Nasdaq, and the Dow were down 1.6%, 3.0%, and 1.2%, respectively. The NYSE Pharma Index was up 1.4%, while the NBI was down 1.3% on the week.

Notable changes in share price:

Terns Pharmaceuticals (NASDAQ: TERN): Shares surged 123.6% after the company announced positive clinical data from its Phase 1 trial in relapsed or refractory chronic myeloid leukemia

Metsera (NASDAQ: MTSR): Shares rose 36.1% after Pfizer acquired the company for over $10B

UniQure (NASDAQ: QURE): Shares fell 58.9% after the company announced that the FDA no longer agrees with uniQure’s Phase 1/2 trial design in Huntington’s disease, which had previously been cleared by an earlier FDA administration and relied on a natural history cohort as the control arm. The agency now deems the design insufficient to support a future BLA submission

Biohaven (NASDAQ: BHVN): Shares fell 43.4% after the company announced it had received a Complete Response Letter for VYGLXIA, its investigational treatment for spinocerebellar ataxia, after the FDA concluded that the use of natural history controls was insufficient to support approval. The decision contrasts with FDA meeting minutes from March 8, 2024, which indicated that a natural history control arm could be acceptable provided that VYGLXIA demonstrated a large and robust treatment effect

Sources: Pitchbook, Biomedtracker, and CapIQ

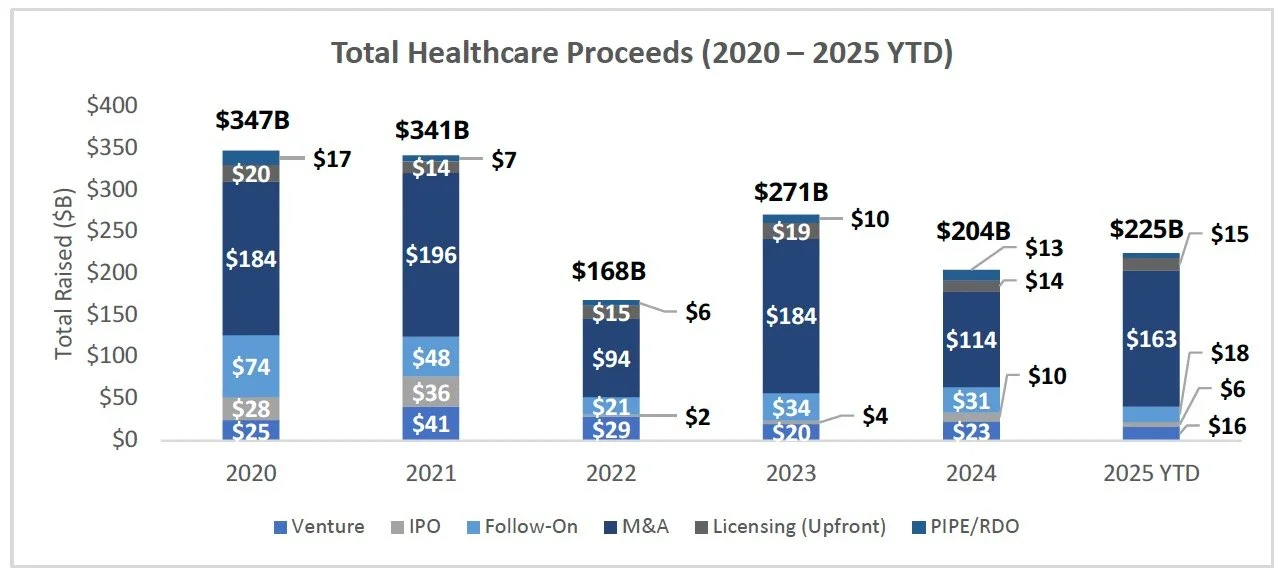

Equity Markets

Source: CapIQ

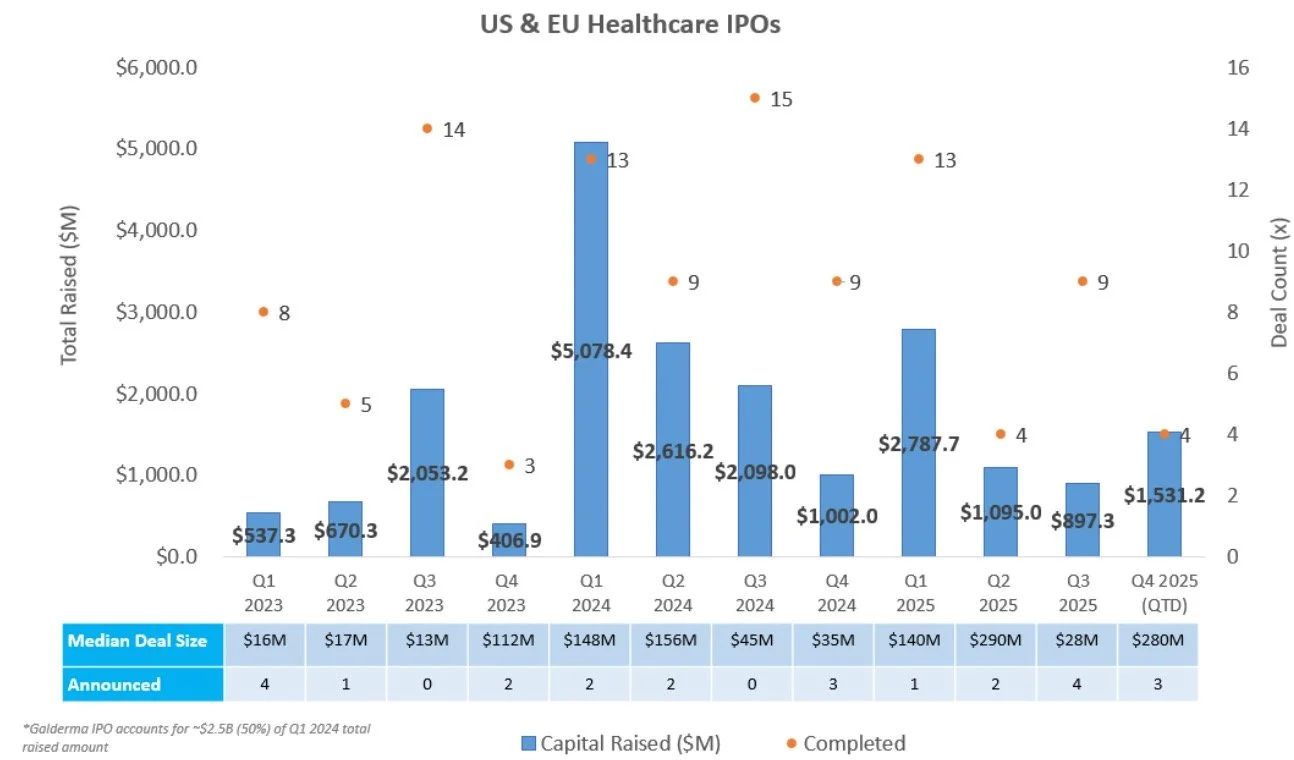

IPO Markets:

Two companies completed an IPO last week, with BillionToOne continuing the trend of commercial medtech companies entering the public markets, and Evommune marking the third clinical-stage biotech IPO of H2 2025:

BillionToOne (Nasdaq: BLLN) raised $273.1M in an upsized IPO to continue development and commercialization of its molecular diagnostic tests for prenatal and oncology applications, including its flagship Unity Screen for non-invasive prenatal testing and Northstar Select for comprehensive cancer genomic profiling

Evommune (NYSE: EVMN) raised $150M to advance its pipeline of therapies for chronic inflammatory diseases, including lead asset EVO756, a Phase 2 MRGPRX2-targeting oral small molecule for chronic spontaneous urticaria, chronic inducible urticaria, and atopic dermatitis

Additionally, two companies filed an S-1 last week, signaling continued IPO interest for commercial medtech companies:

Medline intends to raise ~$5B in capital for its commercial-stage med-surg products business, which manufactures and distributes surgical solutions, front-line care, and laboratory & diagnostics products, and provides supply chain solutions internationally

Saluda Medical intends to raise ~$150M in capital to advance its FDA-approved, commercially available Evoke closed-loop spinal cord stimulation system, a proprietary device that measures the spinal cord’s response to stimulation and adjusts every pulse to optimize activation within the patient’s therapeutic window

Of 21 companies in the queue, only two intend to raise at least $100.0M in proceeds

IPOs that have priced this year have delivered a median gain of 2.5%, with ~50% of newly public companies trading above their offer price

Source: CapIQ

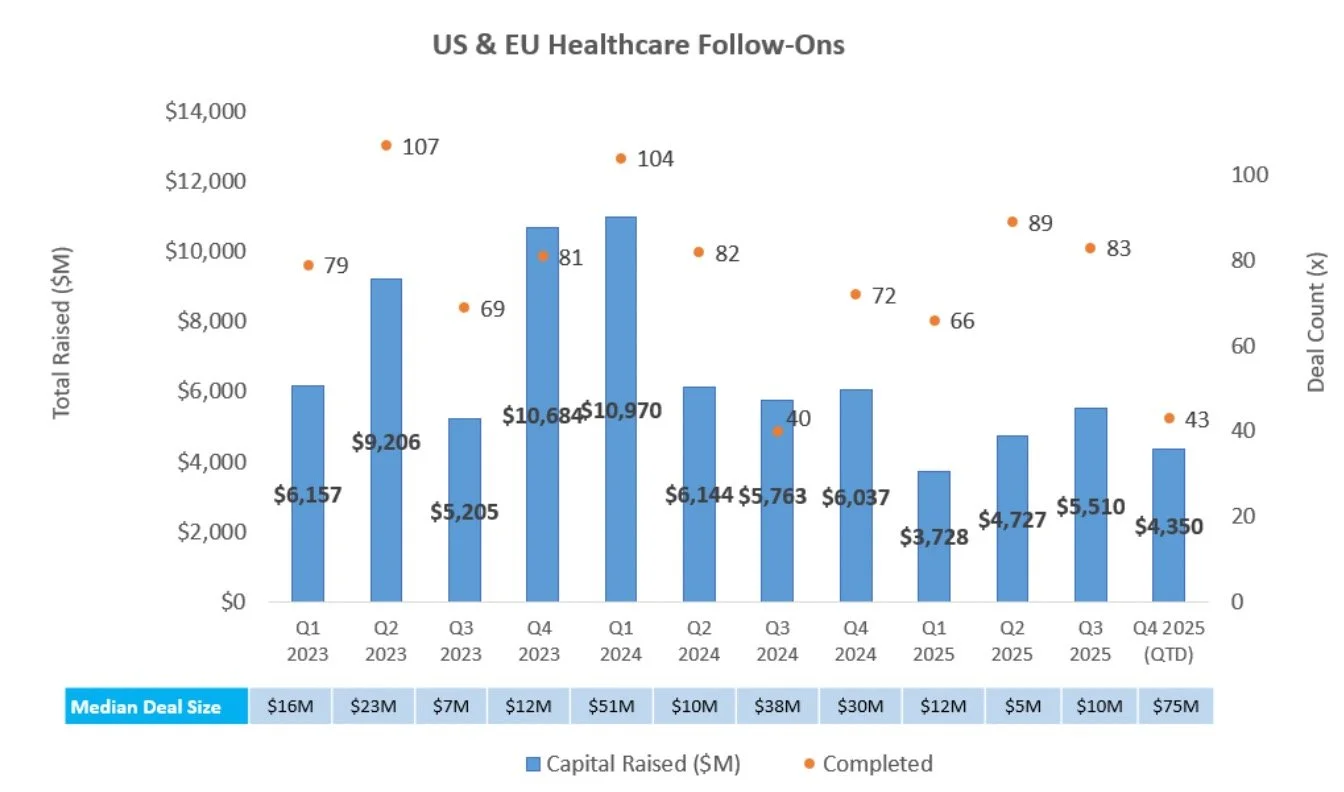

Follow-On Offering Markets:

There were four follow-on equity offerings totaling ~$355.1M, including:

Relmada Therapeutics (NASDAQ: RLMD) raised $100M to support late-stage clinical development of its oncology and CNS portfolio, which includes NDV-01, a Phase 2 sustained-release, intravesical chemotherapy for non-muscle invasive bladder cancer, and sepranolone, a Phase 2-ready GABAA modulating steroid antagonist for Prader-Willi syndrome

4D Molecular Therapeutics (NASDAQ: FDMT) raised $100M to advance its AAV gene therapy portfolio, including 4D-150, a Phase 3 intravitreal injection for retinal vascular diseases, 4D-710, a Phase 1/2 aerosolized therapy for cystic fibrosis lung disease, and 4D-310, an IV therapy for Fabry disease

Benitec Biopharma (NASDAQ: BNTC) raised $80.1M to support continued development of its Silence and Replace ddRNAi platform, including BB-301, a Phase 1/2 gene therapy for oculopharyngeal muscular dystrophy with dysphagia

MoonLake Immunotherapeutics (NASDAQ: MLTX) raised $75M to support late-stage clinical development of sonelokimab, a Nanobody® in Phase 3 studies for hidradenitis suppurativa and psoriatic arthritis

Source: Biomedtracker

PIPE/RDO Markets:

There were two PIPE/RDO deals last week, raising an aggregate ~$26M

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

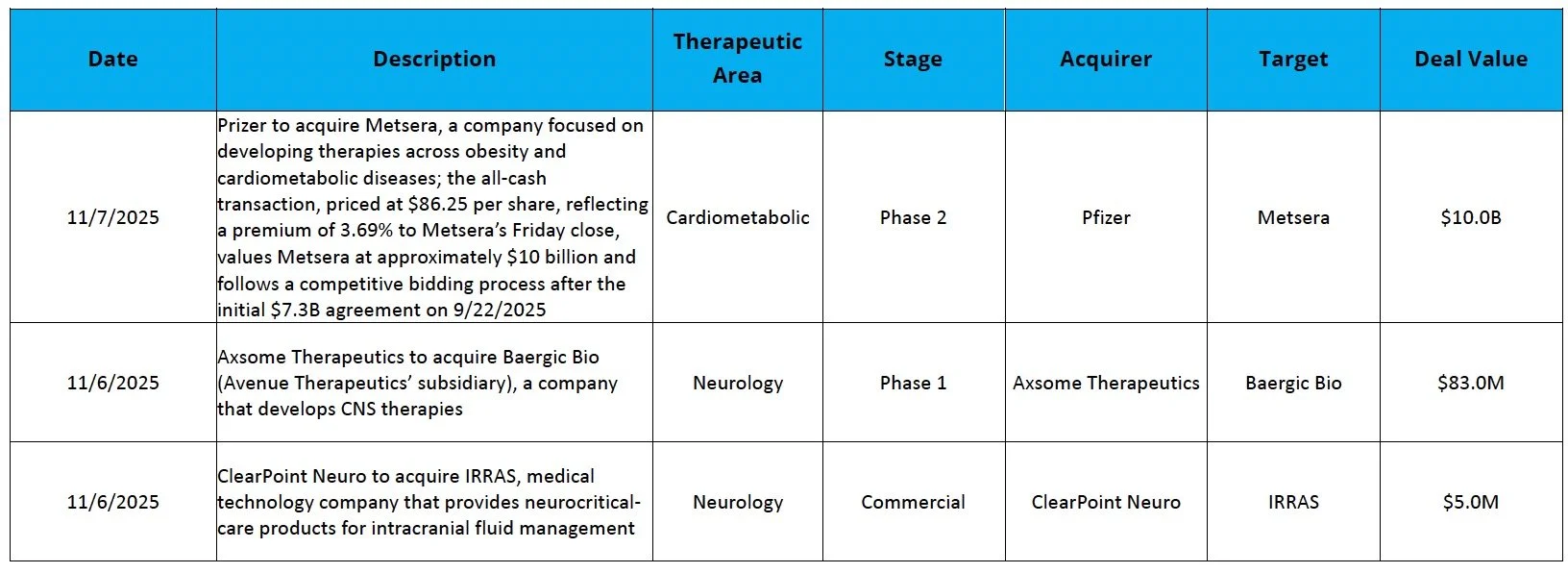

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

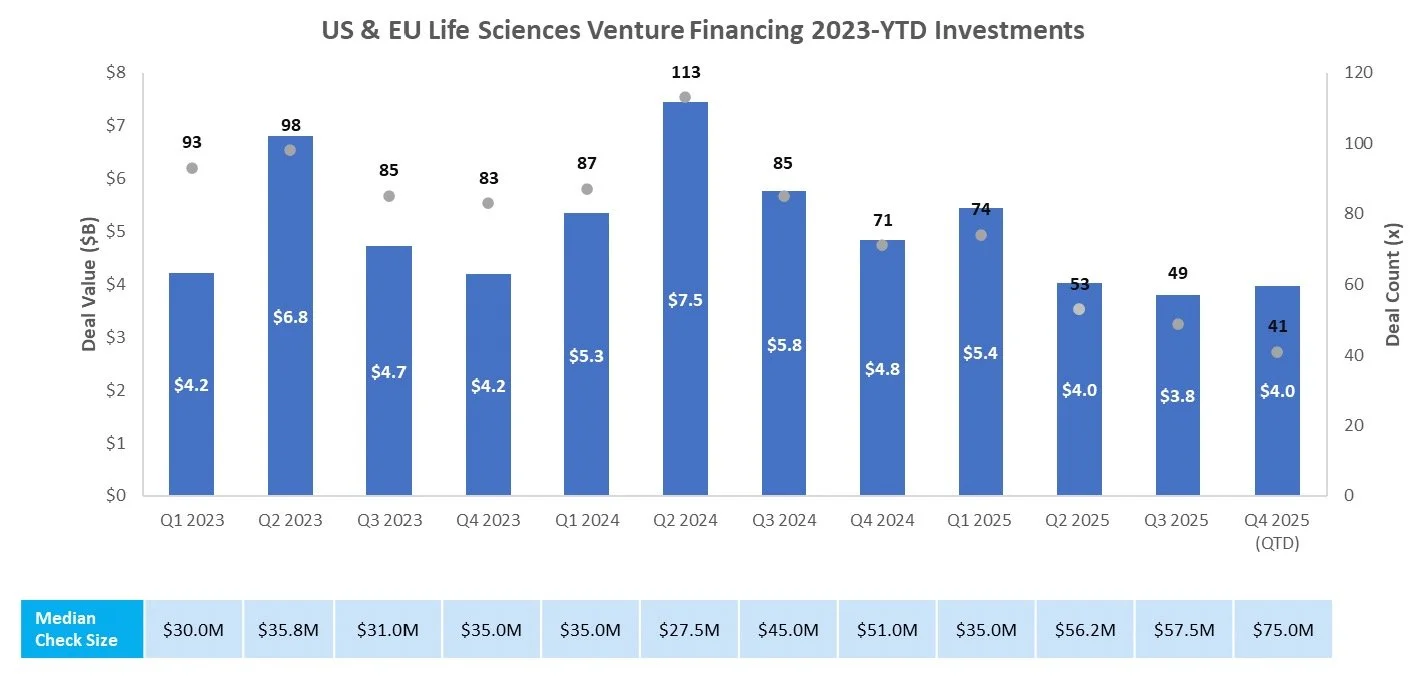

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is now open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speaker:

Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available, focusing on the rapid growth of bispecific or multispecific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB Carnegie // Back Bay Partnership

The DNB Carnegie//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie//Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie//Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.