Week of July 11, 2025

The Week at a Glance:

Markets finish flat due to renewed trade threats: Major indices retreated from record highs posted on Thursday due to Trump announcing revised tariff rates on numerous countries

Commercial biopharma M&A continues: Merck is strengthening their respiratory portfolio by acquiring Verona Pharma for $10.0B, marking the second largest acquisition this year and highlighting the trend of buyers focusing on de-risked commercial-stage targets

Verona’s asset, Ohtuvayre, was approved for the maintenance treatment of chronic obstructive pulmonary disease (COPD) in June 2024

The acquisition price represents a 3-3.5x multiple of the peak projected sales of Ohtuvayre

Follow-ons finally see some action: While follow-ons had a lackluster 2025 YTD in deal volume and value, last week saw a promising amount of deal activity with five deals announced raising an aggregate of $607.6M

Markets Overview

The S&P 500, Nasdaq, and Dow ended the week flat/down 0.3%, 0.1%, and 1.0%, respectively

The White House renewed attacks against Powell, drawing heightened scrutiny from the bond market

Trump’s tariff war was reignited by applying higher tariffs on 14 countries that will go into effect on

August 1Most notably of all announced tariffs, due to Canada being the US’s largest trading partner, the US increased tariffs from 25% to 35% on Canadian imports, threatening further hikes if Canada retaliates

Healthcare indices outperformed the broader market with the NBI and NYSE Arca Pharma Index finishing up 1.4% and 0.8%, respectively

Notable changes in share price:

ProKidney (NASDAQ: PROK): Shares ended the week up 588.1% after the Company reported positive data on its Phase 2 program targeting patients with chronic kidney disease and diabetes

Ultragenyx (NASDAQ: RARE) and Mereo BioPharma (NASDAQ: MREO): Stocks finished down 25.5% and 45.2%, respectively, due to the announcement that their partnership-developed antibody treatment for a rare bone disease failed a second interim analysis in a pivotal trial

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

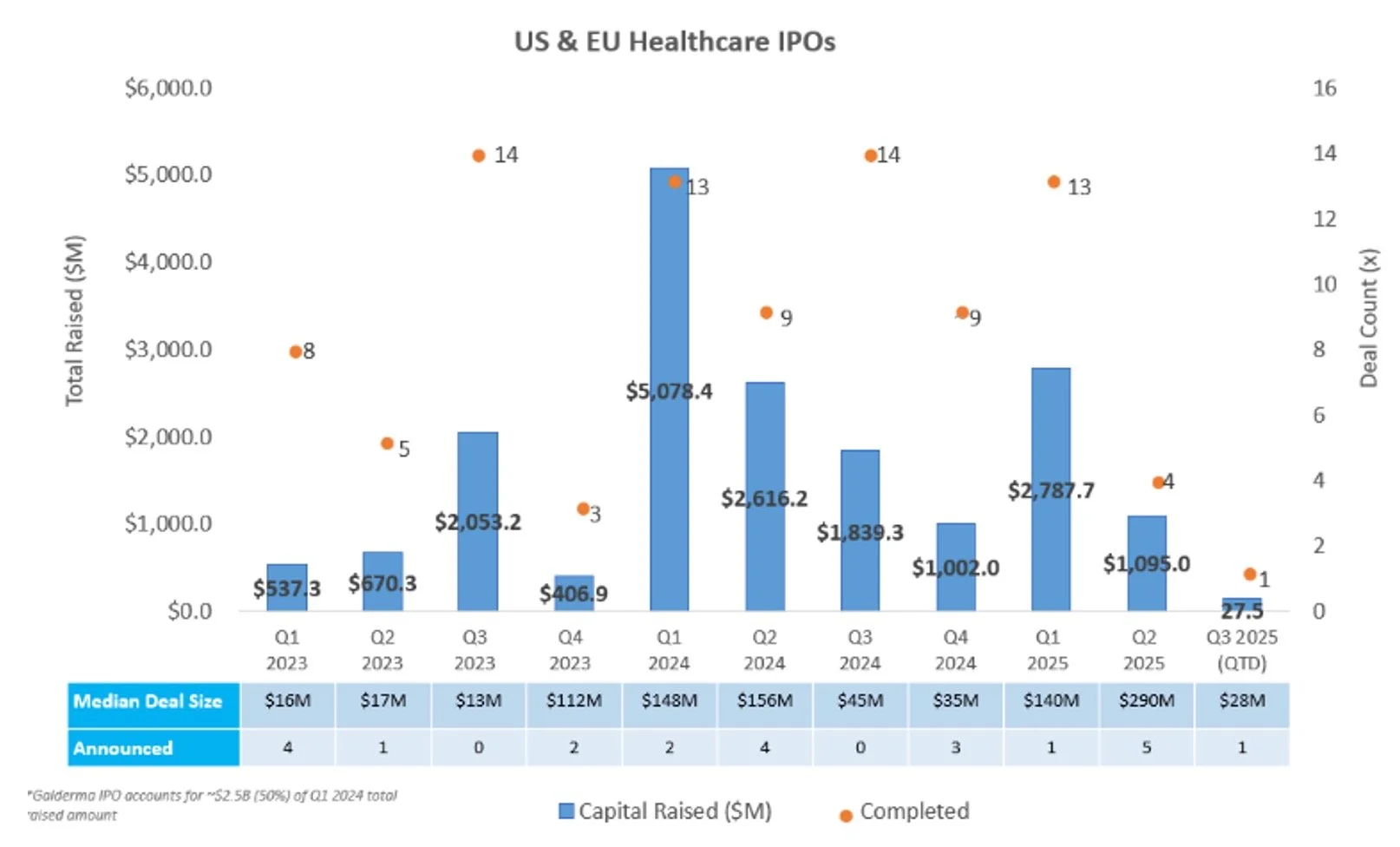

IPO Markets:

No companies completed IPOs last week.

One company filed an S-1:

Shoulder Innovations announced plans to raise $100.0M to support R&D and commercial growth plans for its shoulder arthroplasty products, which include both proprietary implants and procedure visualization software

23 companies in total remain in the queue, of which only three intend to raise more than $30.0M in proceeds:

Of these 23 companies, ten companies filed between Q4 2024 and today

Year-to-date, companies that have gone public in 2025 have had a median loss of 6.5%

Source: CapIQ

Follow-On Offering Markets:

There were five completed follow-on equity offerings last week totaling $607.6M, including:

Cogent Biosciences (NASDAQ: COGT) raised $230.0M to advance bezuclastinib, a small molecule KIT inhibitor being studied in systemic mastocytosis (SM) and gastrointestinal stromal tumors (GIST)

Soleno Therapeutics (NASDAQ: SLNO) raised $200.0M to support commercialization of Vykat XR, the first therapy approved for hyperphagia in patients with Prader-Willi syndrome

Rhythm Pharmaceuticals (NASDAQ: RYTM) raised $175.0M to continue commercializing and developing therapies for rare neuroendocrine diseases, such as Bardet-Biedl syndrome, POMC/LEPR-deficiency obesity, and acquired hypothalamic obesity

Source: Biomedtracker

PIPE/RDO Markets:

There were two PIPEs/RDOs last week totaling $6.0M

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.