Week of November 28, 2025

The Week at a Glance:

December Rate Cut Hopes Rise: Major indices rose ~4% during the shortened trading week as data pointed to a cooling economy: September retail sales showed slowing consumer spending, The Conference Board’s November survey reflected weaker consumer sentiment, and the Fed’s Beige Book highlighted a softening labor market, all of which strengthened expectations for a December rate cut

A Break in the Action: Due to the Thanksgiving holiday, both the healthcare public and private markets had a relatively inactive week

Upcoming JPM Conference: DNB Carnegie//Back Bay will be at the JP Morgan Healthcare Conference in San Francisco. If you plan to attend and would like to schedule a meeting with our strategy and finance teams, contact us.

Markets Overview

The S&P 500, Dow, and Nasdaq were up 3.7%, 3.2%, and 4.9% on the week

Economic data and Fed commentary pointed to a cooling economy, boosting investors’ confidence in a rate cut

The NYSE Pharma Index and NBI were up 1.8% and 3.8%, respectively

Notable changes in share price:

Arrowhead Pharmaceuticals (NASDAQ: ARWR): Shares rose 38.7% following a strong Q4 earnings report, which highlighted the Company’s progress towards launching Redemplo for familial chylomicronemia syndrome (FCS), initiating a Phase 1/2a program in atherosclerotic cardiovascular disease, and increasing business development activity, including milestone payments from Sarepta and a licensing deal with Novartis for its alpha-synuclein siRNA asset

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

No companies completed an IPO or announced a public offering larger than ~$100M last week

Three companies in the IPO queue are targeting raises above ~$100M:

10/28/2025

Medline: $5,000.0 Intended Raise ($M)

11/7/2025

Saluda Medical: $150.0 Intended Raise ($M)

11/17/2025

Lumexa Imaging: $200.0 Intended Raise ($M)

Nineteen additional companies in the IPO queue are pursuing raises below $30M, with five companies announcing their raises in the last three months

IPOs that have priced this year have delivered a median gain of 15.2%, with ~60% of newly public companies trading above their offer price

Source: CapIQ

Follow-On Offering Markets:

There were no follow-on equity offerings last week

Source: Biomedtracker

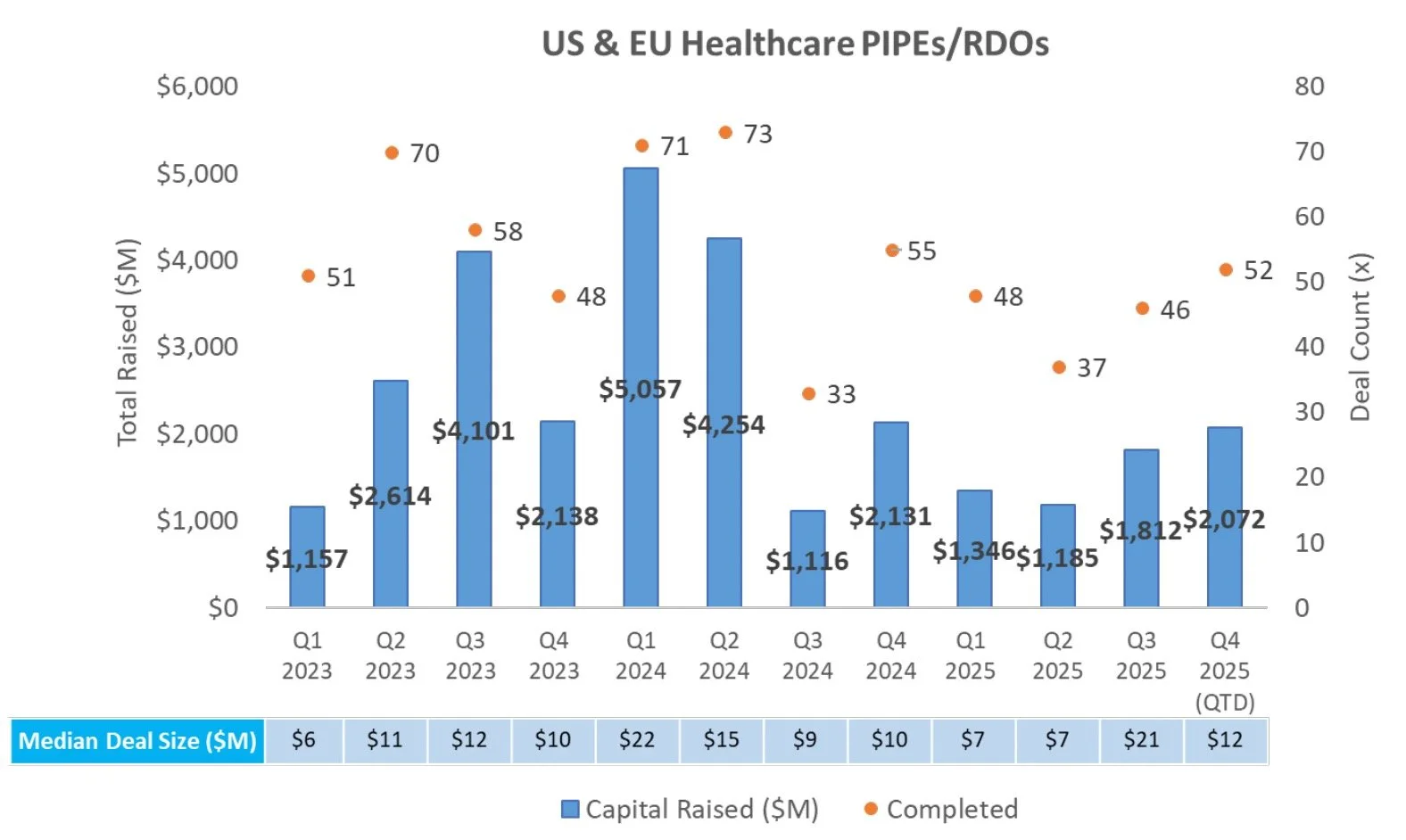

PIPE/RDO Markets:

There was one PIPE/RDO last week raising $50.1M:

Verrica Pharmaceuticals (NASDAQ: VRCA) raised $50.1M to fully repay its outstanding debt obligations

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

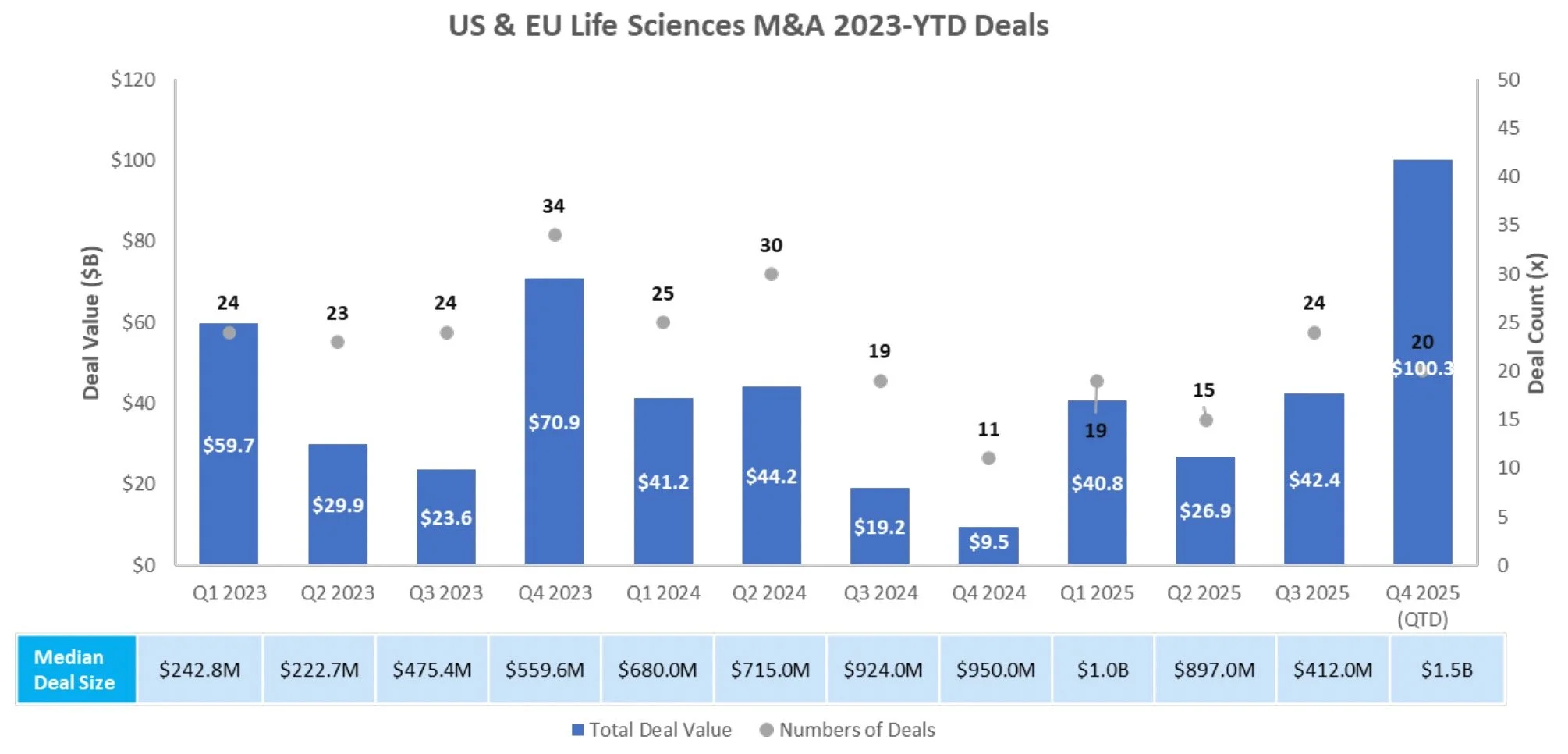

M & A

There were no M&A deals this week. However, the volume of large M&A deals has accelerated in 2025 YTD, highlighting big pharma’s need to bolster both their pipelines and commercial portfolios as they confront near-term revenue pressures from impending patent cliffs.

Sources: Pitchbook, Biomedtracker, and CapIQ

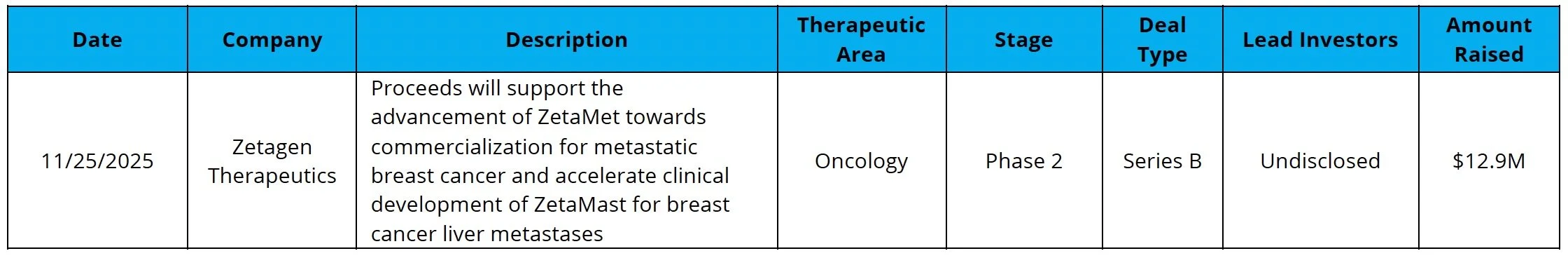

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is now open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speaker:

Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available, focusing on the rapid growth of bispecific or multispecific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB Carnegie // Back Bay Partnership

The DNB Carnegie//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie//Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie//Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.