Week of July 4, 2025

The Week at a Glance:

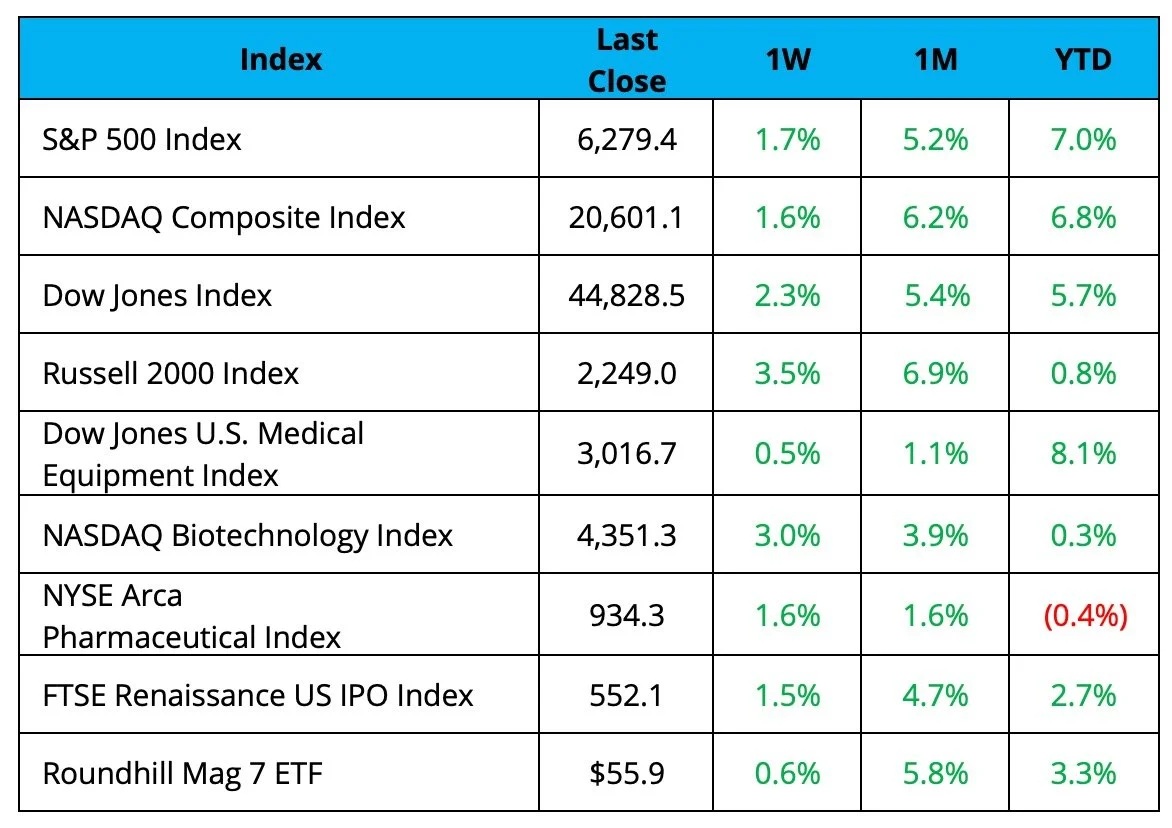

Broader Equity Market Rally Continues: The S&P 500 and Nasdaq hit record highs for a consecutive week driven by continued stronger-than-expected economic data and hopes of upcoming tariff-related trade deal announcements; however, healthcare markets continue to trail in performance

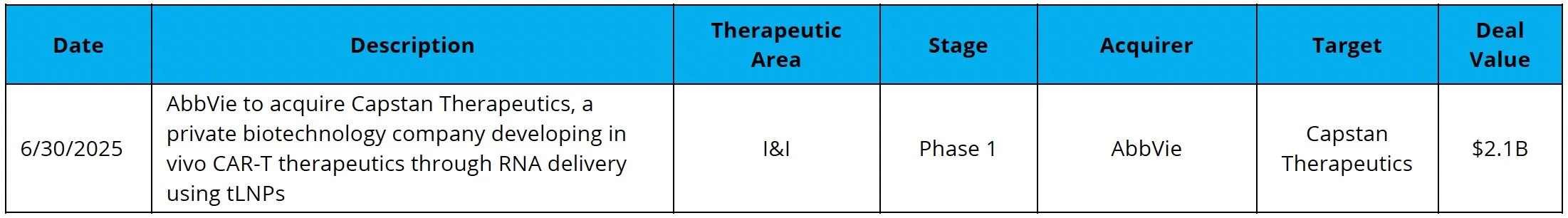

In Vivo CAR-T Makes Headlines: AbbVie agreed to acquire in vivo cell therapy developer Capstan Therapeutics in a deal worth up to $2.1B in cash at closing, marking the largest ever upfront payment for an early-stage private biotech company

Markets Overview

The S&P 500, Nasdaq, and Dow ended the week up 1.7%, 1.6%, and 2.6%, respectively

The US economy added 147,000 nonfarm payrolls in June, more than the expected 106,000

Unemployment rate fell to 4.1%, lower than the expected 4.3%

President Trump announced a trade deal with Vietnam that lowers the tariffs on US imports from 46% to 20%

The GOP-led tax bill was passed that includes an extension of the 2017 tax cuts, spending reductions, and more

Healthcare indices finished with gains with the NBI and NYSE Arca Pharma Index up 3.0% and 1.6%, respectively

Notable changes in share price:

Moderna (NASDAQ: MRNA): Shares increased by 10.2% to finish the week after the CDC recommended the Company’s RSV vaccine for at-risk adults in their 50s

INmune Bio (NASDAQ: INMB): Stock tanked 72.8% by the end of the week after the Company announced that it missed its primary endpoint in a Phase 2 Alzheimer’s trial

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed IPOs over $30.0M or announced plans to file an IPO last week.

22 companies in total remain in the queue, of which only two intend to raise more than $30.0M in proceeds:

Of these 22 companies, nine companies filed between Q4 2024 and today

Year-to-date, companies that have gone public in 2025 have had a median loss of 1.9%

Source: CapIQ

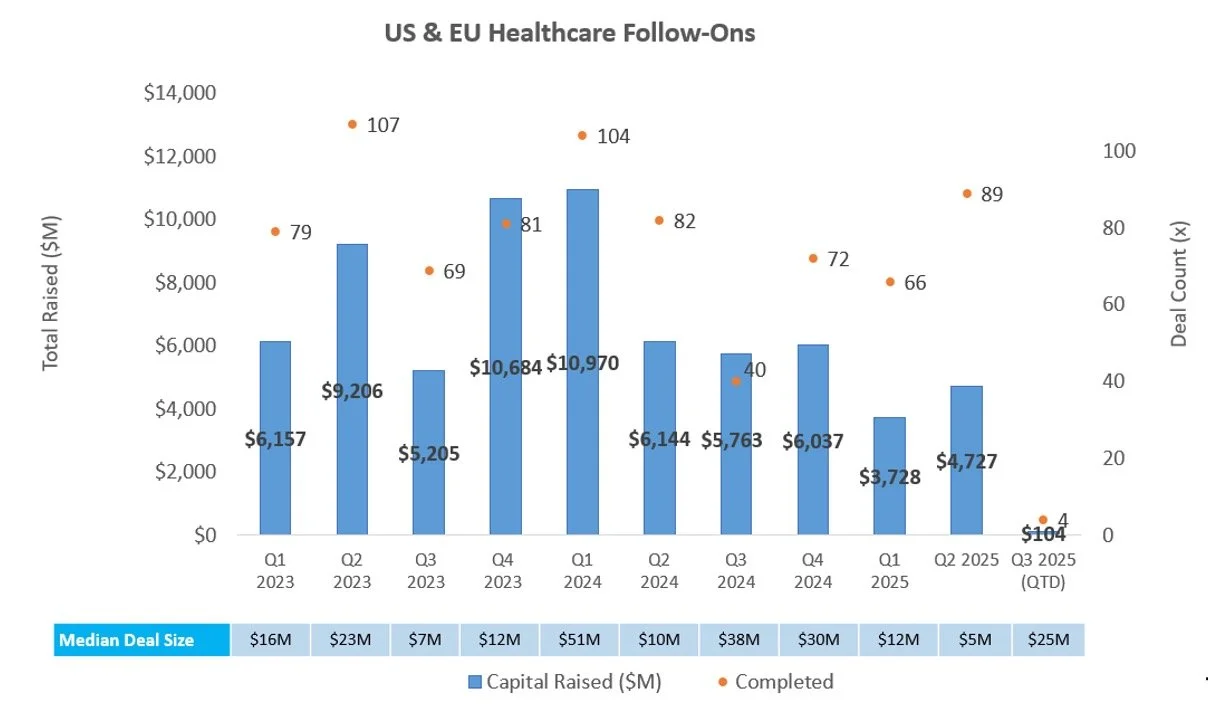

Follow-On Offering Markets:

There were nine completed follow-on equity offerings last week totaling $470.3M, including:

Dyne Therapeutics (NASDAQ: DYN) raised $230.0M to advance its pipeline of therapies for rare neuromuscular disease, including clinical programs for DMD and DM1

Nektar Therapeutics (NASDAQ: NKTR) raised $115.0M to advance its cytokine modulator pipeline, including IL-2 Treg stimulators for autoimmune disease and IL-15 agonists for cancer

ArriVent BioPharma (NASDAQ: AVBP) raised $75.0M to support ongoing clinical development of firmonertinib for EGFR-positive NSCLC and advance its pipeline of oncology assets, including solid tumor ADC programs

Source: Biomedtracker

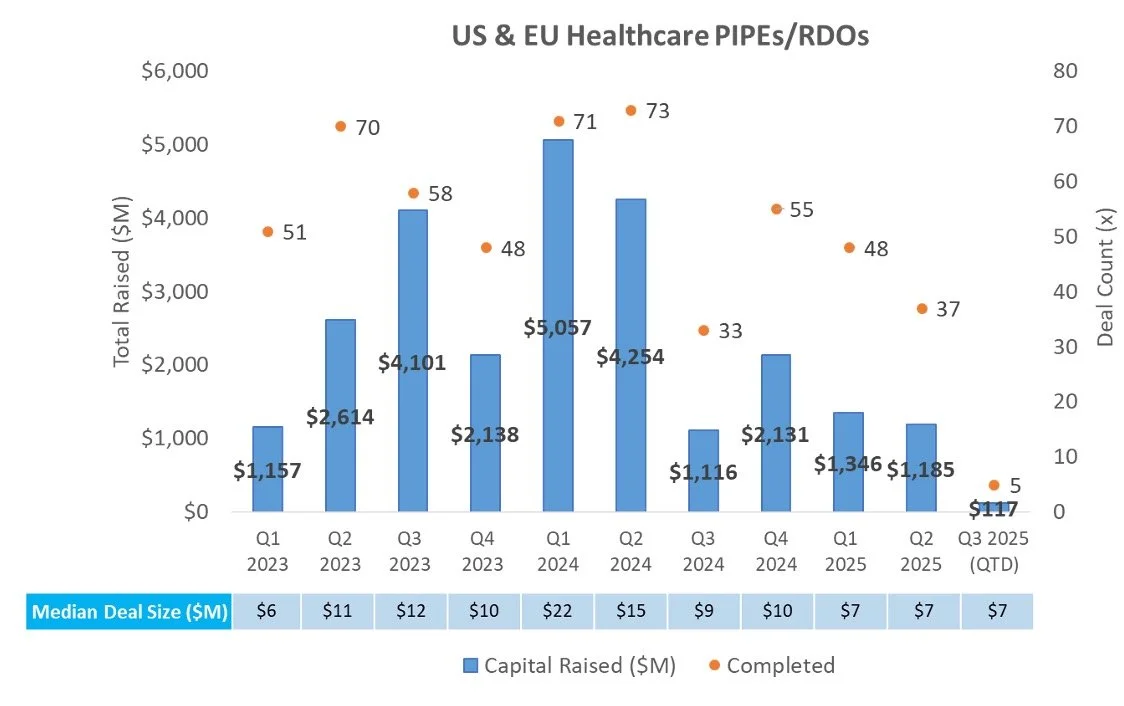

PIPE/RDO Markets:

There were six PIPEs/RDOs last week totaling $127.7M, which included:

Atai Life Sciences, a clinical stage company developing mental health treatments, raised $50M to advance its portfolio – the financing was co-led by Ferring Ventures S.A. and Apeiron Investment Group

Concurrent with its reverse merger with Channel Therapeutics, Pelthos Therapeutics raised $50.1M through a PIPE (investors included Ligand Pharmaceuticals and Murchison) to fund commercialization of Zelsuvmi for molluscum contagiosum infections

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

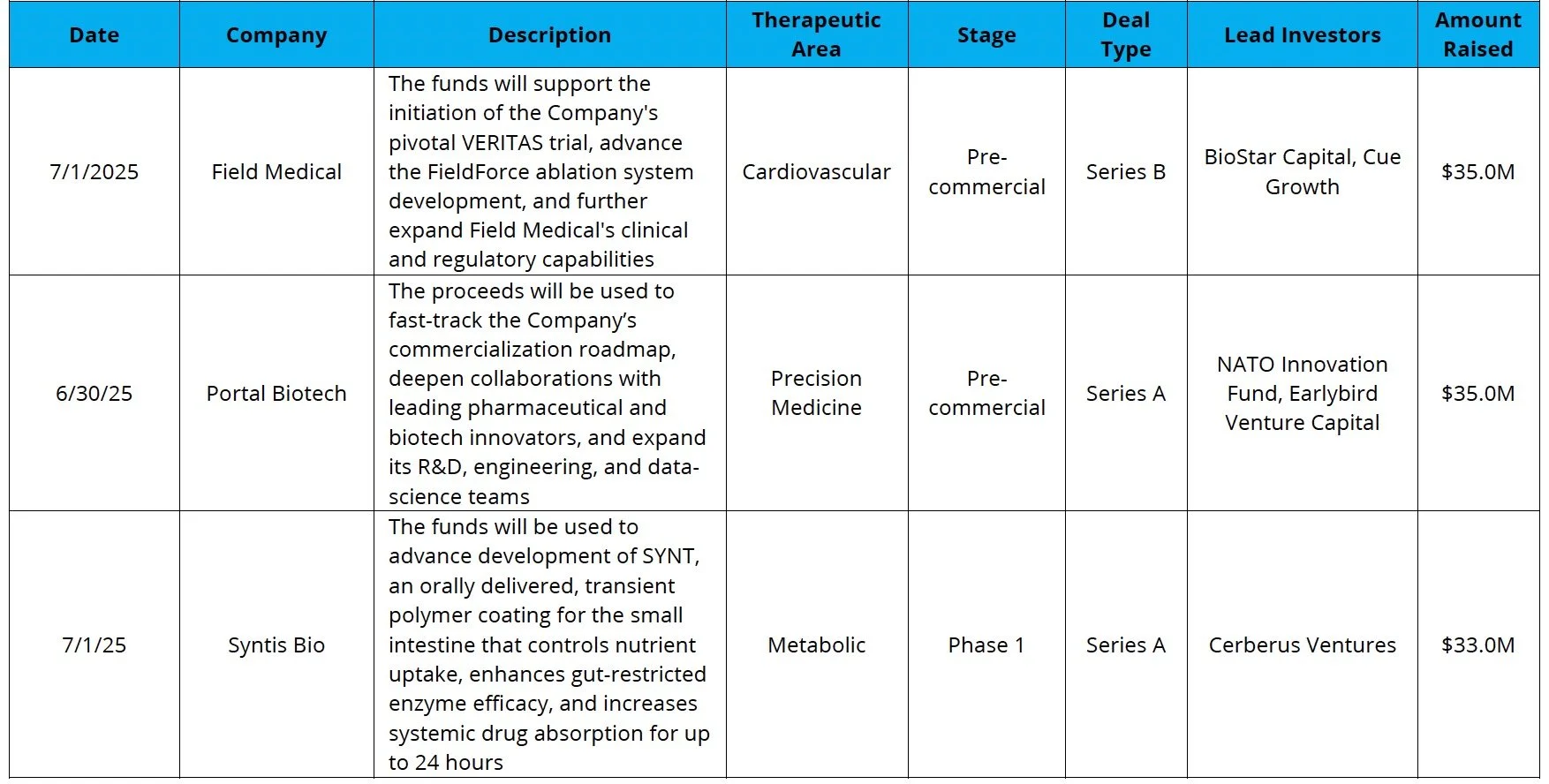

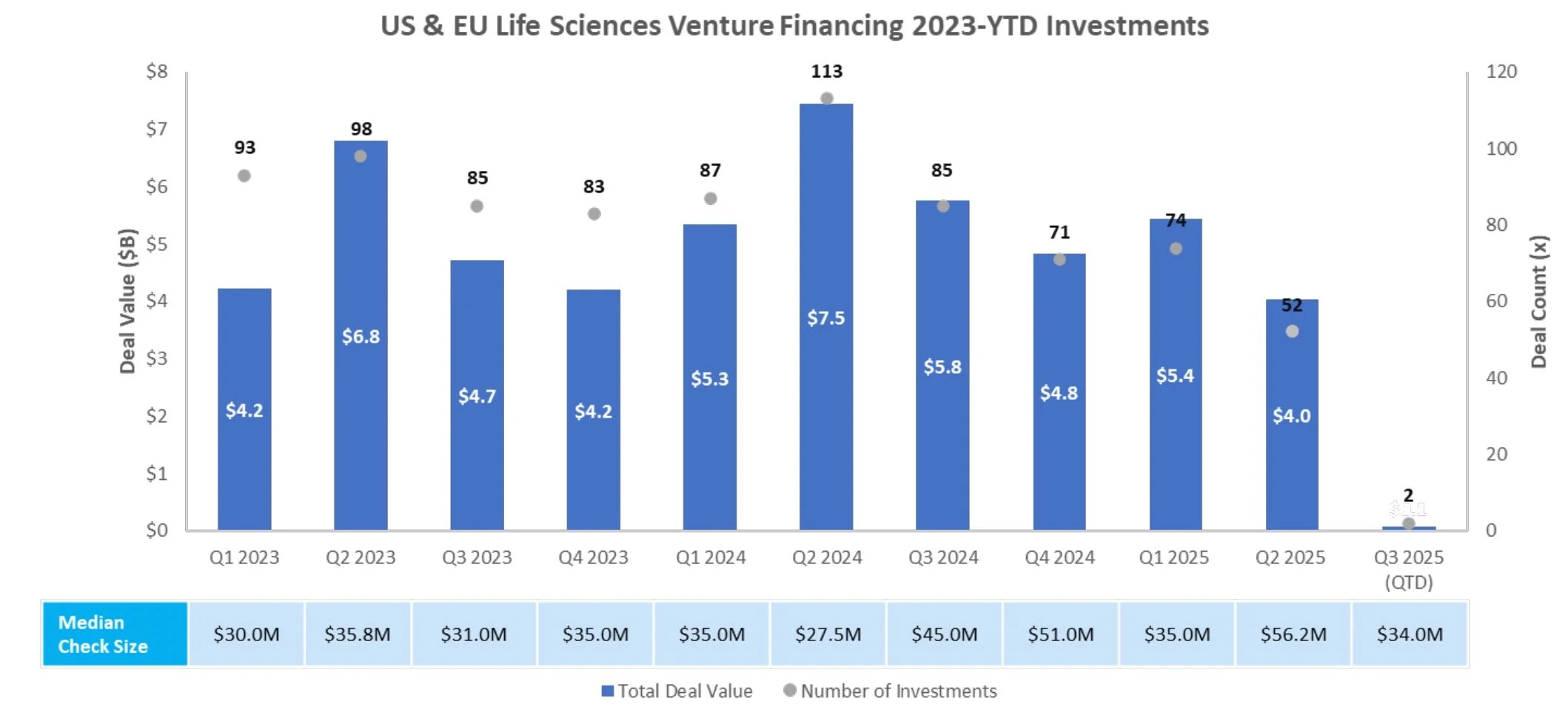

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.