Week of August 15, 2025

The Week at a Glance:

Stocks Rally: Major indices finished the week up for the fourth out of five previous weeks thanks to strong earnings, resilient economic growth, and an increased likelihood of rate cuts

Sarepta Looks for a Lifeline: Sarepta sold its entire Arrowhead stake, raising ~$174M in cash to extend its runway while simultaneously using ~2.7M shares plus $50M cash to settle a $100M milestone owed to Arrowhead. This move comes amid financial challenges, including declining sales of Elevidys and recent FDA scrutiny following patient fatalities

Bayer Bets on KRASi: Bayer struck a deal worth up to $1.3B with Kumquat Biosciences to acquire global rights to a KRAS G12D inhibitor. Kumquat will run the drug through a Phase 1a study before Bayer takes over development, targeting cancers such as pancreatic, colorectal, and non-small cell lung cancer

Markets Overview

The S&P 500, Nasdaq, and Dow finished with gains of 0.9%, 0.8%, and 1.7%, respectively

Inflation data for the week was mixed: the CPI showed signs of cooling inflation, while the PPI pointed to a reacceleration

Investors continue to be hopeful of a rate cut as the market has priced in an 88% chance that the Fed will lower rates in September

The NYSE Pharma Index rose 6.0% and the NBI gained 5.0% on the week, supported by growing investor confidence in a potential rate cut

Notable changes in share price:

Eli Lilly (NYSE: LLY): Shares rose 11.6% to finish the week after rebounding from weak orforglipron data, helped by plans to raise GLP-1 prices abroad to offset potential MFN pricing

Precigen (NASDAQ: PGEN): Shares jumped 58.9% on Friday after the FDA unexpectedly approved its drug for a rare respiratory disease, based on a 35-patient Phase 1/2 trial. The decision underscores the FDA’s push to expedite rare-disease approvals

Novo Nordisk (NYSE: NVO): Shares climbed 7.2% post-Friday’s close after Wegovy gained approval in NASH/MASH. Madrigal Pharmaceuticals fell 7.5% on the news, while companies like Akero Therapeutics and 89Bio, which focus on the fibrotic patient population, remained unchanged

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed IPOs last week.

No companies filed an S-1 last week

18 companies in total remain in the queue, of which none intend to raise more than $30.0M in proceeds

Year-to-date, companies that have gone public in 2025 have had a median loss of (7.8%)

Source: CapIQ

Follow-On Offering Markets:

There were eight completed follow-on equity offerings last week totaling $304.5M, including:

Compass Therapeutics (NASDAQ: CMPX) raised $100.0M to fund commercial readiness and advance its clinical-stage pipeline, including its lead DLL4 x VEGF-A bispecific antibody programs in biliary tract and colorectal cancer

Oxford Biomedica plc (LSE: OXB) raised $81.4M to expand US cell and gene therapy manufacturing capacity and strengthen its CDMO network

Sagimet Biosciences (NASDAQ: SGMT) raised $75.0M to advance its FASN inhibitor denifanstat for MASH and support broader pipeline development

Source: Biomedtracker

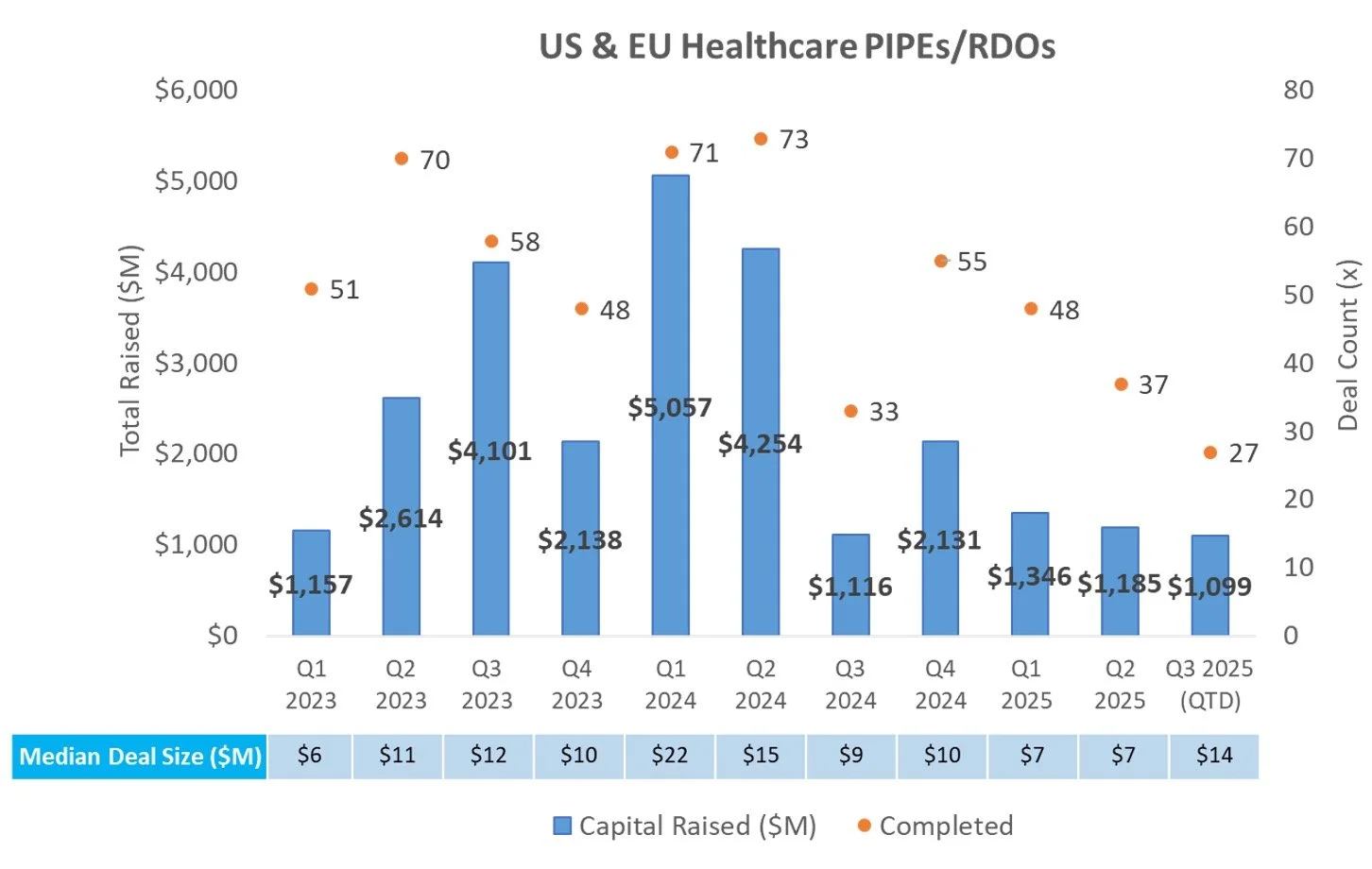

PIPE/RDO Markets:

There were three PIPEs/RDOs last week totaling $138.0M, including:

X4 Pharmaceuticals (NASDAQ: XFOR), developing therapies for rare immunological diseases, raised $85.0M in a PIPE led by Coastlands Capital with support from existing investors Bain Capital Life Sciences and NEA

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.