Week of January 2, 2026

The Week at a Glance:

US Military Action in Venezuela Prompts Market Shifts: The US capture of Venezuelan President Nicolas Maduro over the weekend has become a primary focus for markets. While investors are largely downplaying long-term economic fallout, the event has triggered significant risk-based speculation

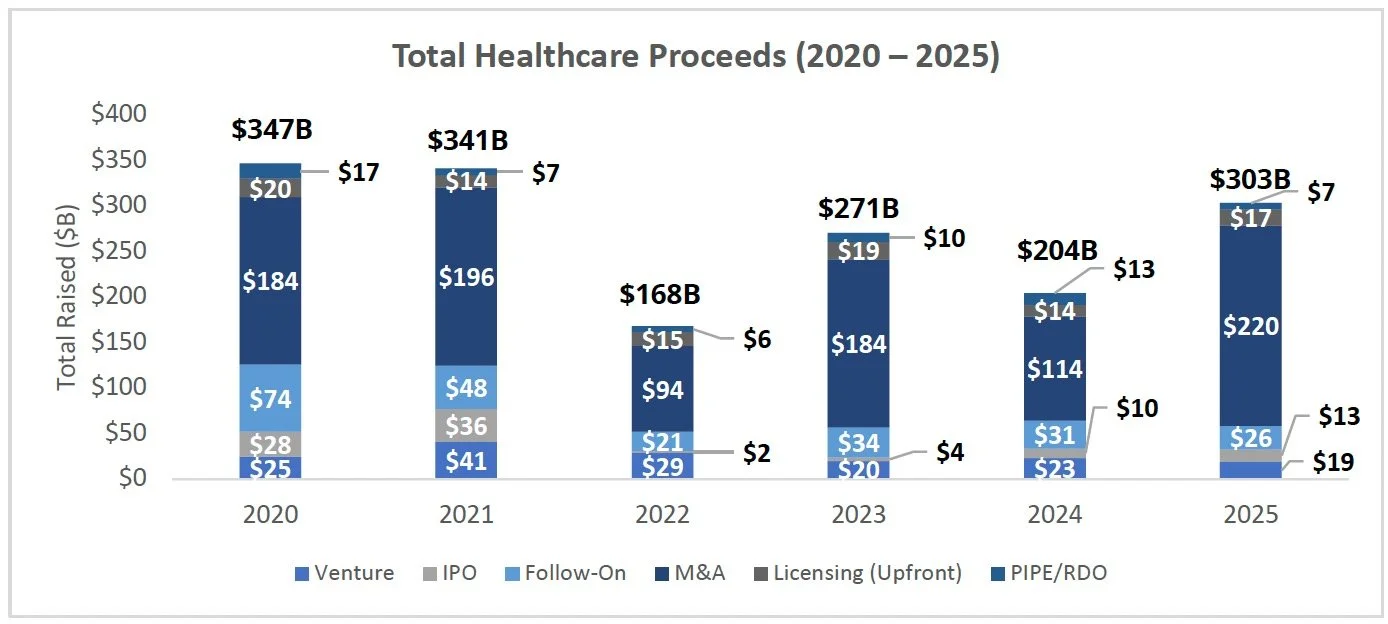

Year-in-Review for Healthcare Markets: The NBI ended the year up 31.6%, total M&A proceeds reached $220B, follow-on offerings totaled $26B, and venture financings hit $19B, with deal volume trending upward into year-end

2025 Marked a Strong Year for Biotech: In 2025, biotech had the most $1B+ M&A deals in the past 20 years, a single week of follow-on offerings totaling $4.1B, and 24 life sciences funds raising $13B+, all of which bolsters optimism surrounding a strong start to 2026

The Macro Environment Continues to Stabilize: The labor market continues to strengthen, with jobless claims falling for a third straight week, down 16,000 for the week ending December 27th versus the prior week; broader implications of these trends may be limited, however, given the uptick in seasonal workers during the holiday season

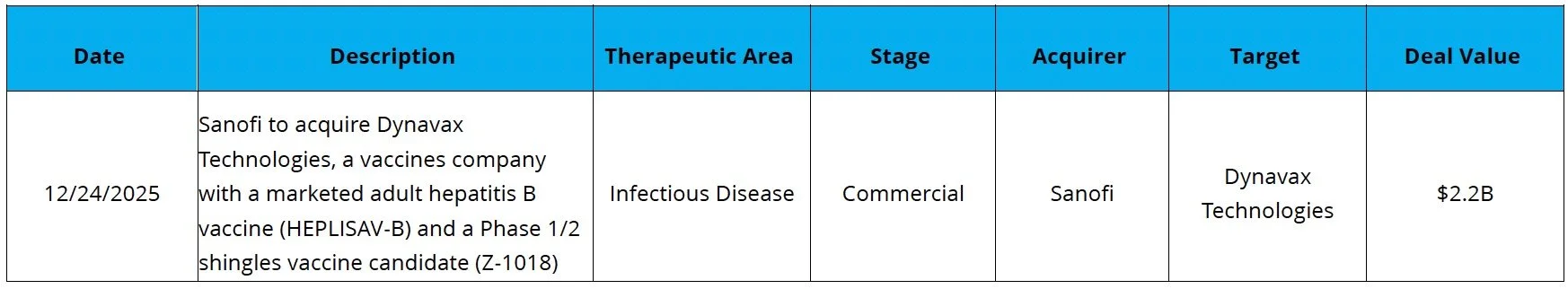

Sanofi Furthers Their Vaccine Presence to Close Out a Record Q4 for M&A: Sanofi’s acquisition of Dynavax for $2.2B caps a record-breaking Q4 for biopharma M&A and underscores acquirers’ focus on commercial-stage targets throughout 202

Meet us in San Francisco: DNB Carnegie | Back Bay will be in San Francisco in early January. If you would like to meet with our strategy and finance teams, contact us

Markets Overview

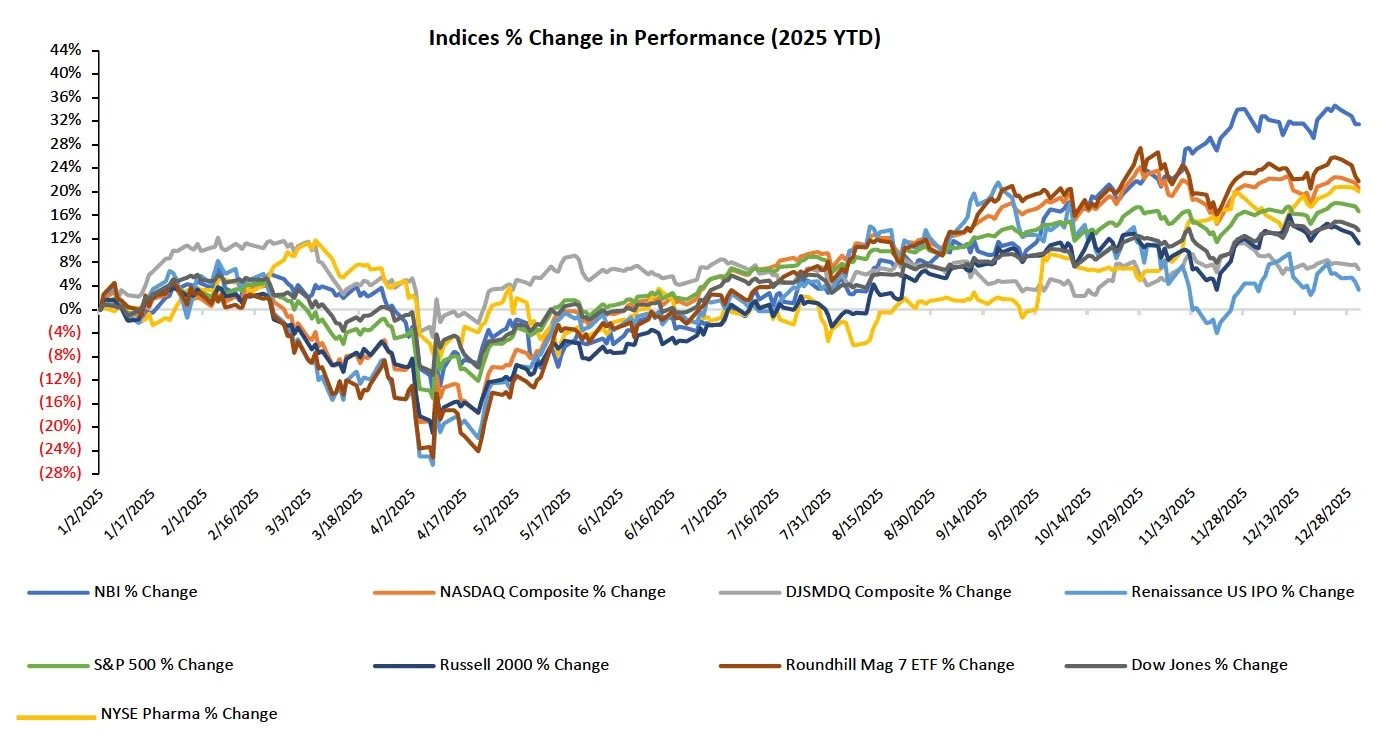

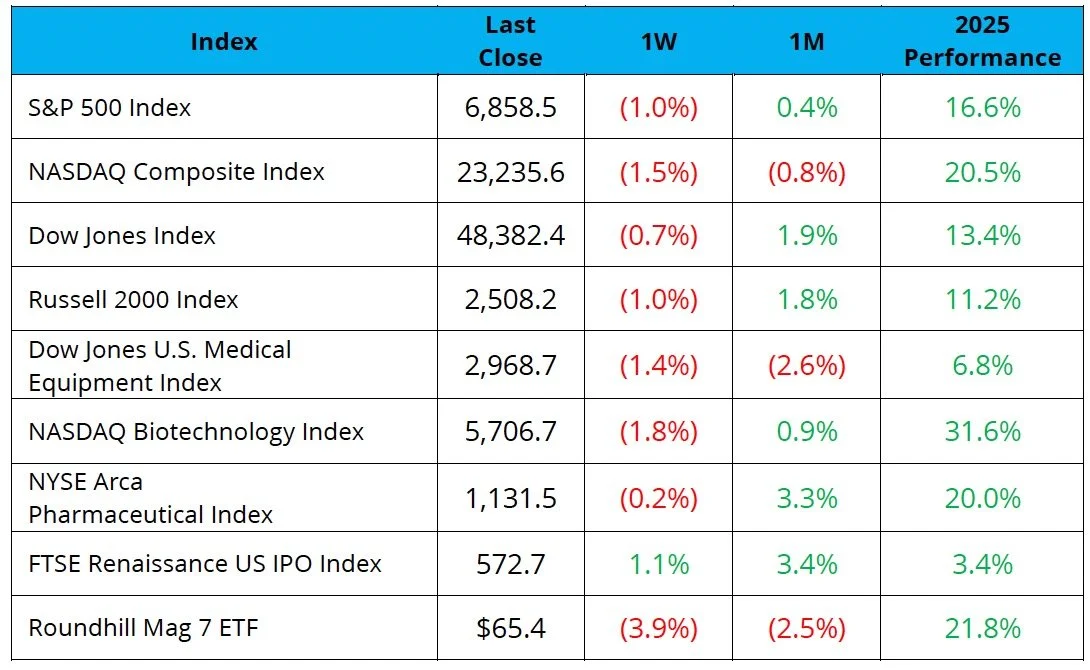

The S&P 500, Nasdaq, and Dow were down 1.0%, 1.5%, and 0.7% respectively on the week

Biotech outpaced the major indices in 2025, with the NBI up 31.6% versus the best performing major index, the Nasdaq, being up 20.5%

The NYSE Pharma Index and NBI were down 0.2% and 1.8% respectively

Notable changes in share price:

Dynavax (NASDAQ: DVAX): Shares rose 37.8% over the past two weeks after the Company announced that Sanofi was to acquire them for $2.2B

Omeros (NASDAQ: OMER): Shares jumped 72.2% after the Company obtained an FDA approval for their drug treating transplant-associated thrombotic microangiopathy

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

IPO Markets:

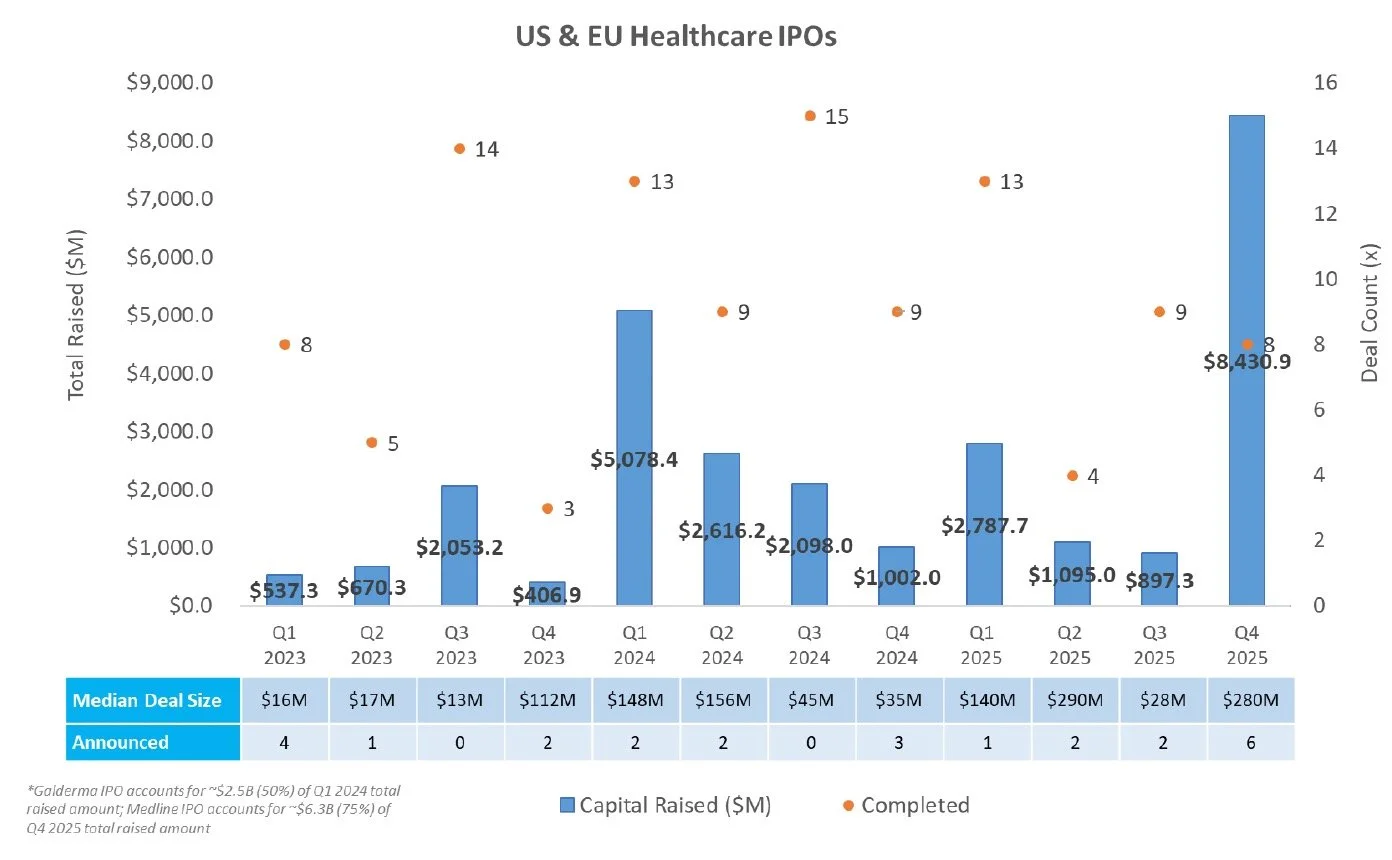

In 2025, there were 34 IPOs totaling ~$13.2B in deal value, largely driven by Medline’s ~$6B IPO in Q4 2025, compared to 46 IPOs in 2024 with total deal value of ~$10.8B

No companies completed an IPO or filed to publicly list in the last two weeks.

Only one company in the IPO queue is targeting a raise over ~$200M:

12/19/2025

Aktis Oncology: $212.0 Intended Raised

Nineteen remaining additional companies in the IPO queue are pursuing raises below $40M, with one additional company (MiniMed Group) not yet disclosing its intended raise amount

IPOs that have priced in 2025 have delivered a median gain of 7%, with ~60% of newly public companies trading above their offer price

Source: CapIQ

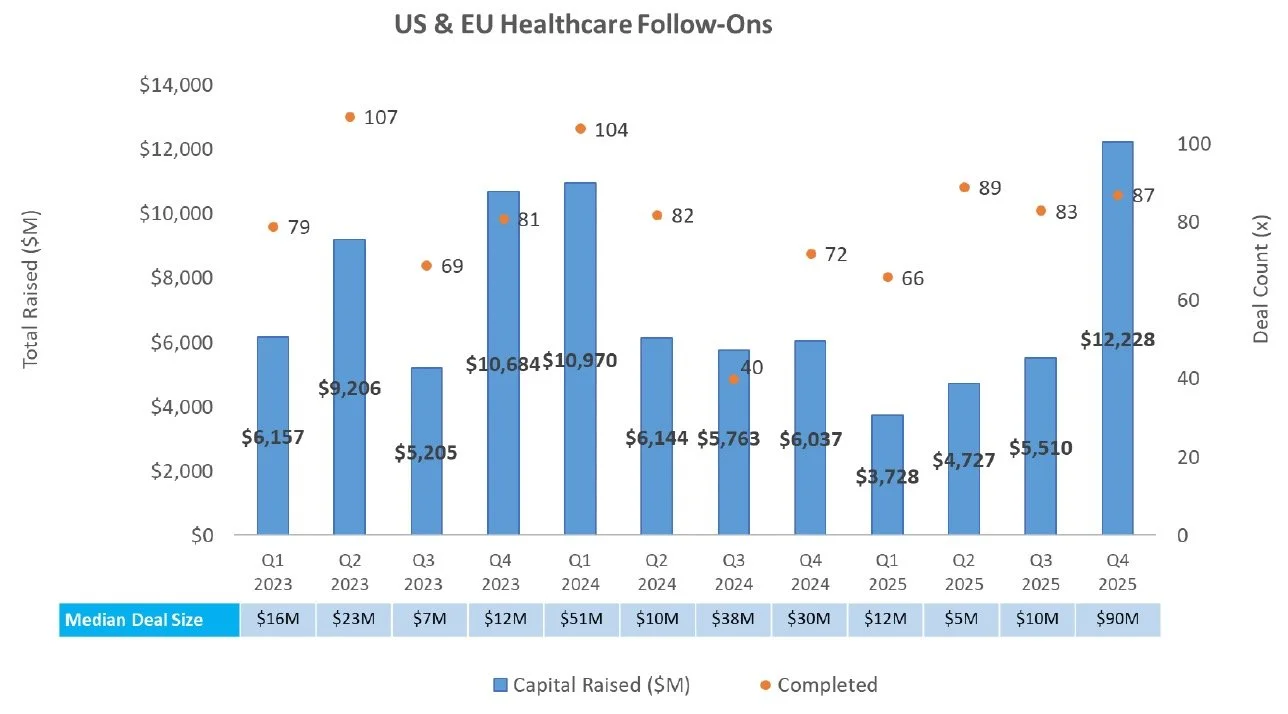

Follow-On Offering Markets:

In 2025, there were 325 follow-on equity offerings totaling ~$26.2B in deal value, compared to 298 follow-on equity offerings in 2024 with total deal value of ~$28.9B

There were no follow-on equity offerings in the last two weeks.

Source: Biomedtracker

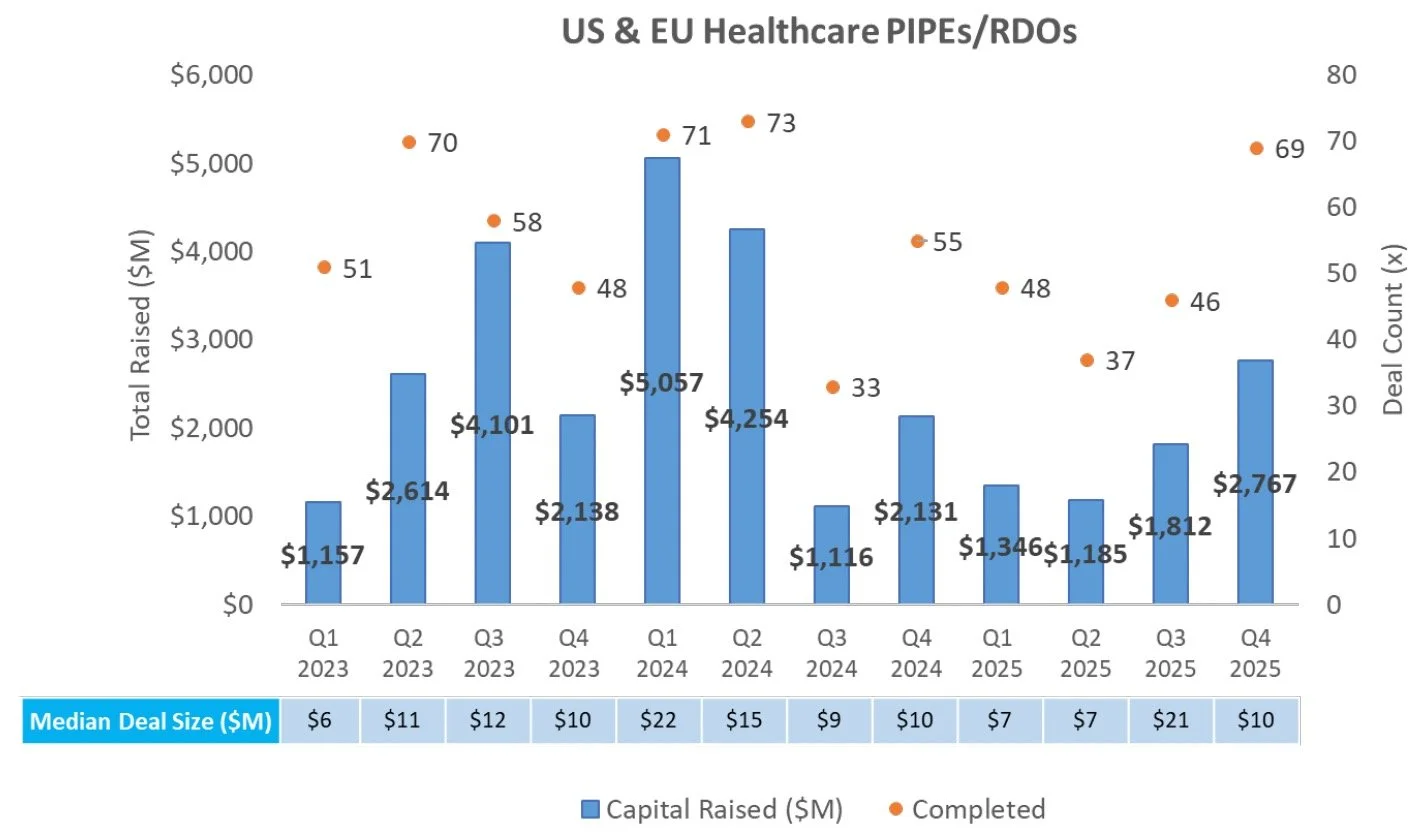

PIPE/RDO Markets:

In 2025, there were 200 PIPE/RDOs totaling $7.1B in deal value, compared to 232 PIPE/RDOs totaling $12.6B in 2024

There was five PIPEs/RDOs last week raising $73.6M

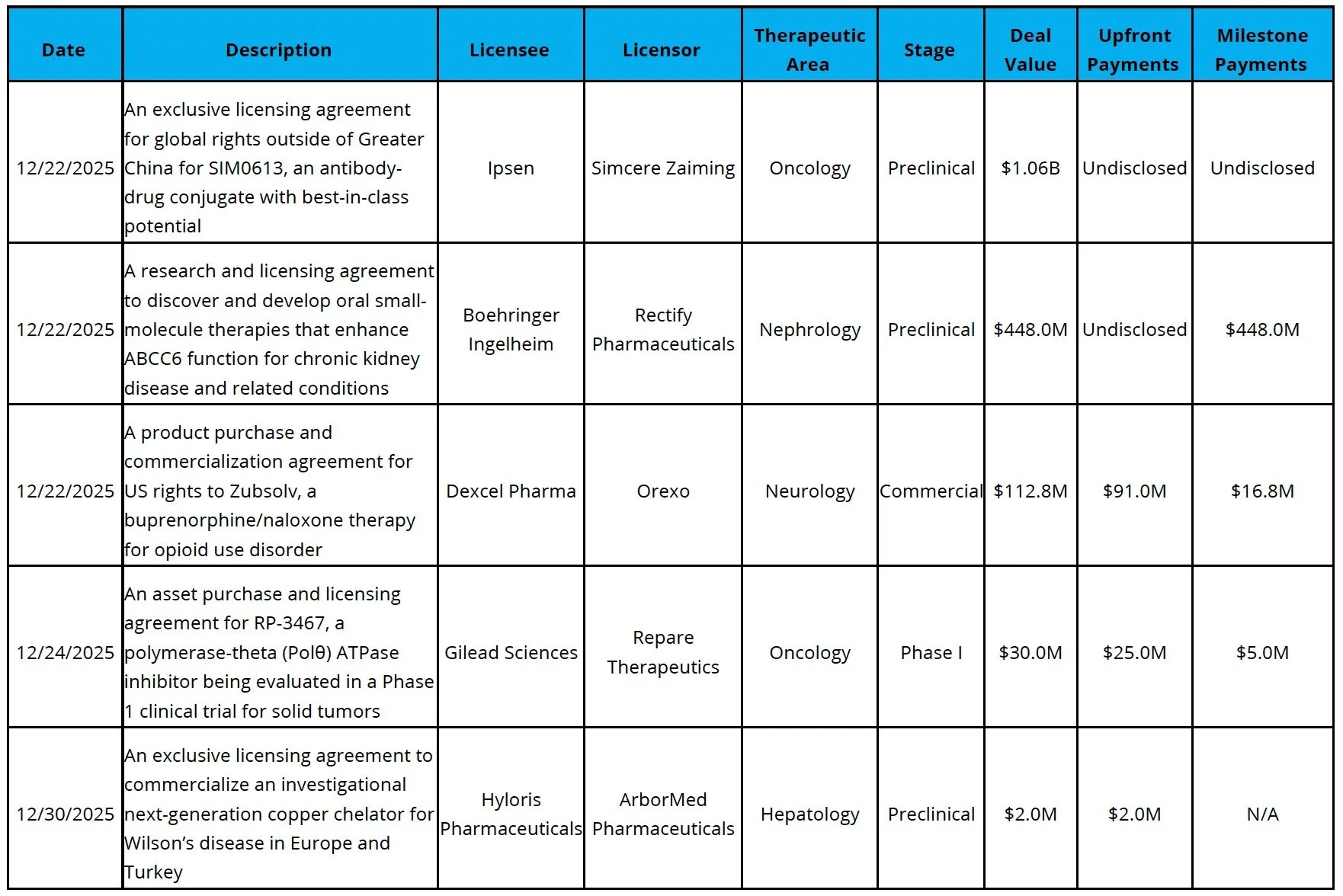

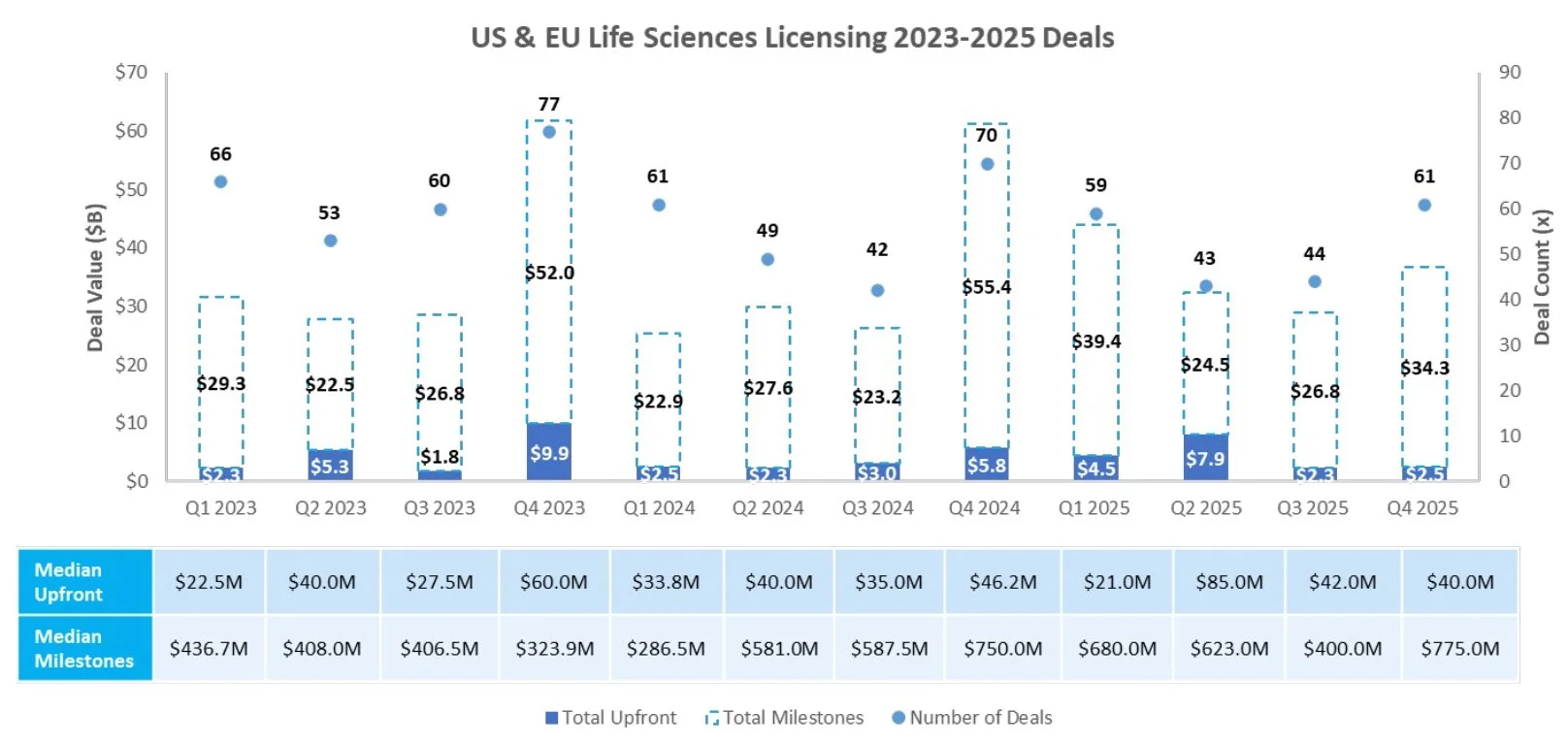

Licensing

In 2025, there were 207 licensing deals with upfronts totaling $17.2B and milestone payments totaling $125.0B, compared to 222 licensing deals with upfronts totaling $13.6B and milestone payments totaling $129.1B in 2024

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

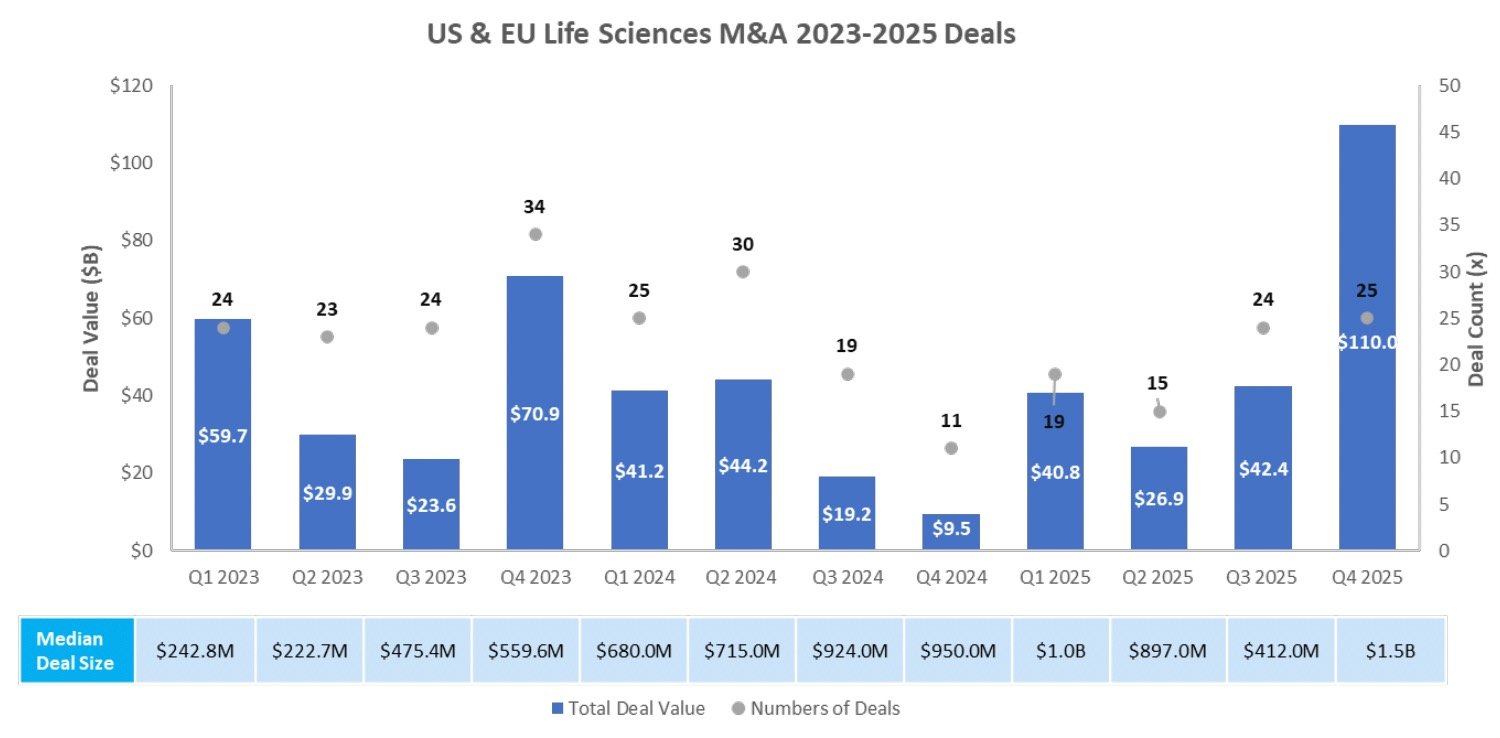

M & A

In 2025, there were 83 M&A transactions totaling $220.1B in deal value, compared to 85 M&A transactions totaling $114.1B in 2024

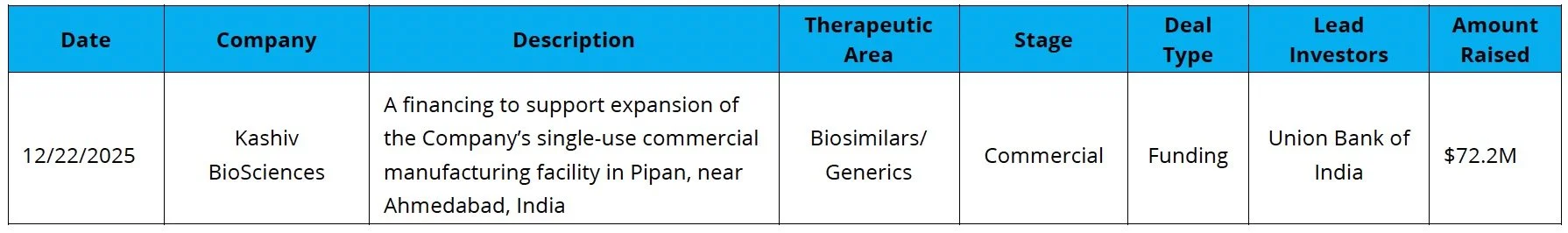

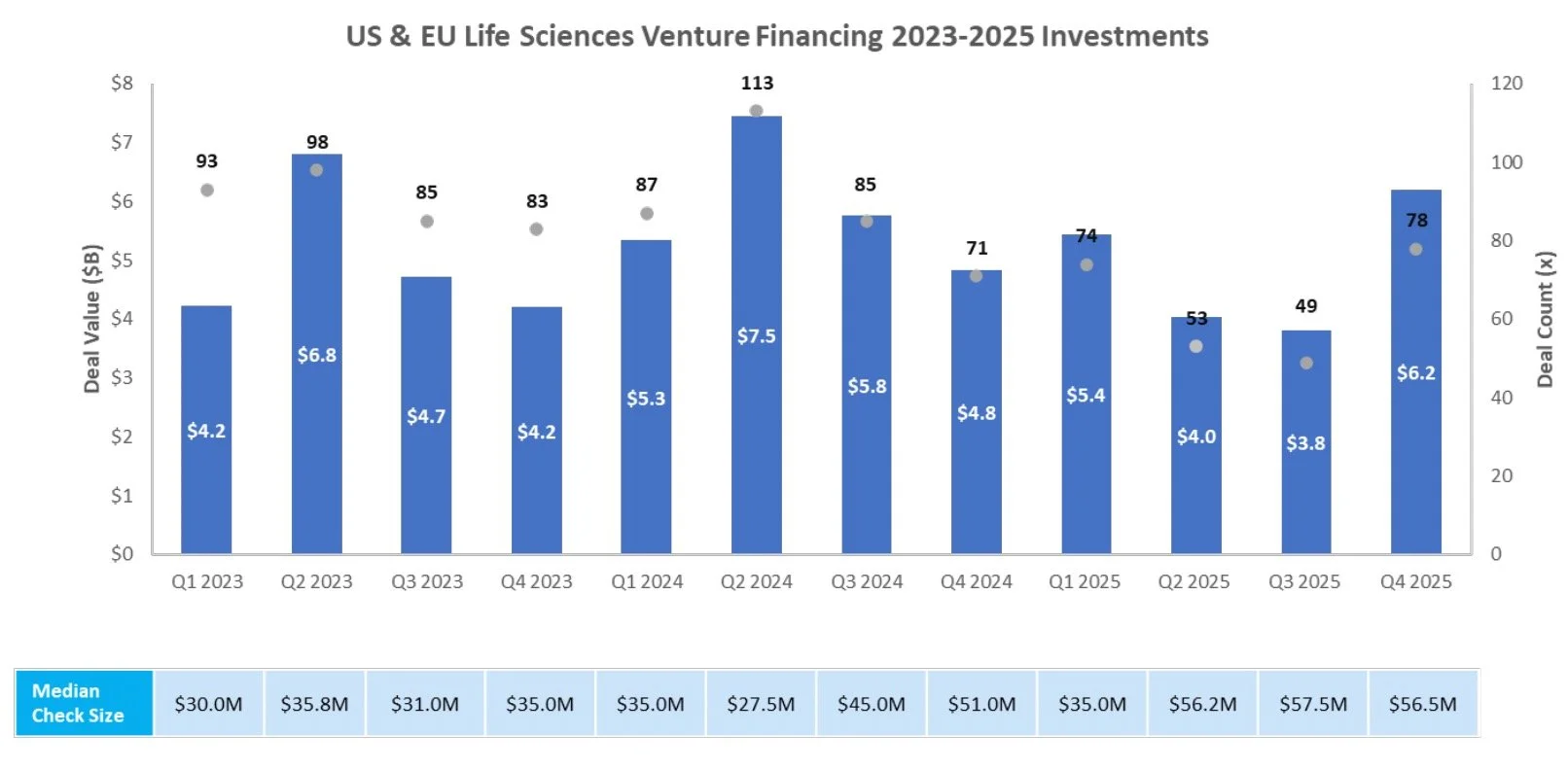

Venture Financing

In 2025, there were 254 venture financings totaling $19.4B, compared to 356 financings totaling $23.4B in 2024

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is now open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speaker:

Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

Multi-Specific Antibodies, Market Analysis & Investment Trends

The latest in our series of healthcare analyst reports is now available, focusing on the rapid growth of bispecific or multispecific antibodies (msAbs). With now 14 FDA-approved msAbs and nearly 250 assets in clinical development, msAbs are indeed entering an age of innovation and commercial validation.

HEALTHCARE MARKET REPORTS ARCHIVE

About the DNB Carnegie // Back Bay Partnership

The DNB Carnegie//Back Bay Partnership drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie//Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie//Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.