Week of August 29, 2025

The Week at a Glance:

The summer wraps up with flat indices: The three major indices finished slightly down as investors wait for the Fed’s September meeting—some question the Fed’s independence following Trump’s comments that he will fire Fed Governor Lisa Cook

Regulatory uncertainty remains high: Only weeks after being confirmed, Susan Monarez was pushed out of her role as CDC director following her refusal to resign after pressure to change vaccine policy

Update on the political economy: DNB//Back Bay tracked macroeconomic, regulatory, and healthcare deal making activity over the summer and will publish the next in our series of updates. View our current political economy update here: Vital Signs: A Pulse Check on the Healthcare Market

NAHC companies to be announced: DNB//Back Bay is proud to bring together compelling mid- and large-cap and pre-IPO Nordic and US healthcare companies and US institutional investors in NYC for the 10th Annual Nordic-American Healthcare Conference (NAHC) this March. We have limited presentation spots remaining. If you would like to be considered or nominate a company to present, please be in touch!

Markets Overview

The S&P 500, Dow, and Nasdaq slipped 0.1%, 0.2%, and 0.2%, respectively

US core PCE stayed stable in July, as investors await the Fed’s September meeting

President Trump said he would fire Fed Governor Lisa Cook, setting the stage for a major governance and legal decision

The NYSE Pharma Index and NBI declined 0.5% and 1.3%, respectively.

Notable changes in share price include:

J&J (NYSE: JNJ): Following disappointing Phase 2a data, J&J was down 1.1% after discontinuing the development of nipocalimab in combination with an anti-TNFa for rheumatoid arthritis

Madrigal Pharmaceuticals (NASDAQ: MDGL): Shares rose 6.2% after the FDA announced it is considering the use of non-invasive liver measurements as a surrogate endpoint in place of liver biopsies in MASH. Other MASH companies also traded higher on the news: VKTX +4.2%, IVA +29.8%, and ALT +8.5%

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

Zero companies completed IPOs last week

Zero companies filed an S-1 last week

18 companies remain in the queue, of which only one intends to raise more than $30.0M in proceeds

For the year-to-date, companies that have gone public in 2025 have had a median gain of 0.2%

Source: CapIQ

Follow-On Offering Markets:

There were five small follow-on equity offerings last week totaling $19.5M

Source: Biomedtracker

PIPE/RDO Markets:

There were three PIPEs/RDOs last week raising an aggregate $161.2M, including:

Shattuck Labs (NASDAQ: STTK) closed a $103.0M RDO led by OrbiMed to fund a Phase 2 trial for their lead asset, SL-325, targeting IBD

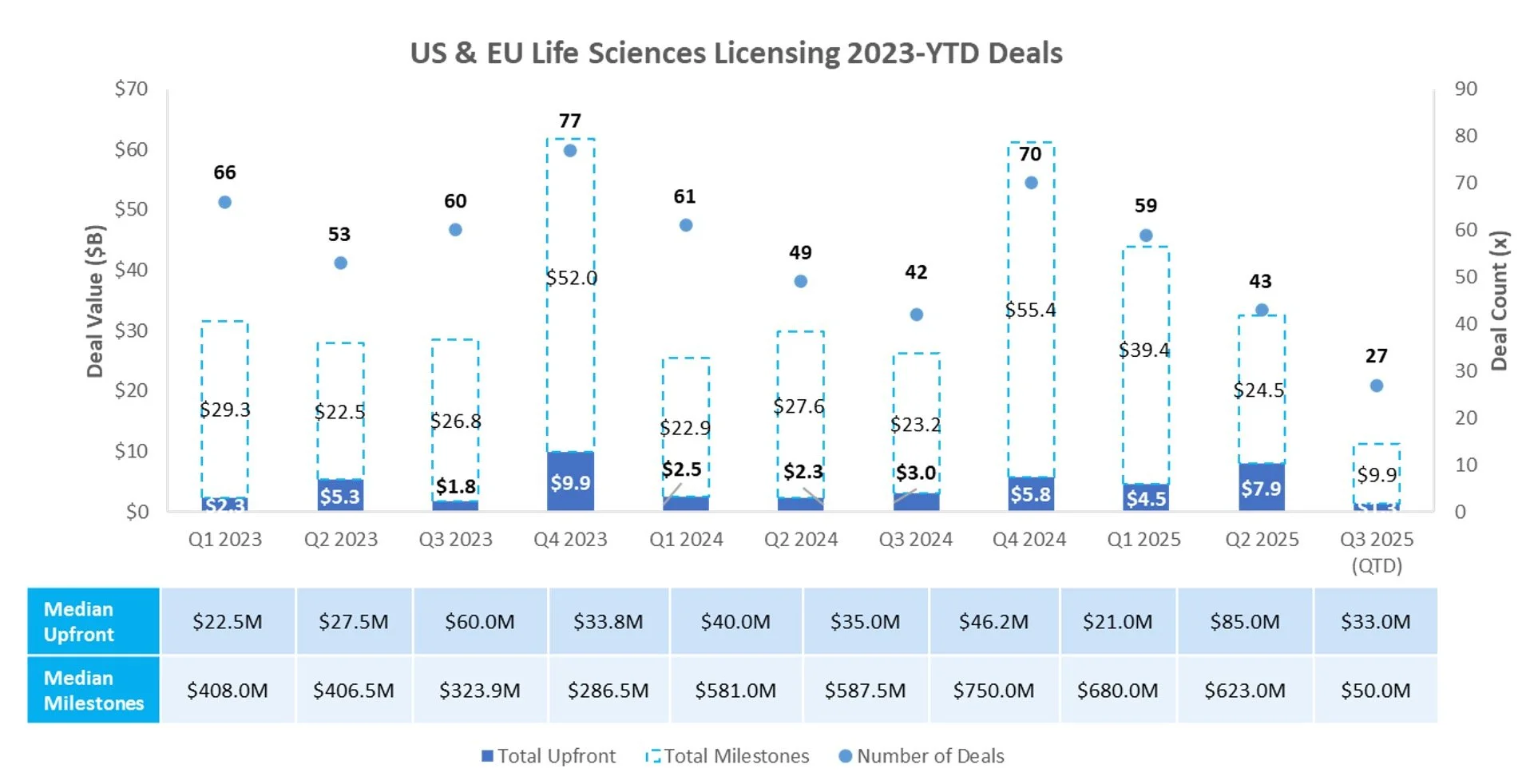

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

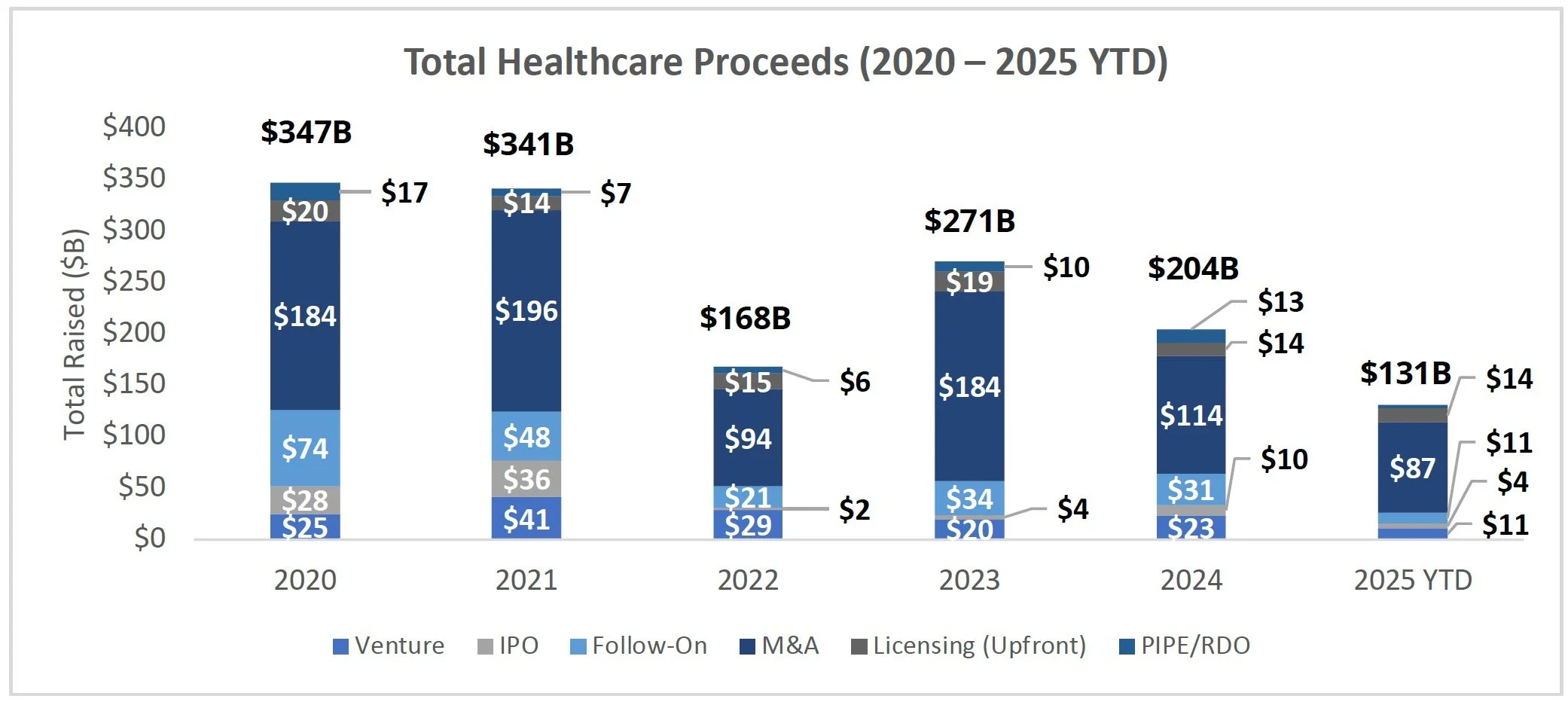

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available and focuses on the rapid growth of bispecific or multi-specific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.