Week of October 10, 2025

The Week at a Glance:

China trade tensions worsen: Major indices fell an average of ~2.5% due to Trump’s proposed doubling of tariffs on Chinese goods to 100% in retaliation to China’s export controls on rare earth minerals

European IPOs have no problem raising capital: Ottobock SE, a developer of prosthetics and other mobility technology, raised ~$820.0M in an IPO on the Frankfurt Stock Exchange. The deal marks the second largest healthcare IPO this year, behind Asker’s $887.0M on the Oslo Exchange

The transaction highlights that companies listing on European exchanges have been able to raise substantial amounts of capital and that healthcare IPOs continue to be dominated by commercial MedTech YTD

In Vivo is so in vogue: BMS announced it would acquire Orbital Therapeutics for $1.5B in cash, gaining Orbital’s in vivo CAR-T RNA platform and its lead candidate OTX-201 which reprograms T cells in vivo to express CD19 CAR. This deal joins a wave of in vivo CAR-T activity in 2025: AbbVie acquired Capstan Therapeutics, Gilead/Kite picked up Interius BioTherapeutics, and AstraZeneca acquired EsoBiotec to expand in vivo delivery capabilities

DNB//Back Bay opened early NAHC registration for US healthcare investors: it’s not too early to save the date for our US-Nordic healthcare equity conference, the Nordic-American Healthcare Conference, March 25-26, 2026 in New York City, where we hear from companies like Adcendo, ALK-Abello, Novo Nordisk, Camurus, Lundbeck. Institutional investors can request a seat and request company meetings here.

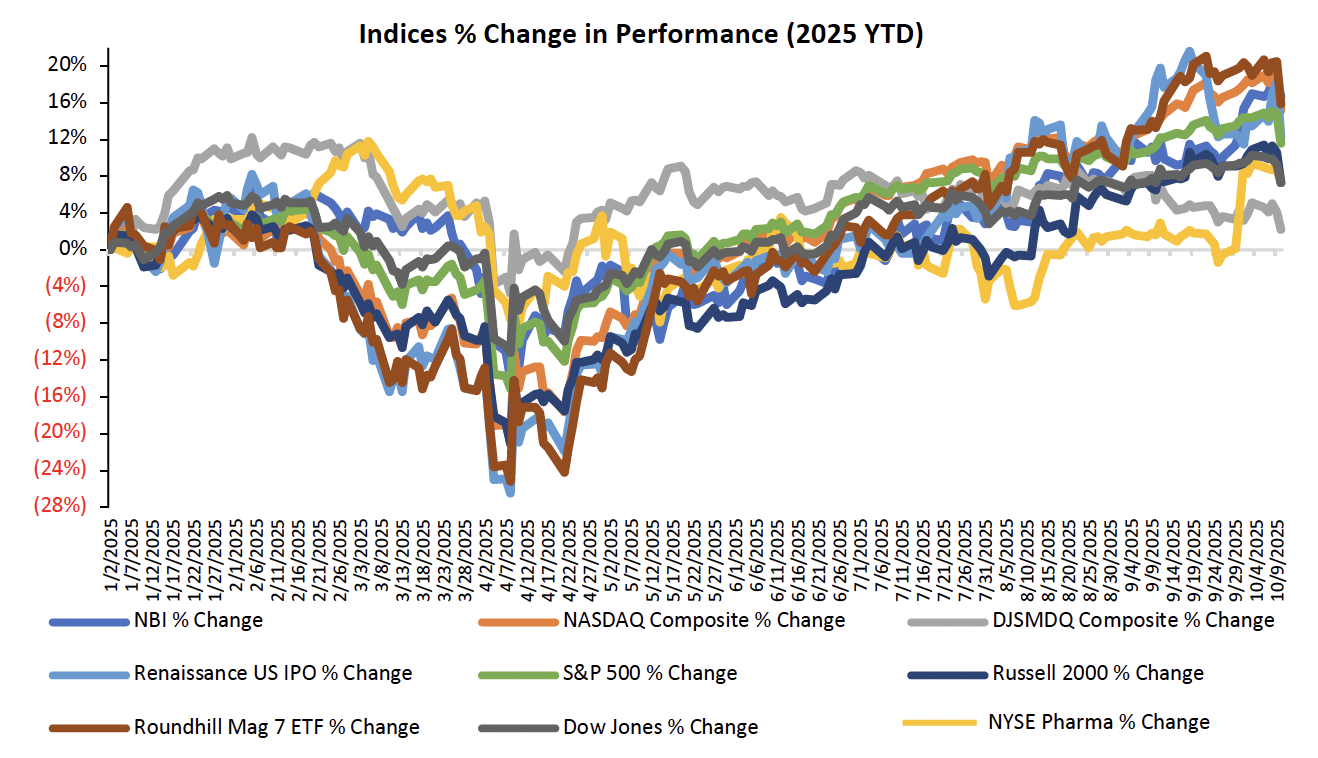

Markets Overview

The S&P 500, Nasdaq, and the Dow were down 2.4%, 2.5%, and 2.7%, respectively

Trump’s threat to double tariffs on China to 100% sparked market turmoil on Friday

The NYSE Pharma Index and the NBI were down 1.9% and 0.3%, respectively

Notable changes in share price included:

Akero Therapeutics (NASDAQ: AKRO): Shares rose 16.9% after the Company announced its acquisition by Novo Nordisk for up to $5.2B, including a $4.7B upfront consideration

Protagonist Therapeutics (NASDAQ: PTGX): Shares surged 33.7% after reports surfaced suggesting that J&J is considering acquiring Protagonist in a transaction expected to exceed $5B

Skye Bioscience (NASDAQ: SKYE): Shares fell 59.3% after the Company announced that its Phase 2a obesity trial failed to show a significant reduction in weight compared to placebo after 26 weeks of treatment

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

One company completed an IPO last week:

Ottobock SE & Co. KGaA raised ~$820.0M to advance its portfolio of prosthetics, orthotics, and mobility technologies, continuing the broader trend this year of commercial-stage MedTech companies pursuing public listings

Three companies filed an S-1 last week:

Evommune intends to raise ~$100.0M to propel its clinical-stage pipeline for chronic inflammatory diseases, including Phase 2 programs EVO756 for atopic dermatitis, chronic spontaneous urticaria, chronic inducible urticaria and EVO301 for atopic dermatitis and ulcerative colitis

BillionToOne intends to raise ~$100.0M as it scales its molecular diagnostics platform for prenatal and oncology applications, including its flagship Unity Screen for non-invasive prenatal testing and Northstar Select for comprehensive cancer genomic profiling

Akston Biosciences intends to raise ~$20.0M to support development of antibody and protein therapies for companion animal health, including its lead candidate AKS-701d, an antibody for canine bladder cancer

Of 22 companies in the queue, only two (Evommune and BillionToOne) intend to raise more than $30.0M in proceeds

IPOs that have priced this year have delivered a median gain of 25.0%, with ~65% of newly public companies trading above their offer price

Source: CapIQ

Follow-On Offering Markets:

There were eight follow-on equity offerings last week, totaling $526.5M, including:

Apogee Therapeutics (NASDAQ: APGE) raised $300.0M to fund preclinical, clinical, and commercial readiness activities for its antibody programs in inflammatory and immunology diseases, including lead asset APG777 for atopic dermatitis and asthma

Idorsia Pharmaceuticals (SIX: IDIA) raised $82.0M to extend its operating cash runway into 2028 and accelerate the commercial trajectory of insomnia medication QUVIVIQ (daridorexant), as well as support its pipeline development of lucerastat (Fabry disease) and daridorexant (pediatric insomnia)

Esperion Therapeutics (NASDAQ: ESPR) raised $75.0M to fund commercialization of LDL-lowering medications NEXLETOL® (bempedoic acid) and NEXLIZET® (bempedoic acid + ezetimibe), as well as advance clinical development of additional pipeline candidates for primary sclerosing cholangitis and renal disease

Source: Biomedtracker

PIPE/RDO Markets:

There were 15 PIPE/RDO deals last week raising an aggregate $725.3M, including:

Jade Biosciences (NASDAQ: JBIO) raised a $135.0M PIPE led by RA Capital, Fairmount, Venrock, and other prominent life science investors to advance its early-stage pipeline of autoimmune targeting therapies

Zenas BioPharma (NASDAQ: ZBIO) priced a $120.0M direct offering to fund the completion of their Phase 3 trial targeting IgG4-RD, along with additional programs within autoimmune diseases

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

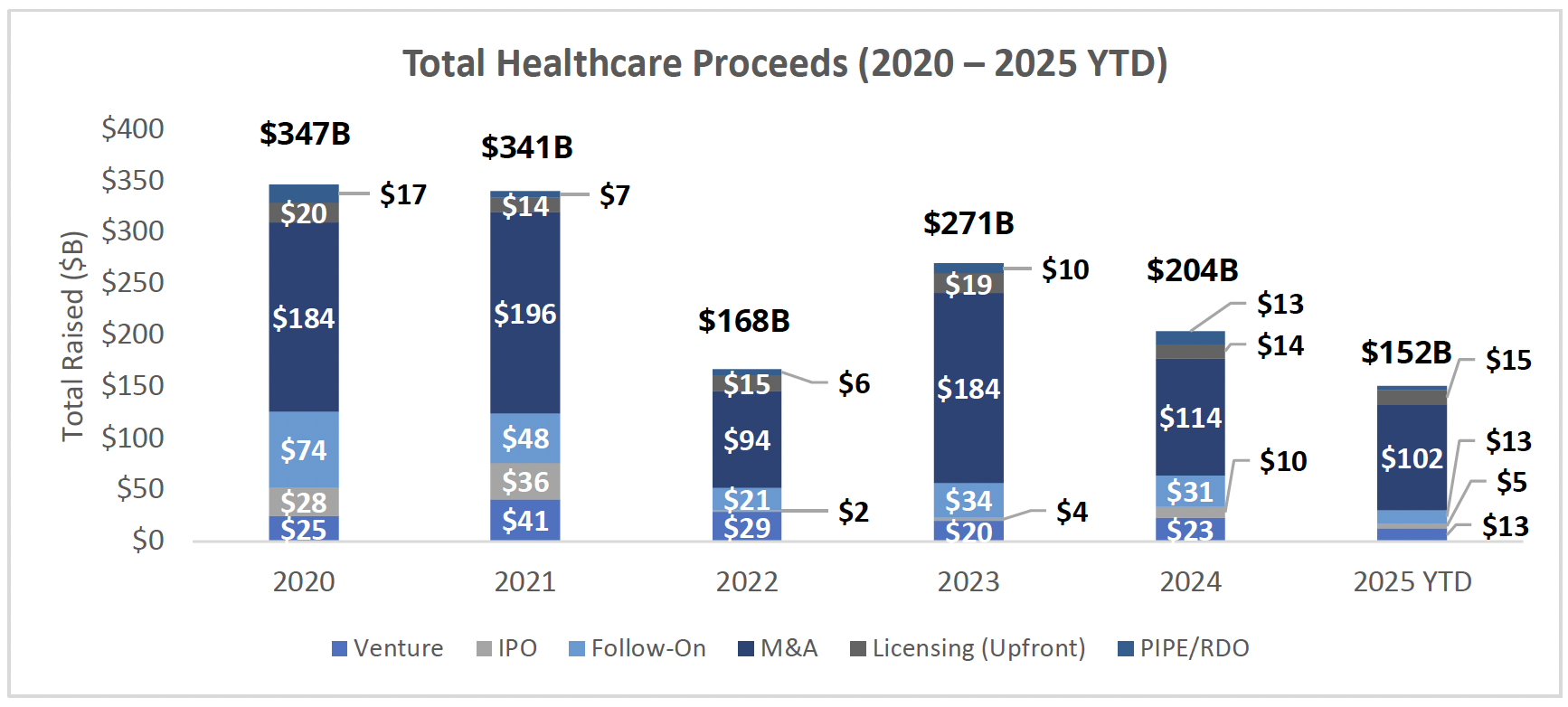

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available and focuses on the rapid growth of bispecific or multi-specific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.