Week of December 12, 2025

The Week at a Glance:

Healthcare Outperforms: Increased M&A activity and positive clinical readouts have driven healthcare to outperform the broader market since early October, signaling strong momentum for follow-on offerings and IPOs in the coming year

Biotech Funding Continues to Show Strength: Investors continue to reward positive clinical data and novel science, with approximately $4.1B in follow-on offerings during the week

The Fed Cuts Again: Despite the Fed cutting interest rates by 25 bps at Wednesday’s FOMC meeting, markets were largely unchanged as the move was widely expected

Obesity Is Still Hot: Structure Therapeutics and Wave Life Sciences were both up >100% on the week after reporting clinical data from their obesity programs and subsequently raised $747.5M and $350.0M, respectively

Meet Us in San Francisco: DNB Carnegie//Back Bay will be in San Francisco in early January. If you would like to meet with our strategy and finance teams, contact us

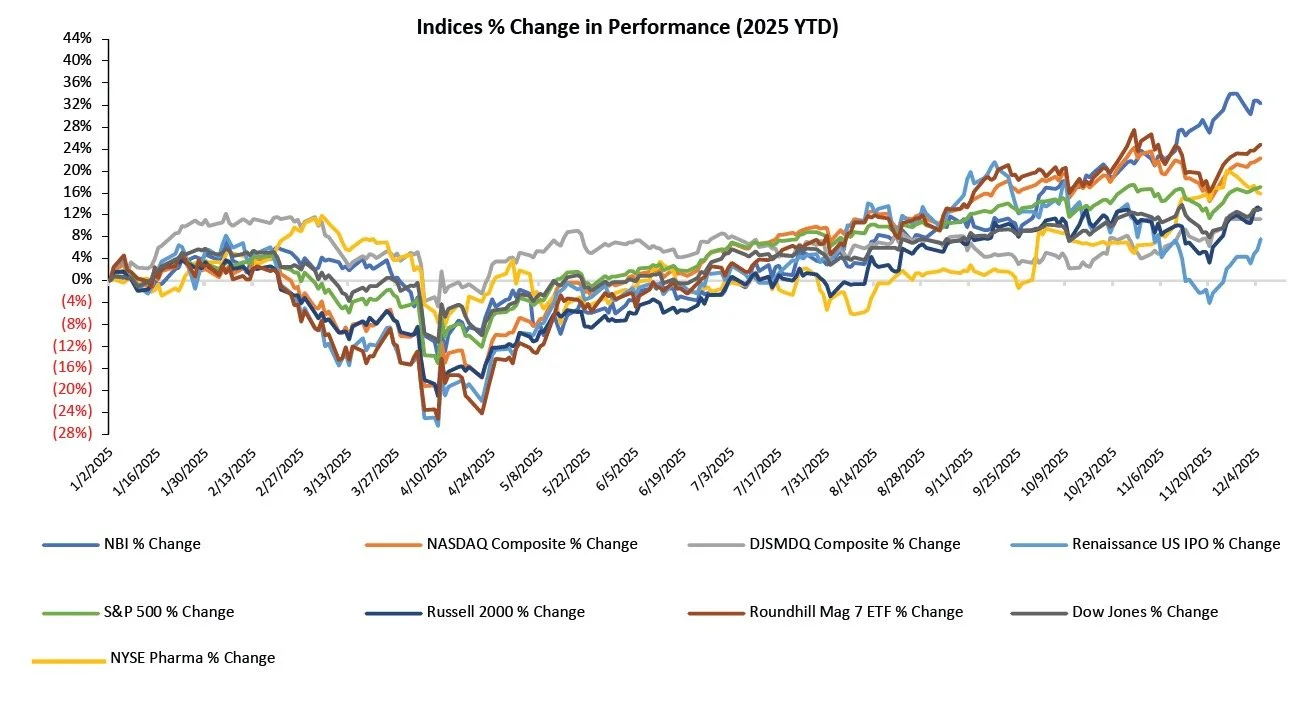

Markets Overview

The S&P 500 and Nasdaq were down 0.6% and 1.6%, respectively, while the Dow was up 1.0% on the week

As year-end approaches, the NBI has nearly doubled the S&P 500’s YTD returns, nearly tripled the Dow’s, and outpaced the Nasdaq, highlighting biotech’s relative strength as investors rotate capital into the sector

The NYSE Pharma Index was up 1.2% while the NBI was down 0.5% on the week

Notable changes in share price:

Wave Life Sciences (NASDAQ: WVE): Shares rose 121.1% after the Company reported positive Phase 1 obesity trial results for its INHBE-targeted siRNA therapy

Structure Therapeutics (NASDAQ: GPCR): Shares jumped 94.4% after the Company released positive topline data from its Phase 2b obesity trial evaluating its oral GLP-1 receptor agonist

Kymera Therapeutics (NASDAQ: KYMR): Shares rose 34.6% after the Company reported positive Phase 1b results for its oral STAT6 degrader in moderate-to-severe atopic dermatitis

Terns Pharmaceuticals (NASDAQ: TERN): Shares rose 45.1% after the Company released updated data from its ongoing trial of TERN-701, an investigational allosteric BCR::ABL1 inhibitor, in patients with previously treated chronic myeloid leukemia

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

One company completed an IPO larger than ~$100M last week:

Lumexa Imaging raised ~$462.5M to expand and enhance its national network of outpatient diagnostic MRI and CT imaging centers, supporting growth of its national footprint, pay down of existing debt to strengthen its balance sheet, and investment in technology and operational improvements

Lumexa is the 19th MedTech company to publicly list this year, raising the fourth most in capital after the following companies:

3/27/2025

Asker*: $1,021.3 Capital Raised, 32.8% Performance YTD

10/7/2025

Ottobock: $819.7 Capital Raised, 4.4% Performance YTD

6/17/2025

Caris Life Sciences: $494.0 Capital Raised, 27.4% Performance YTD

* (DNB Carnegie acted as joint global coordinator and bookrunner)

No companies announced IPOs last week.

Only one company currently in the IPO queue is targeting a large cap, multi-billion-dollar offering:

10/28/2025

Medline: $5,000.0 Intended Raise ($M)

All 18 remaining additional companies in the IPO queue are pursuing raises below $30M

IPOs that have priced this year have delivered a median gain of 27.5%, with ~70% of newly public companies trading above their offer price

Source: CapIQ

Follow-On Offering Markets:

There were 14 follow-on equity offerings last week raising $4,148.3M, including:

Structure Therapeutics (NASDAQ: GPCR) raised $747.5M to advance its obesity-focused R&D programs, which include aleniglipron, an oral GLP-1 receptor agonist in Phase 2b development, and ACCG-2671, an oral amylin receptor agonist candidate entering Phase 1 development

Terns Pharmaceuticals (NASDAQ: TERN) raised $650.0M to fund ongoing Phase 1 clinical development and manufacturing activities for lead asset TERN-701, as well as to support commercial readiness activities for a potential future launch

Kymera Therapeutics (NASDAQ: KYMR) raised $602.0M to continue advancing its pipeline of preclinical and clinical oral degrader programs, including KT-621, a Phase 2 STAT6 degrader for multiple I&I indications (e.g., atopic dermatitis, asthma, and COPD) and additional preclinical IRF5 (KT-579) and IRAK4 (KT-485) degrader programs

Immunovant (NASDAQ: IMVT) raised $550.0M to support advancement of its anti-FcRn pipeline, which includes IMVT-1402, currently in Phase 3 studies for Graves’ disease, ACPA+ difficult-to-treat rheumatoid arthritis, Sjögren’s disease, myasthenia gravis, chronic inflammatory demyelinating polyneuropathy (CIDP), and cutaneous lupus erythematosus (CLE)

Dyne Therapeutics (NASDAQ: DYN) raised $350.2M to fund planned Phase 1/2 clinical development of z-basivarsen (DYNE-101) in myotonic dystrophy type 1 and z-rostudirsen (DYNE-251) for Duchenne muscular dystrophy, as well as advance additional preclinical programs in FSHD and Pompe disease

Wave Life Sciences (NASDAQ: WVE) raised $350.0M to advance its RNA medicines pipeline, which includes WVE-003, an allele-selective antisense oligonucleotide for Huntington's disease preparing for Phase 2/3 development; WVE-007, a siRNA oligonucleotide for obesity in an ongoing Phase 1 study; and WVE-N531, an exon-skipping antisense oligonucleotide therapy for Duchenne muscular dystrophy being evaluated in a Phase 2 open label study

Vera Therapeutics (NASDAQ: VERA) raised $260.9M to fund commercial launch of atacicept in IgA nephropathy (anticipated 2026 if approved) and initiate R&D activities to identify new clinical indications for atacicept

Denali Therapeutics (NASDAQ: DNLI) raised $200.0M to advance its pipeline of enzyme replacement therapies, including commercial readiness for tividenofusp alfa (currently in marketing application review for Hunter syndrome), an accelerated regulatory pathway for DNL-126 (Phase 1/2 asset in Sanfilippo syndrome type A), and pipeline advancement of DNL-593 (Phase 1/2 asset for GRN-related frontotemporal dementia) and DNL-952 (Phase 1 asset for Pompe disease)

Fulcrum Therapeutics (NASDAQ: FULC) raised $175.0M for general corporate purposes, which include supporting R&D for Phase 1 pociredir in sickle cell disease and additional preclinical R&D programs in Diamond-Blackfan anemia, bone marrow failure syndromes, and fibrotic disorders

Immix Biopharma (NASDAQ: IMMX) raised $100.0M to fund clinical development for NXC-201, a BCMA-targeting CAR-T therapy for relapsed / refractory AL amyloidosis currently in Phase 2 studies, as well as for additional corporate purposes that enable Immix to extend its cash runway to mid-2027

Contineum Therapeutics (NASDAQ: CTNM) raised $90.0M to support continued development of its neuroscience, inflammation, and immunology (NI&I) portfolio, including completing Phase 2 clinical trial of PIPE-307, an M1R antagonist for relapsing-remitting multiple sclerosis being developed with J&J, and advancing development of PIPE-791, a brain-penetrant small molecule LPA1R antagonist with a completed Phase 1b trial in IPF and progressive multiple sclerosis and an ongoing Phase 1b trial in chronic pain

Tenaya Therapeutics (NASDAQ: TNYA) raised $60.0M to fund ongoing and planned development of its AAV9 gene therapy clinical candidates, including Phase 1b/2 studies for TN-201 for MYBPC3-associated hypertrophic cardiomyopathy and Phase 1b studies for TN-401 for genetic arrhythmogenic right ventricular cardiomyopathy (ARVC)

Source: Biomedtracker

PIPE/RDO Markets:

There was four PIPEs/RDOs last week raising $235.8M, including:

Mirum Pharmaceuticals (NASDAQ: MIRM) raised $200.0M to fund clinical development and commercial build-out tied to its proposed Bluejay Therapeutics acquisition, which is expected to close in Q1 2026 pending customary approvals

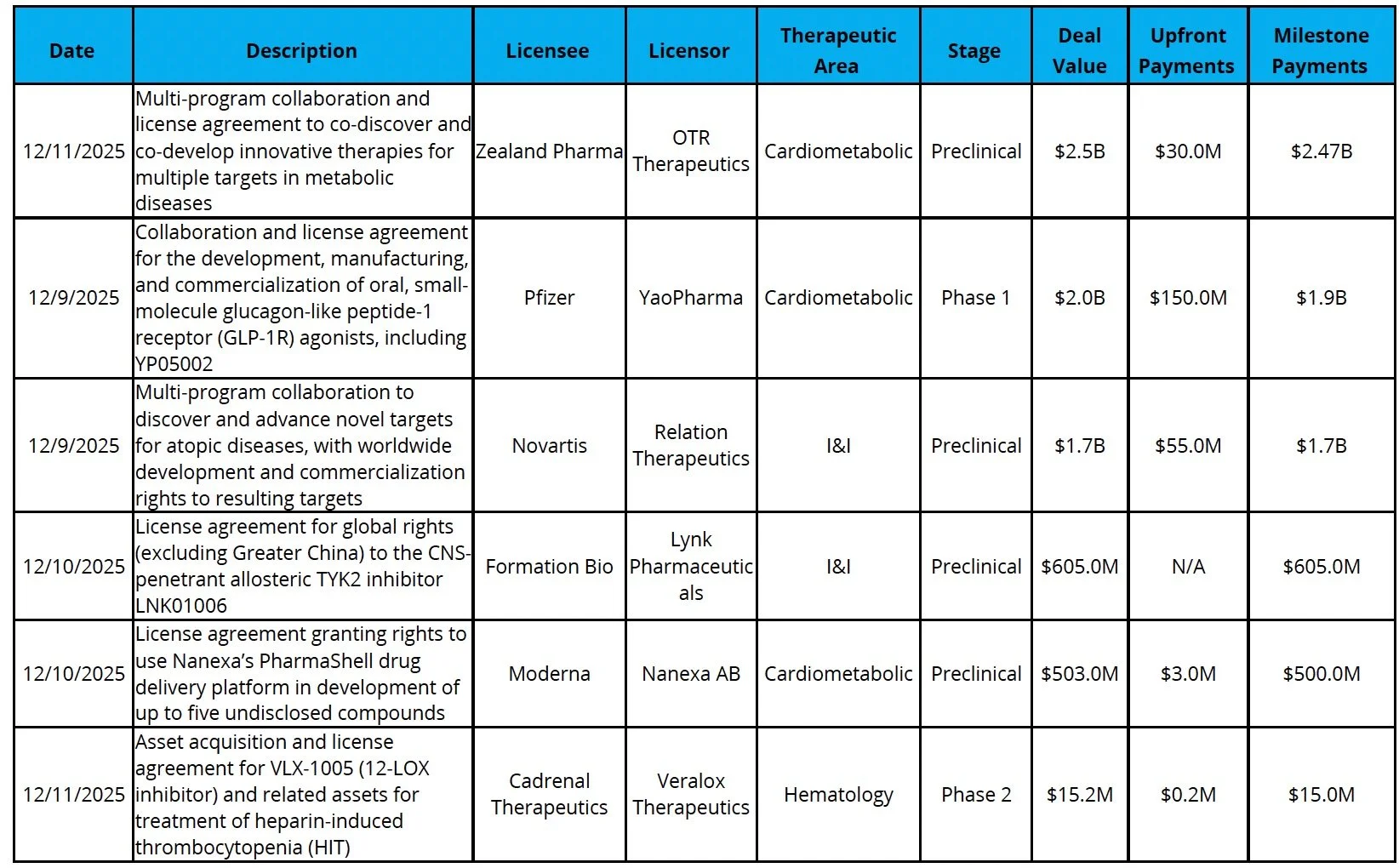

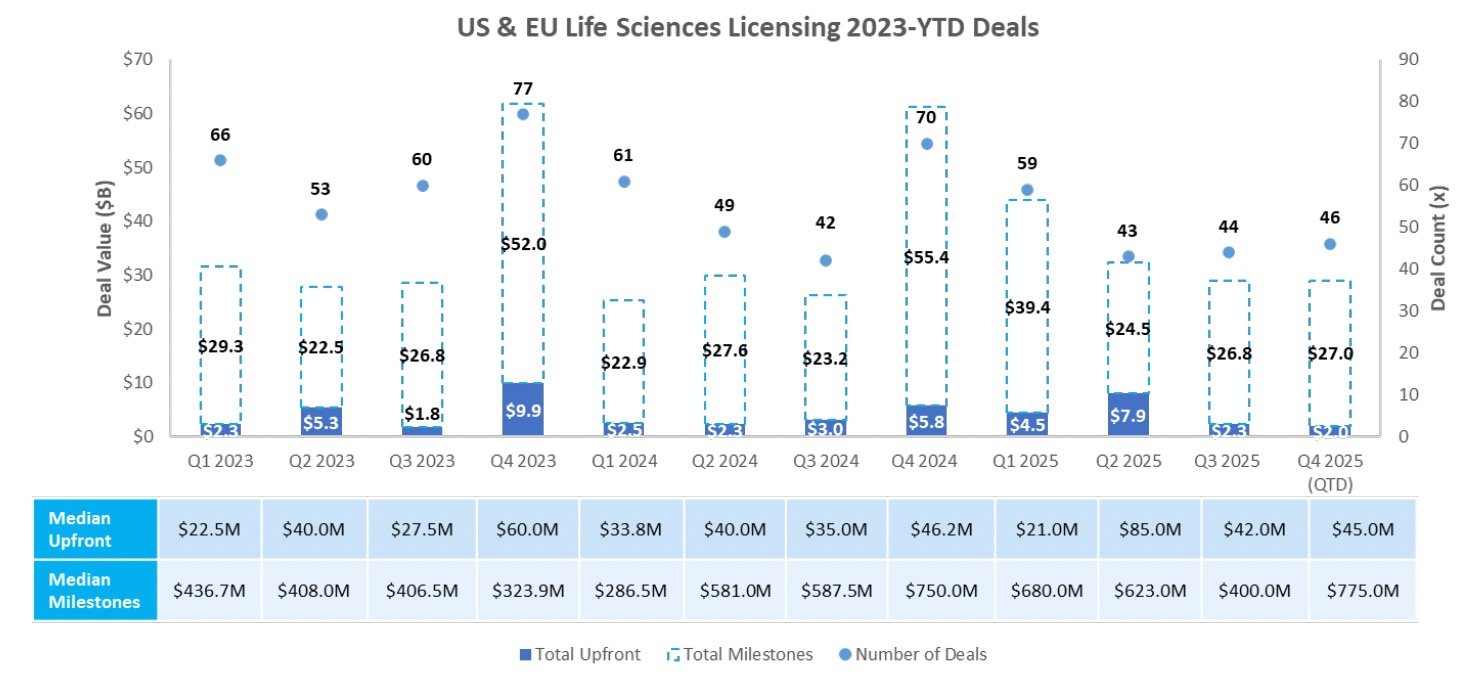

Licensing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

M & A

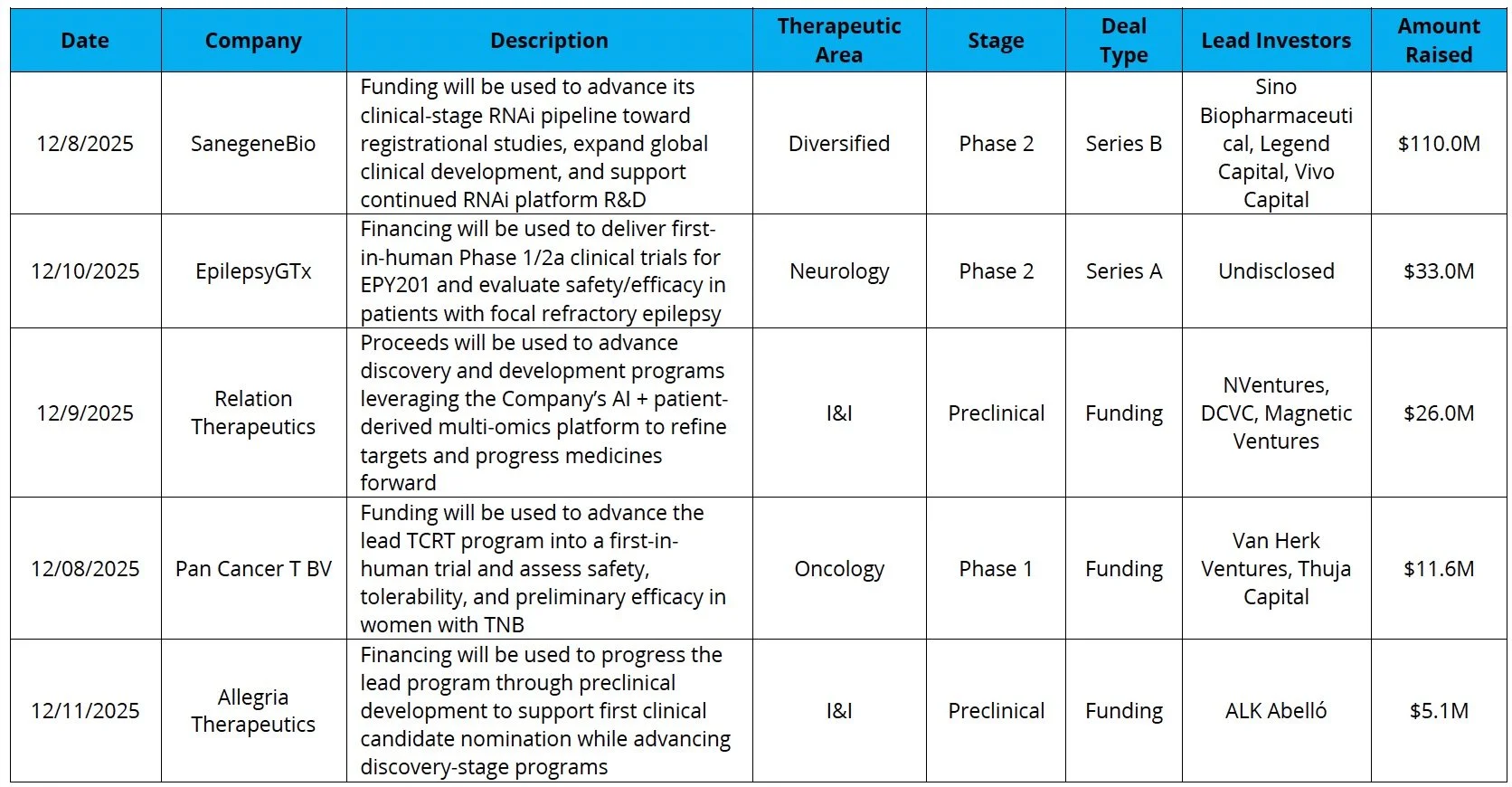

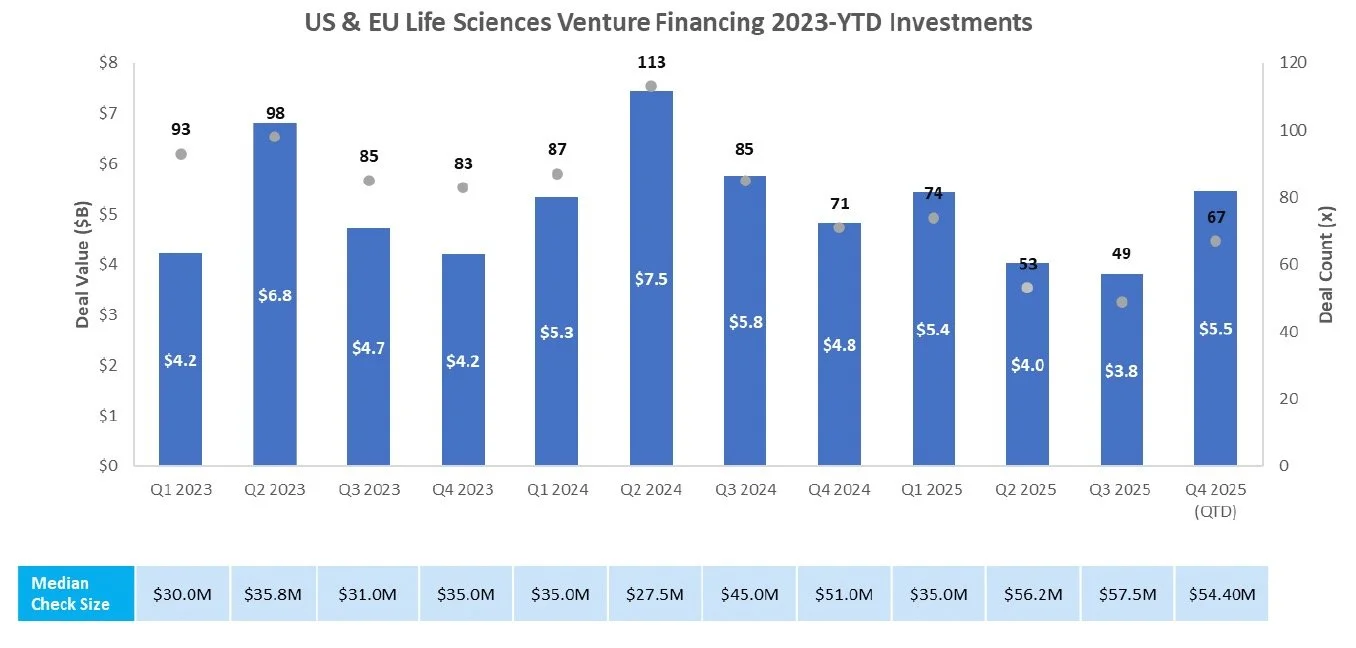

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is now open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speaker:

Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available, focusing on the rapid growth of bispecific or multispecific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB Carnegie // Back Bay Partnership

The DNB Carnegie//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie//Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie//Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.