Week of June 27, 2025

The Week at a Glance:

Markets Finish with Gains: The three major US indices ended the week with gains propelled by the announcement of a ceasefire between Israel and Iran

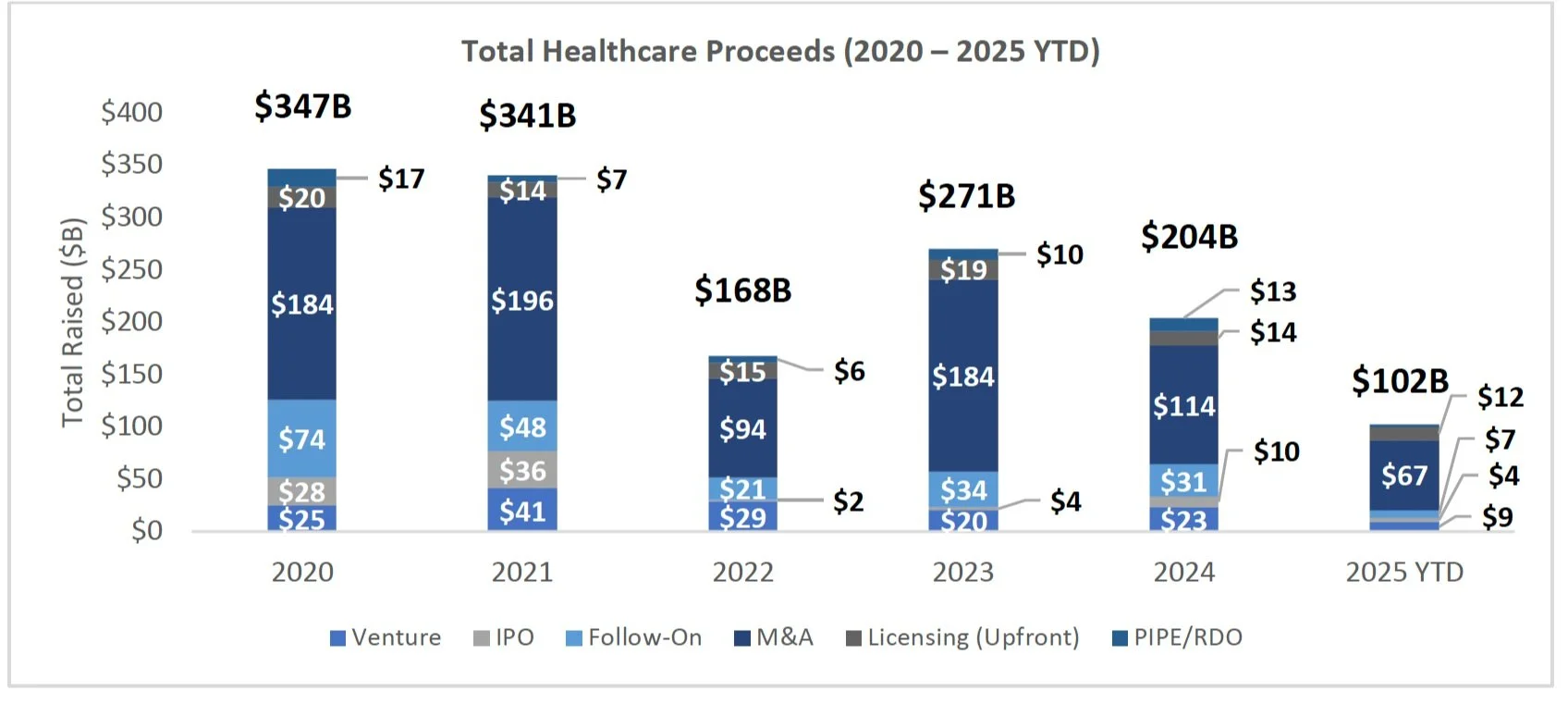

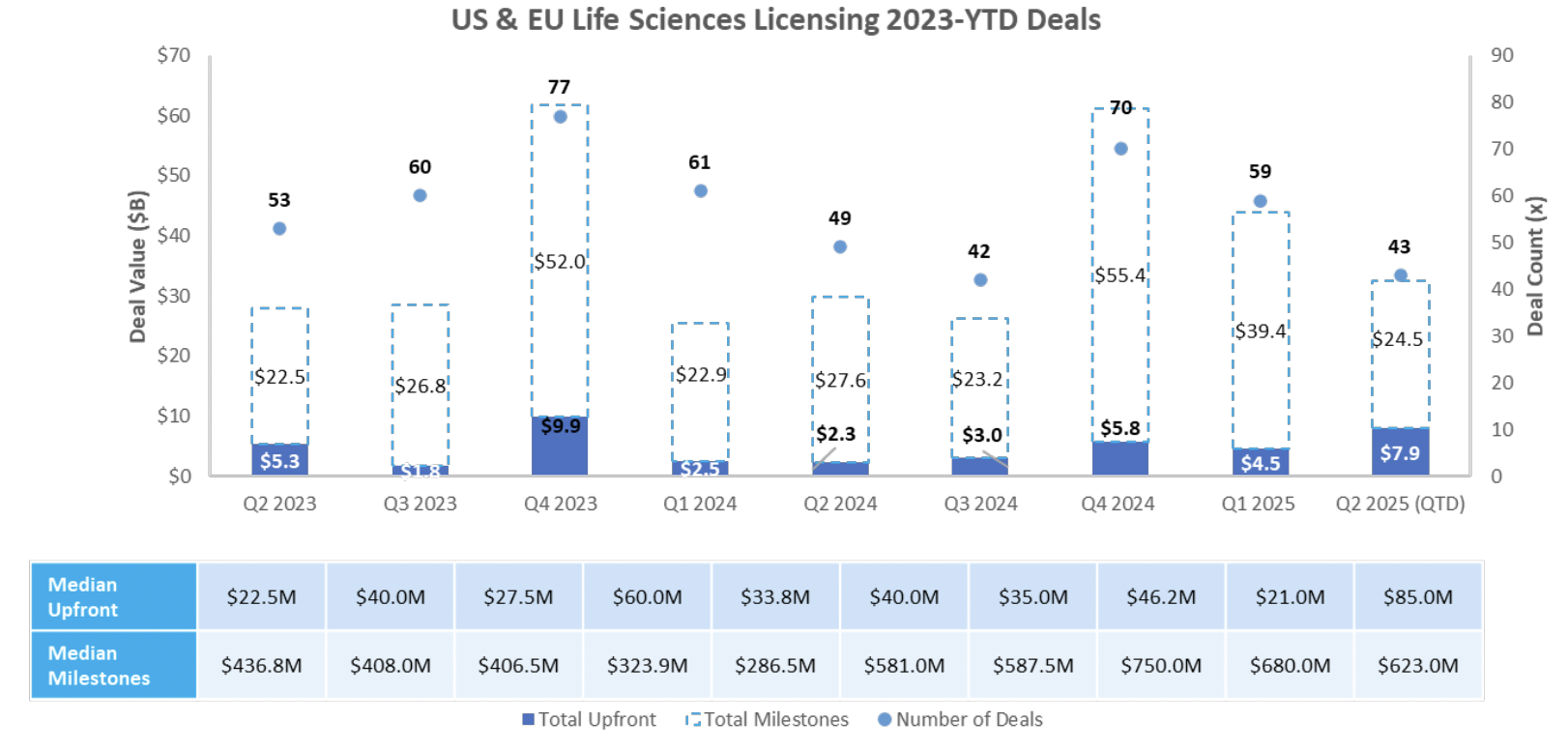

Licensing Finally Sees Some Activity: Despite this quarter being the second worst quarter for licensing deal volume over the past two years, Q2 is ending on a high note with six deals announced last week with an average deal value of $1.2B

Venture Continues to Struggle: Venture financings in Q2 hit their lowest amount in volume and aggregate proceeds over the past two years, with seed financings faring the worst

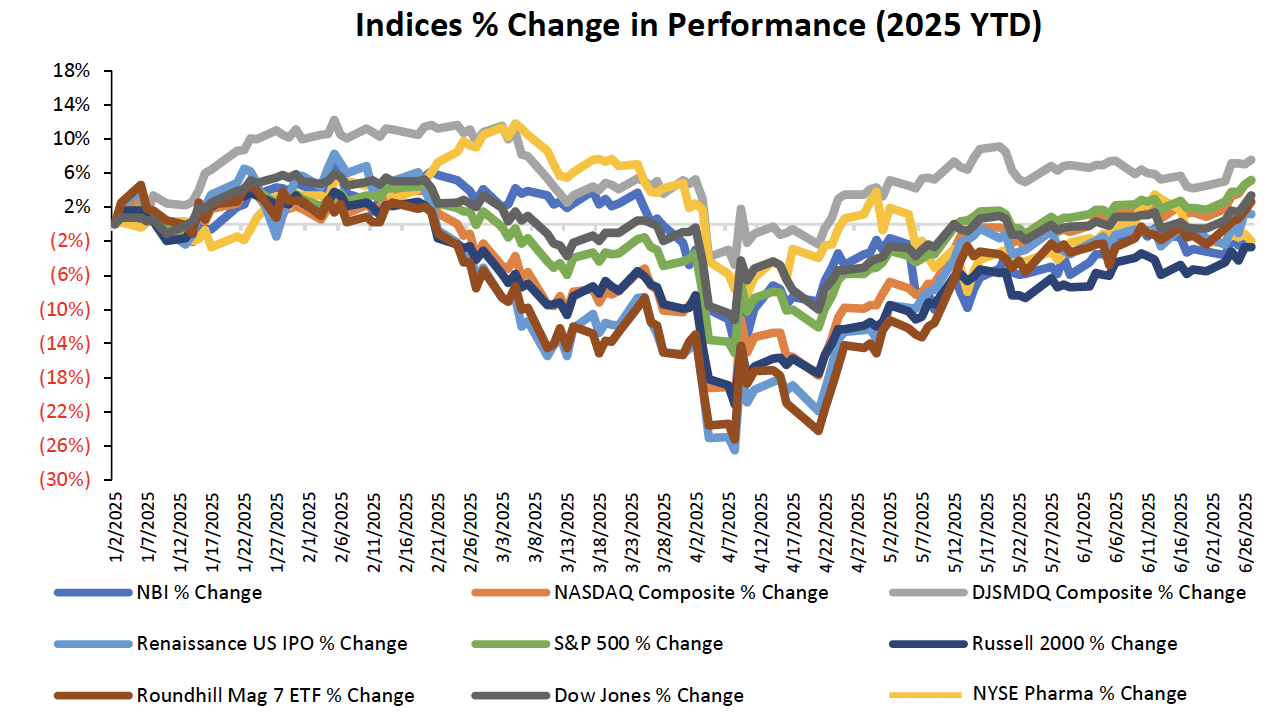

Markets Overview

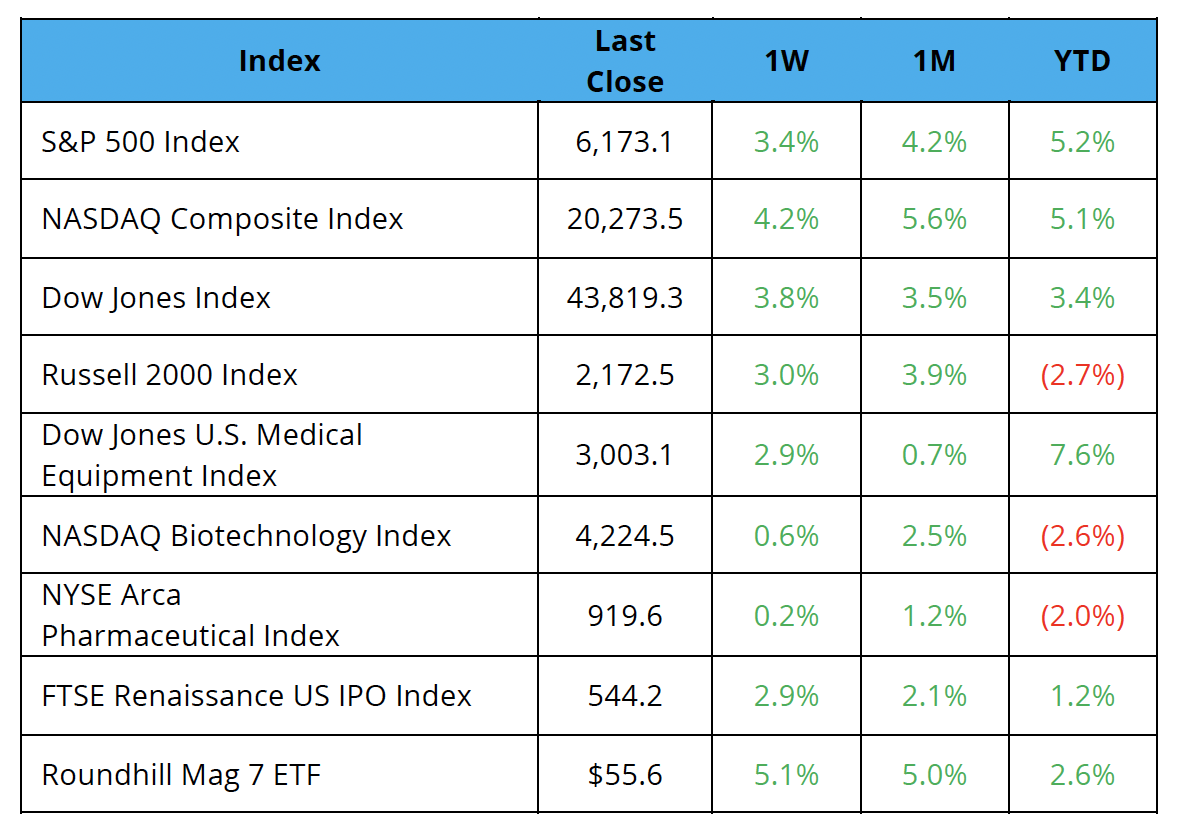

The S&P 500, Nasdaq, and Dow ended the week up 3.4%, 4.2%, and 3.8%, respectively

The S&P 500 and Nasdaq hit all-time highs on Friday

The US revealed details of its trade deal with China, while Commerce Secretary Howard Lutnick promised up to 10 deals before the July 9 tariff-pause deadline

The Personal Consumption Expenditures (PCE) index rose 0.1% in June, making the annual inflation rate 2.3%, slightly above the Fed’s goal of 2% NYSE Pharma % Change

Markets reacted positively to the US announcing that a ceasefire was agreed to between Isreal and Iran

Healthcare indices underperformed the broader market last week with the NBI and NYSE Pharma Index up 0.6% and 0.2%, respectively

Notable changes in share price:

Altimmune (NASDAQ: ALT): Shares plummeted 49.2% by the end of the week after the Company reported a mixed readout on its Phase 2b study targeting serious fatty liver disease

Nektar Therapeutics (NASDAQ: NKTR): Stock skyrocketed 208.1% to finish the week driven by the announcement that its eczema therapy showed substantial symptom improvement in a Phase 2b study

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

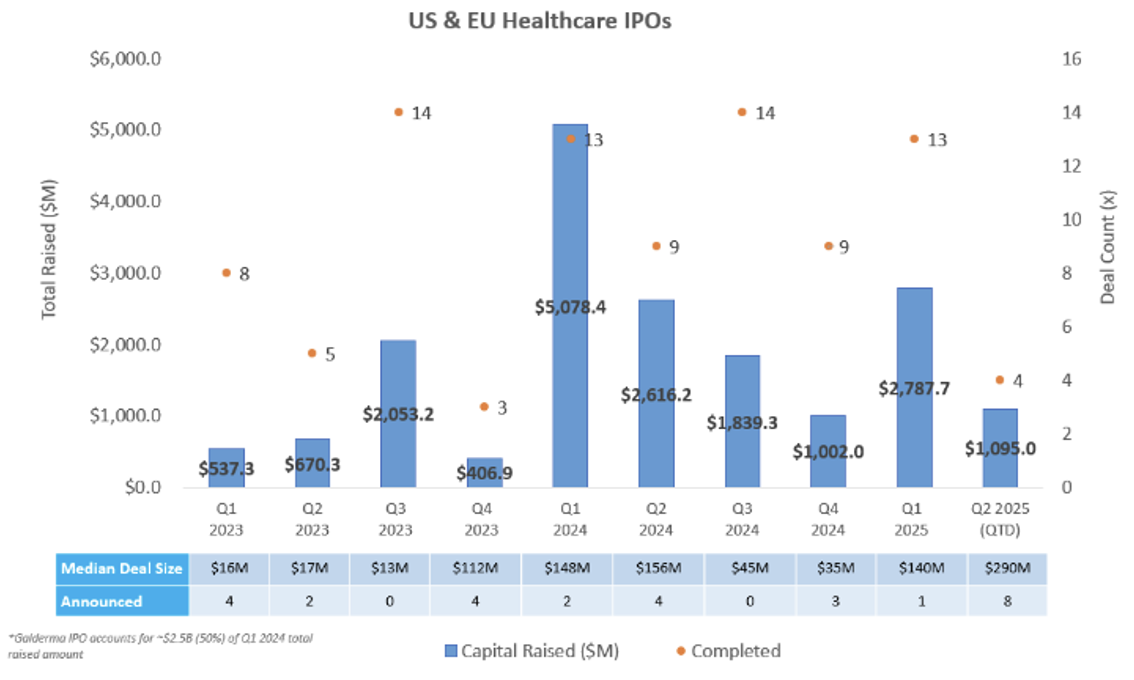

IPO Markets:

No companies completed IPOs last week

Four companies announced plans to file IPOs last week, two of which intend to raise $100.0M or more:

Brainlab AG intends to raise $538.1M aiming to expand its digital surgery and radiotherapy portfolio, including intraoperative imaging platforms for global neurosurgery and oncology markets

Carlsmed intends to raise $100.0M to accelerate development and commercial adoption of its AI-driven personalized spinal implants

25 companies in total remain in the queue, of which only one intends to raise more than $30.0M in proceeds:

Of these 25 companies, 12 companies filed between Q4 2024 and today

Year-to-date, companies that have gone public in 2025 have had a median loss of -7.3%

Source: CapIQ

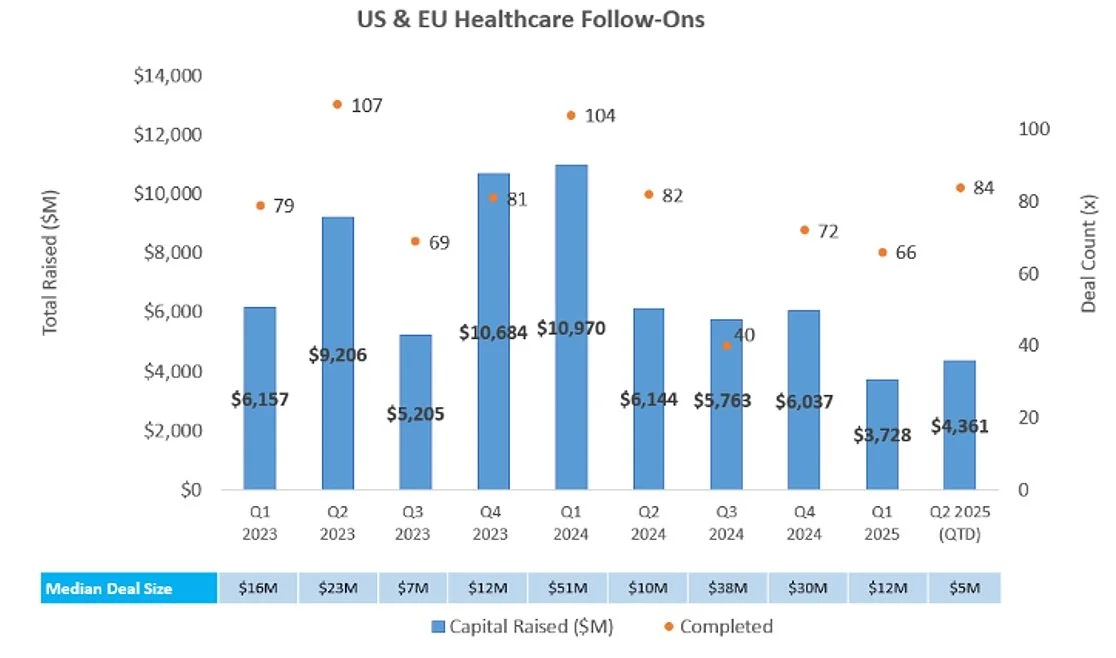

Follow-On Offering Markets:

There were nine follow-on offerings last week totaling $838.2M, with five notable deals being:

Cidara Therapeutics (NASDAQ: CDTX) raised $402.5M to advance its Cloudbreak antiviral conjugate platform and support late-stage development of its oncology and infectious disease programs

Kymera Therapeutics (NASDAQ: KYMR) raised $221.9M to fund ongoing clinical trials of its targeted protein degraders across oncology and immunology indications

CorMedix Inc. (NASDAQ: CRMD) raised $85.0M to support the commercial launch of DefenCath, a catheter lock solution for preventing infection in patients with end-stage renal disease

Forte Biosciences (NASDAQ: FBRX) raised $67.6M to continue development of its autoimmune pipeline, targeting diseases such as celiac disease, vitiligo, type 1 diabetes, and alopecia areata

Achieve Life Sciences (NASDAQ: ACHV) raised $45.0M to support commercialization and further studies of cytisinicline for smoking cessation and nicotine addiction

Source: Biomedtracker

PIPE/RDO Markets:

There were six PIPEs/RDOs last week totaling $243.2M

Vor Bio, a clinical-stage biotech company developing therapies for autoimmune diseases, grossed $175.0M through a PIPE that consisted of RA Capital, Mingxin Capital, Forbion, Venrock Healthcare Capital, Caligan Partners, and NEXTBio

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

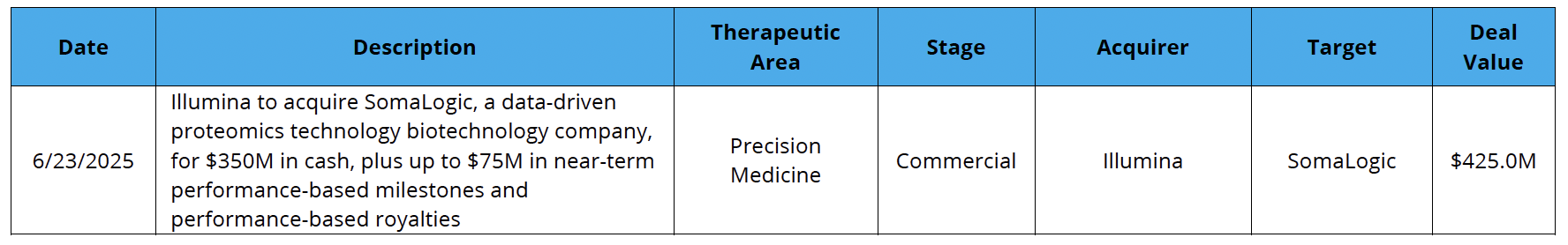

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.