Week of July 25, 2025

The Week at a Glance:

More Market Record Highs: The S&P 500 notched record highs last week, as major indices were lifted thanks to the US trade deal with Japan, continued indicators of a robust labor market and strong tech earnings

Sarepta’s Drama Continues: Sarepta Therapeutics notified the FDA of its decision to voluntarily and temporarily pause all shipments of ELEVIDYS (delandistrogene moxeparvovec) for Duchenne muscular dystrophy in the United States

Roche also announced that they are pausing the shipment of ELEVIDYS in a handful of countries outside the US

The US and EU Strike a Deal: President Trump and EU Commission President Ursula von der Leyen announced a trade deal on Sunday where the European Union’s 27 countries will be charged a baseline tariff of 15% on most exports to the US, which still needs to be approved by both US and EU political bodies

While the deal does not explicitly include pharmaceuticals, senior US officials said a 15% tariff for EU pharma exports was agreed upon. However, von der Leyen notes that how Trump wishes to deal with pharmaceuticals in general globally is to be determined

Markets Overview

The S&P 500, Nasdaq, and Dow finished with gains of 1.5%, 1.0%, and 1.3%, respectively

President Trump announced a trade deal with Japan that lowers the “reciprocal” tariff rate on Japanese imports from 25% to 15%, along with Japan investing $550B in the US

Jobless claims fell by 4,000 to a total of 217,000 (economists had predicted unemployment to increase by 6,000)

Alphabet (NASDAQ: GOOG) led the way for tech earnings, rising ~4% to finish the week thanks to beating Q2 revenue estimates

Healthcare indices had a strong performance last week, with the NBI and NYSE Arca Pharma Index finishing up 3.6% and 4.2%, respectively

Notable changes in share price:

Medpace (NASDAQ: MEDP): Shares ended up 43.5% thanks to strong Q2 earnings that exceeded analyst expectations, the Company reported an EPS of $3.10 (compared to analyst estimates of $3.00) and updated their FY 2025 guidance

Illumina (NASDAQ: ILMN): Stock finished up 13.7% thanks to a high amount of institutional and insider buying, led by ARK Invest purchasing $3.0M worth of shares

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

One company completed an IPO last week:

Carlsmed (NASDAQ: CARL) completed its IPO, raising $100.0M to support development and commercialization of its AI-enabled personalized spine surgery solutions

Carlsmed reported $27.2M in revenue in 2024, nearly double its 2023 figure, underscoring the ongoing IPO trend towards commercial-stage companies with established sales momentum

No companies filed S-1s last week

20 companies in total remain in the queue, of which only two intend to raise more than $30.0M in proceeds

Year-to-date, companies that have gone public in 2025 have had a median gain of 1.1%

Source: CapIQ

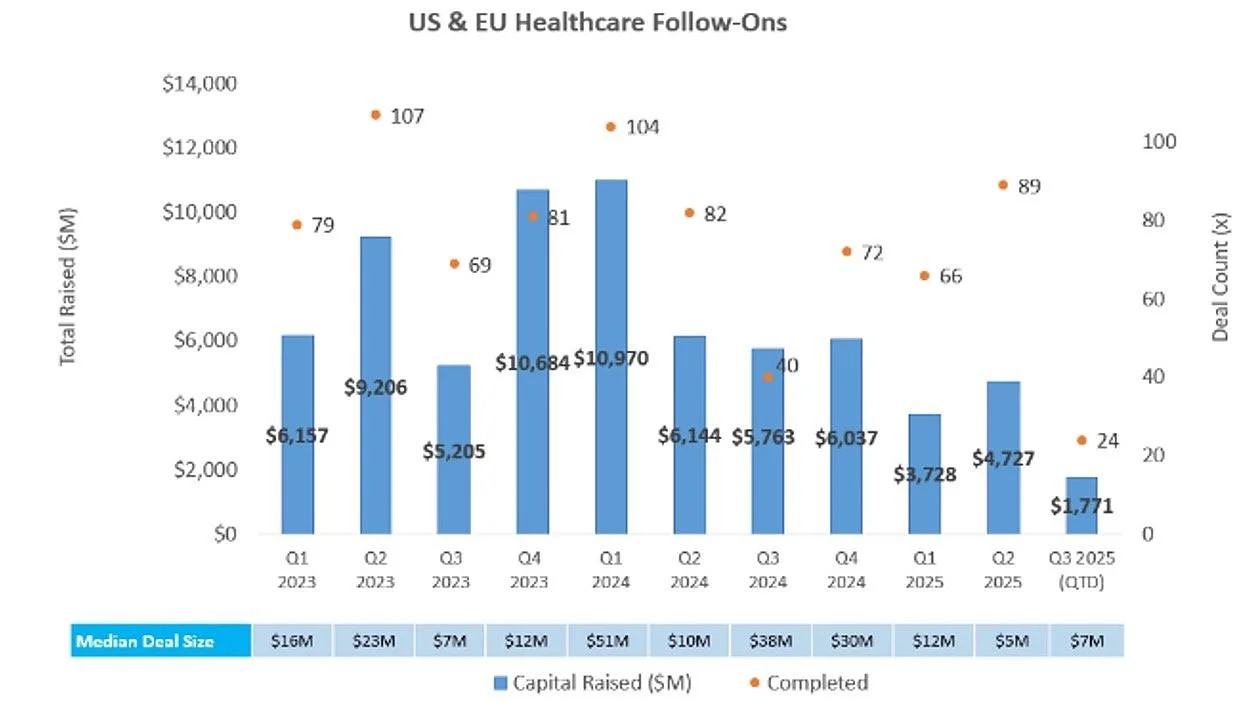

Follow-On Offering Markets:

There were five completed follow-on equity offerings last week totaling $20.9M.

Source: Biomedtracker

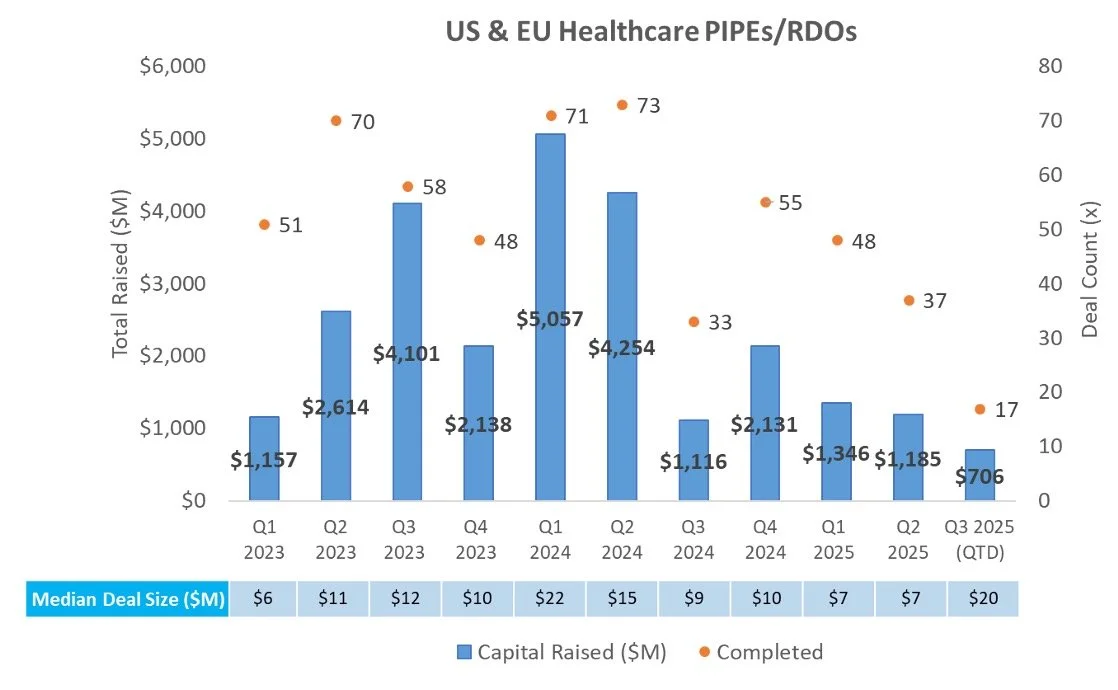

PIPE/RDO Markets:

There were nine completed follow-on offerings raising an aggregate of $1.0B, including:

Abivax (NASDAQ: ABVX) raised $747.5M to continue funding R&D activities, but also to begin commercial preparation following the positive Phase 3 data readout for its lead asset in moderate-to-severe UC

Pharvaris N.V. (NASDAQ: PHVS) raised $191.3M to fund late-stage R&D activities for its hereditary angioedema asset, hire a sales and marketing team in the US, and support additional pre-commercialization expenses

Absci (NASDAQ: ABSI) raised $50.0M to advance its AI-designed internal drug programs and to further develop its Integrated Drug Creation™ platform

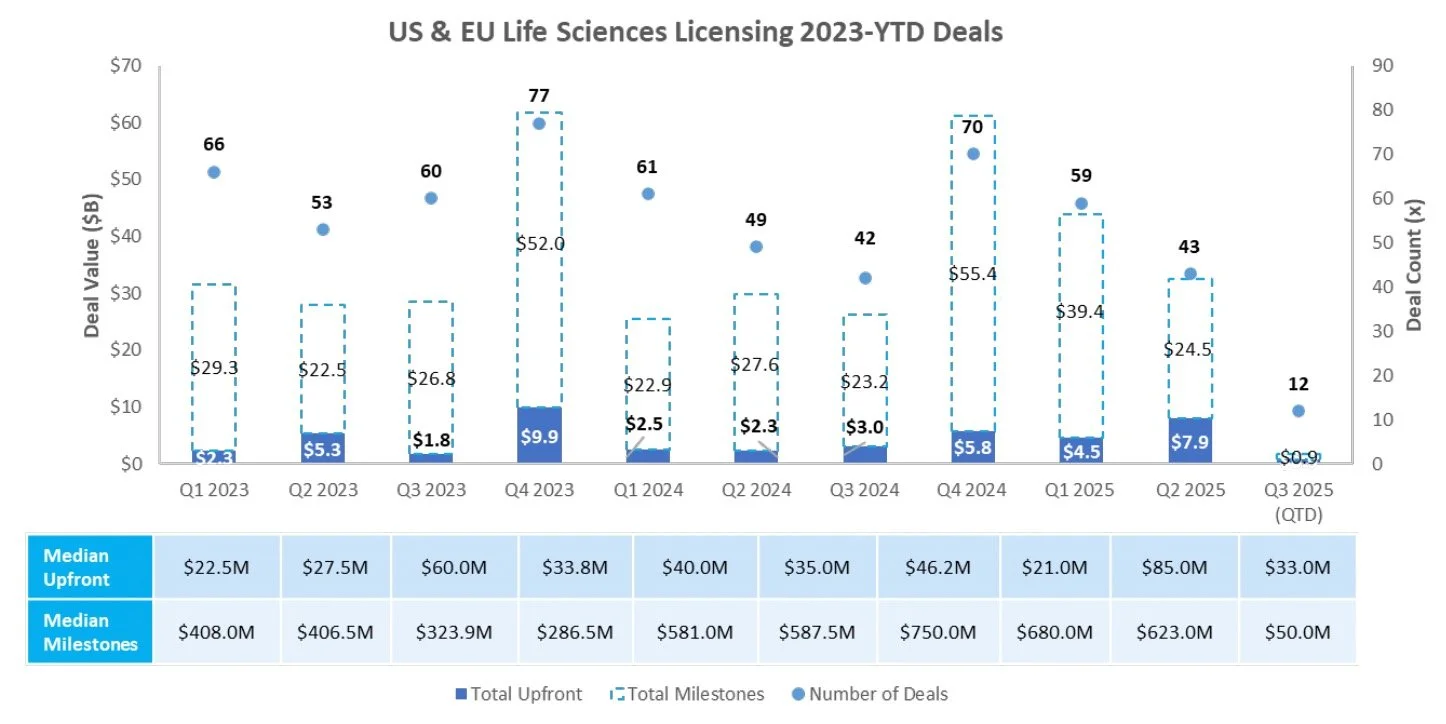

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

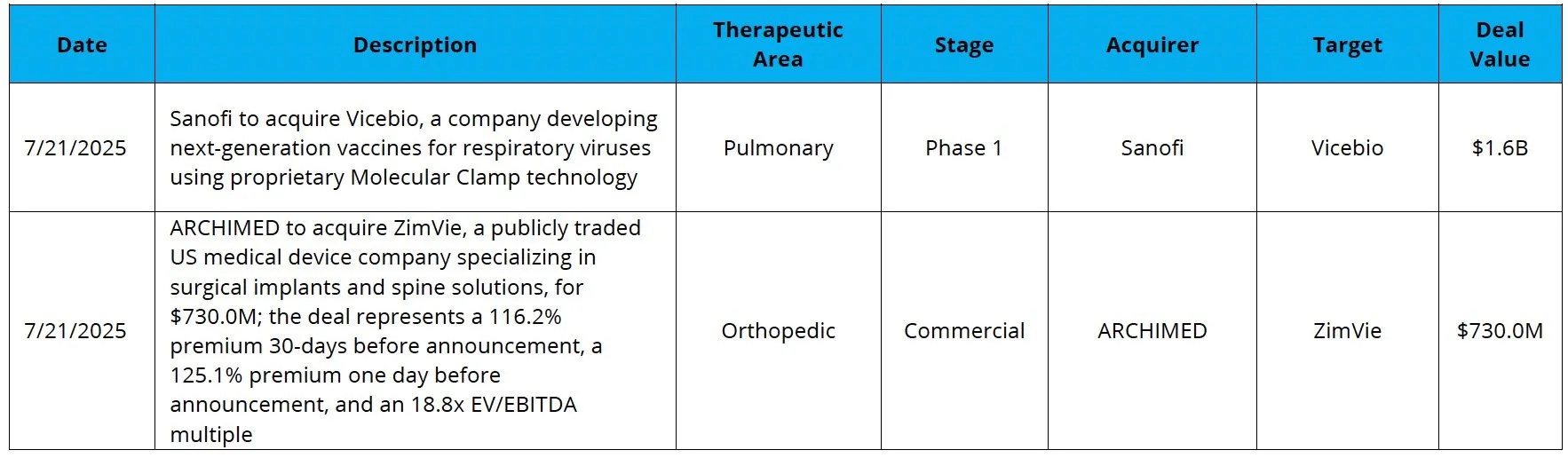

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

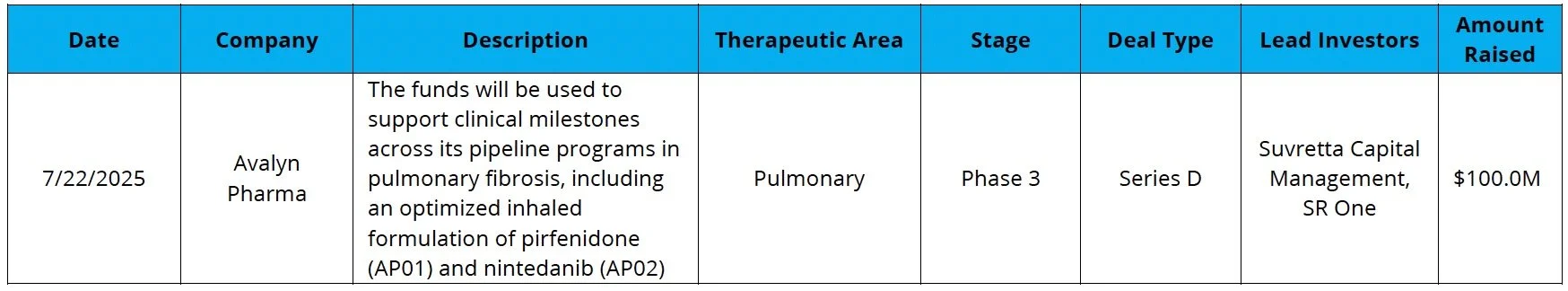

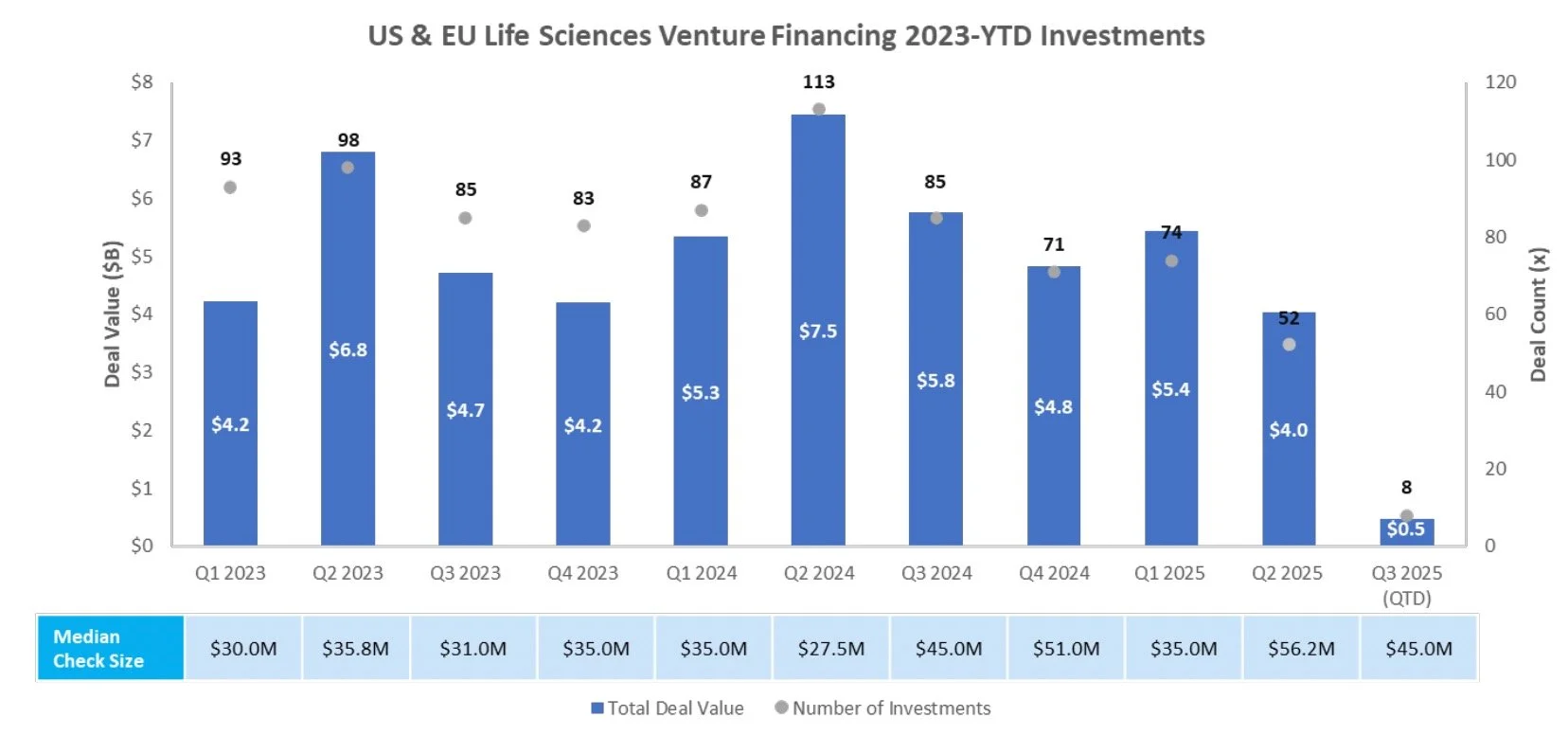

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Obesity Drug Development

The second in our series of healthcare development reports focuses on the clinical and market needs within the GLP-1 space and how biopharma, investors and academia view the next obesity breakthrough.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.