Week of July 18, 2025

The Week at a Glance:

Markets Observe Minor Gains: Increases based on solid economic data and Q2 earnings were partially erased due to the Trump and Powell feud continuing

Sarepta’s Negative News Week: The rare disease biotech had a tough news cycle capped off by saying it will not pull its Duchenne targeting gene therapy off the market despite a request from the FDA

A Persistent Disconnect Between Fundraising and Deployment: The dichotomy between fund raising and deploying capital continues as private biotechs struggle to raise capital due to the lack of viable exit strategies today and despite investors sitting on ample dry powder

Markets Overview

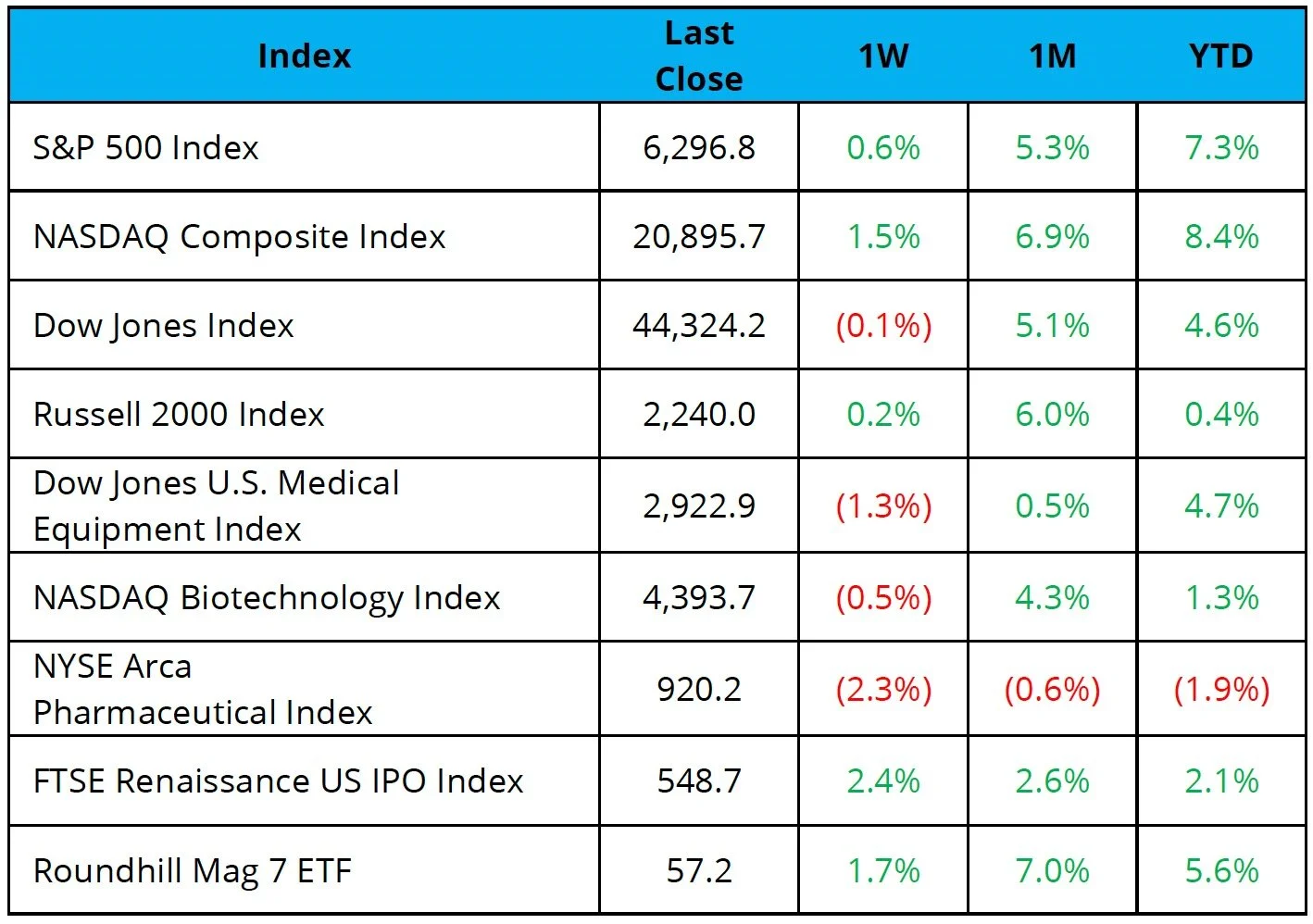

The S&P 500 and Nasdaq finished with gains of 0.6% and 1.5%, respectively, while the Dow finished down 0.1%

83% of S&P 500 companies that have reported Q2 earnings so far have beat estimates

CPI rose 2.7% on an annual basis in June (up from 2.4% in May but in line with expectations), hinting that the tariffs may be beginning to impact inflation

Trump backtracked his rhetoric on firing Powell after his comments triggered equities to fall ~1% on Wednesday

Healthcare indices underperformed the broader market with the NBI and NYSE Arca Pharma Index finishing down 0.5% and 2.3%, respectively

Notable changes in share price:

Sarepta Therapeutics (NASDAQ: SRPT): Shares ended down 22.6% after a series of adverse events, including the addition of a black box warning to Elevidys, layoffs impacting 500 employees alongside executive pay increases, disclosure of another patient death, and resistance to an FDA request to halt Elevidys sales

Abbott Laboratories (NYSE: ABT): Stock finished down 6.3% after the Company lowered its 2025 annual revenue growth forecast from 7.5-8.5% to 7.5-8.0%, citing headwinds in its diagnostic business in China

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed IPOs last week.

One company filed an S-1:

HeartFlow announced plans to raise $100.0M to accelerate both commercial and R&D activities for its AI-powered diagnostic platform, which creates 3D heart models to detect coronary artery disease more precisely

24 companies in total remain in the queue, of which only four intend to raise more than $30.0M in proceeds:

Year-to-date, companies that have gone public in 2025 have had a median loss of 6.7%

Source: CapIQ

Follow-On Offering Markets:

There were five completed follow-on equity offerings last week totaling $20.9M.

Source: Biomedtracker

PIPE/RDO Markets:

There were five PIPEs/RDOs last week totaling $176.1M, with notable deals including:

MEI Pharma, a clinical-stage oncology company, secured $100M via private placement to become the first publicly traded company on a national exchange to adopt Litecoin as a treasury reserve asset

Windtree Therapeutics, a clinical-stage biopharma developing oncology and cardiovascular therapies, raised $60M through a PIPE (with up to $140M in future proceeds) led by Build & Build Corp to fund a crypto‑treasury strategy

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.