Week of September 5, 2025

The Week at a Glance:

Hopes rise for rate cuts: The S&P 500 and NASDAQ finished the shorter trading week up 0.3% and 1.1%, respectively, thanks to a weak August job report that bolstered expectations for a rate cut in September

Novartis doubles down on RNAi: Novartis inked two licensing deals last week around RNA interference modalities; the first was with Arrowhead for its preclinical siRNA drug targeting Parkinson’s for $200.0M upfront and $2.0B in milestones, while the second was for Argo Biopharmaceuticals’ RNAi asset in Phase 2 targeting dyslipidemia along with two discovery stage compounds for $160.0M upfront and $5.2B in milestones

Novartis’ deal with Argo Biopharmaceuticals highlights the continued trend this year of large pharma in-licensing assets from China

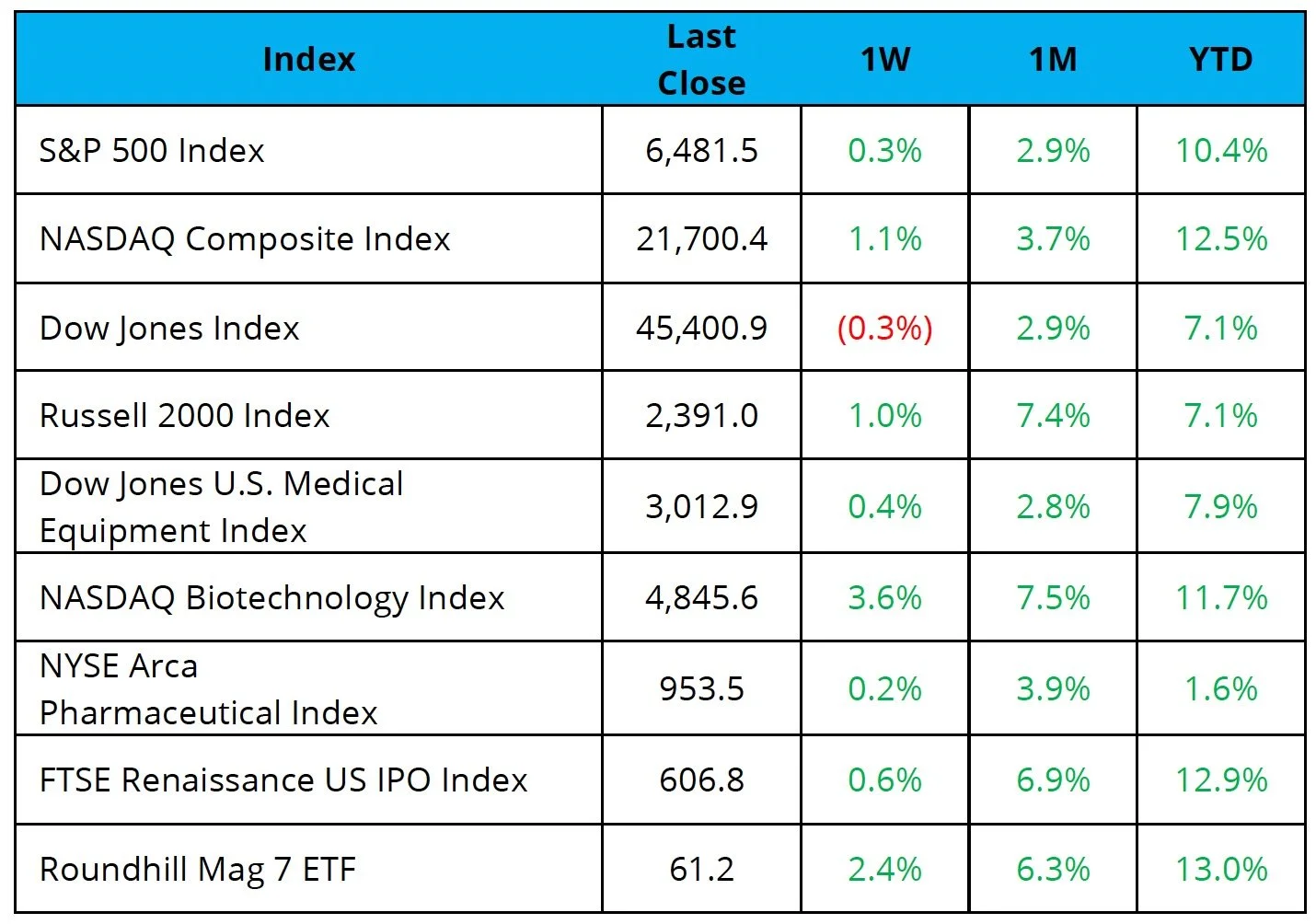

Markets Overview

The S&P 500 and Nasdaq were up 0.3% and 1.1% respectively, while the Dow slipped 0.3%

Only 22K job were added in August versus 75K that were expected, highlighting a weakening labor market and forcing the Fed’s hand to cut rates in September

The NYSE Pharma Index and NBI increased 0.2% and 3.6% respectively on the week

Notable changes in share price:

Cytokinetics (NASDAQ: CYTK): Shares rose 41.5% after potentially paradigm-shifting Phase 3 results in obstructive hypertrophic cardiomyopathy (oHCM)

United Therapeutics (NASDAQ: UTHR): Shares rose 30.7% after Tyvaso delivered positive results in a pivotal Phase 3 trial for idiopathic pulmonary fibrosis (IPF)

Genmab (NASDAQ: GMAB): Shares rose 10.7% after epcoritamab, a T-cell engager partnered with AbbVie, reported positive Phase 2 results in r/r diffuse large B-cell lymphoma (DLBCL) in the outpatient setting, supporting broader patient access

Wave Life Sciences (NASDAQ; WVE): Shares fell 16.2% after Wave’s RNA editor failed to meet expectations in its Phase 1b/2a interim readout for alpha-1 antitrypsin deficiency (AATD). Other AATD companies traded higher on the news: KRRO +38.3% and BEAM +23.8%

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed IPOs last week

No companies filed an S-1 last week

19 companies in total remain in the queue, of which only one intends to raise more than $30.0M in proceeds

For the year-to-date, companies that have gone public in 2025 have had a median gain of 18.8%

Source: CapIQ

Follow-On Offering Markets:

There were four follow-on equity offerings last week totaling $294.4M, including:

Mineralys Therapeutics (NASDAQ: MLYS) raised $287.5M to support lorundrostat through pre-commercialization activities in hypertension and clinical development in CKD and obstructive sleep apnea

Source: Biomedtracker

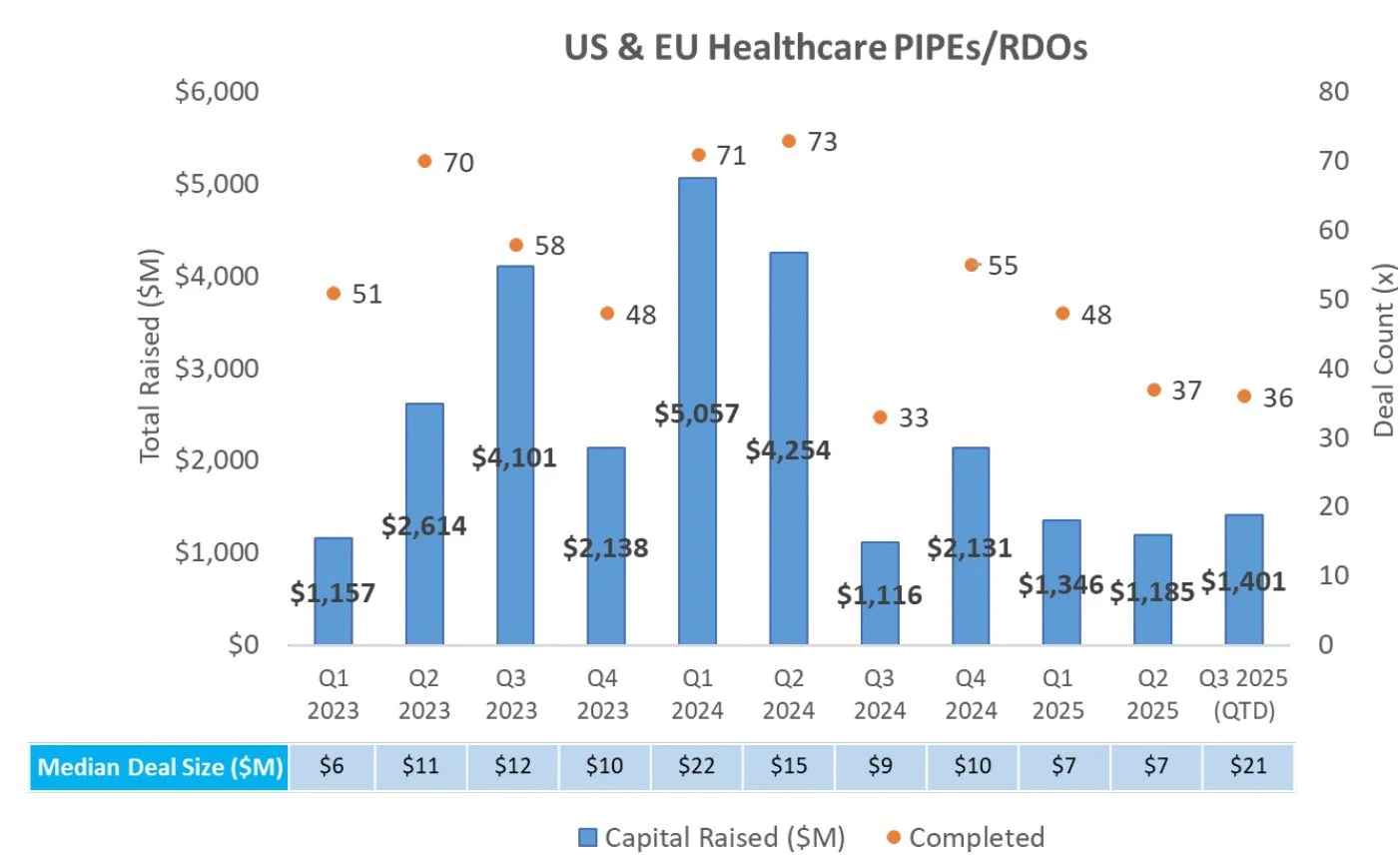

PIPE/RDO Markets:

There were two PIPEs/RDOs last week raising an aggregate $82.2M

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

There were no M&A deals this week.

Sources: Pitchbook, Biomedtracker, and CapIQ

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Vital Signs: A Pulse Check on the Healthcare Market

This executive summary from the Investment Banking Division of DNB//Back Bay focuses on a macro environment overview of current US economic markets, policy and regulatory updates in light of the current administration’s full-spectrum overhaul of US healthcare policies and the life science ecosystems and healthcare market activity as it relates to healthcare dealmaking in the US and Europe.

VIEW OUR LATEST HEALTHCARE LANDSCAPE REPORT: Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available and focuses on the rapid growth of bispecific or multi-specific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB // Back Bay Partnership

The DNB//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB-Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB-Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Markets, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Markets, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.