Week of February 20, 2026

The Week at a Glance:

Supreme Court Ruling on Tariffs: On February 20th, the Supreme Court ruled against the US administration’s use of broad tariffs by a vote of 6 to 3 causing indices to inch higher; however, President Trump is attempting to replace the repealed tariffs through various existing trade laws

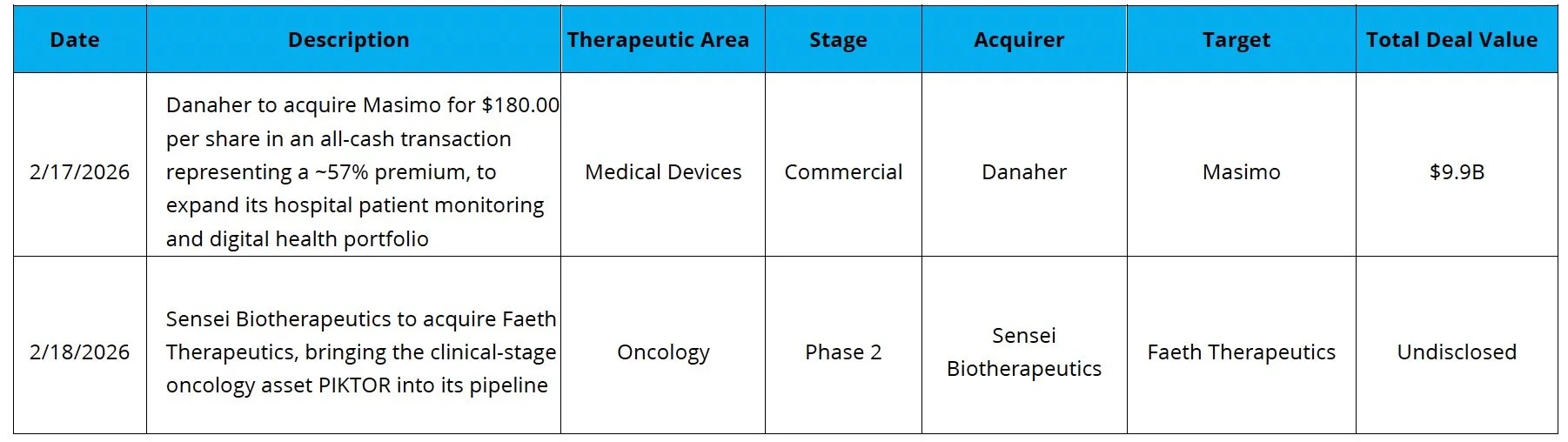

Danaher Bolsters Diagnostics: Danaher acquired Masimo for ~$9.9B at 18x EBITDA, adding to their diagnostics segment which generated $9.8B in revenue in 2025

Robust Follow-On Activity: There were five follow-on offerings raising $855.1M in total, led by Nektar Therapeutics’ $400.0M raise following strong atopic dermatitis maintenance data

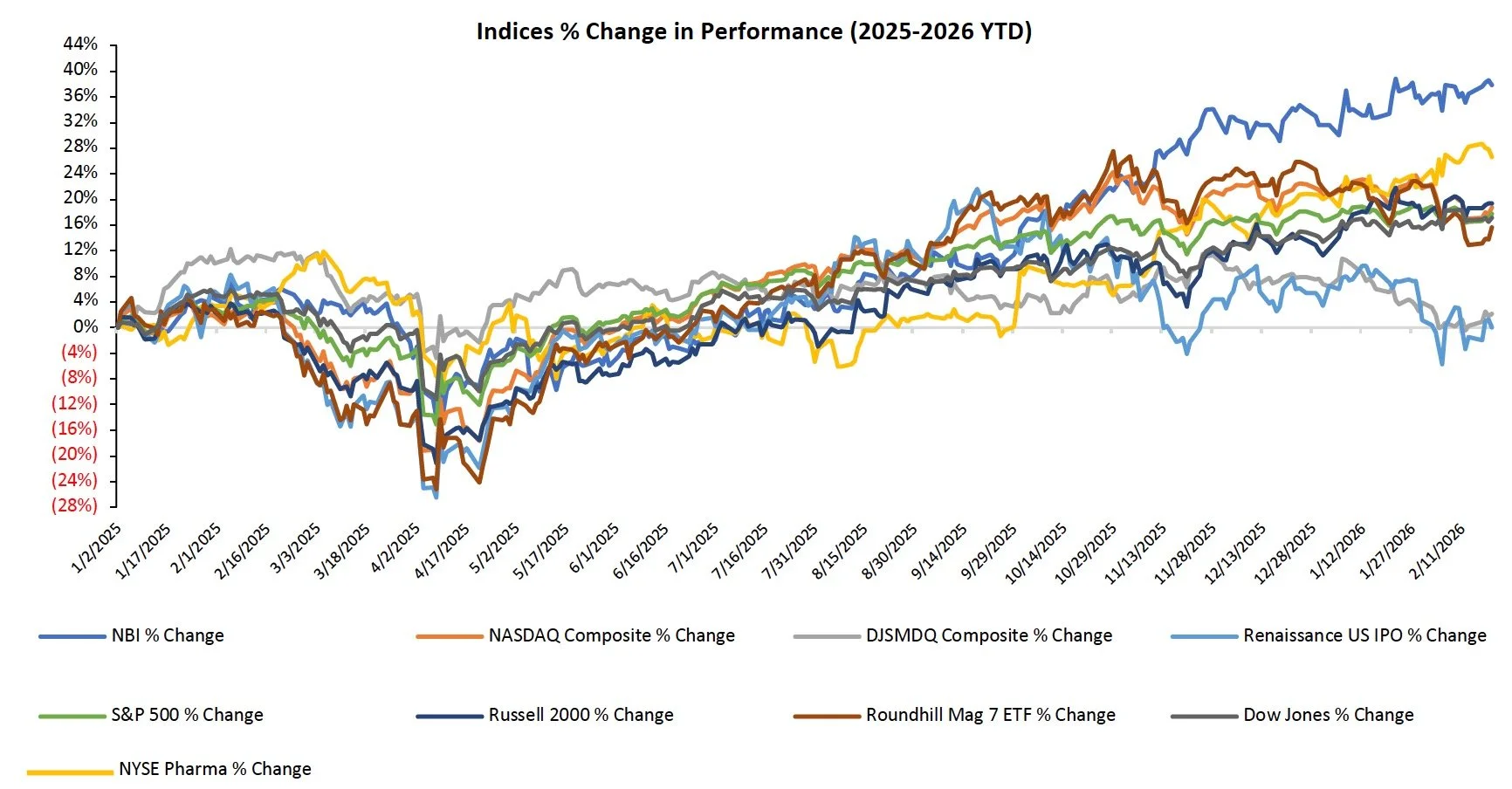

Markets Overview

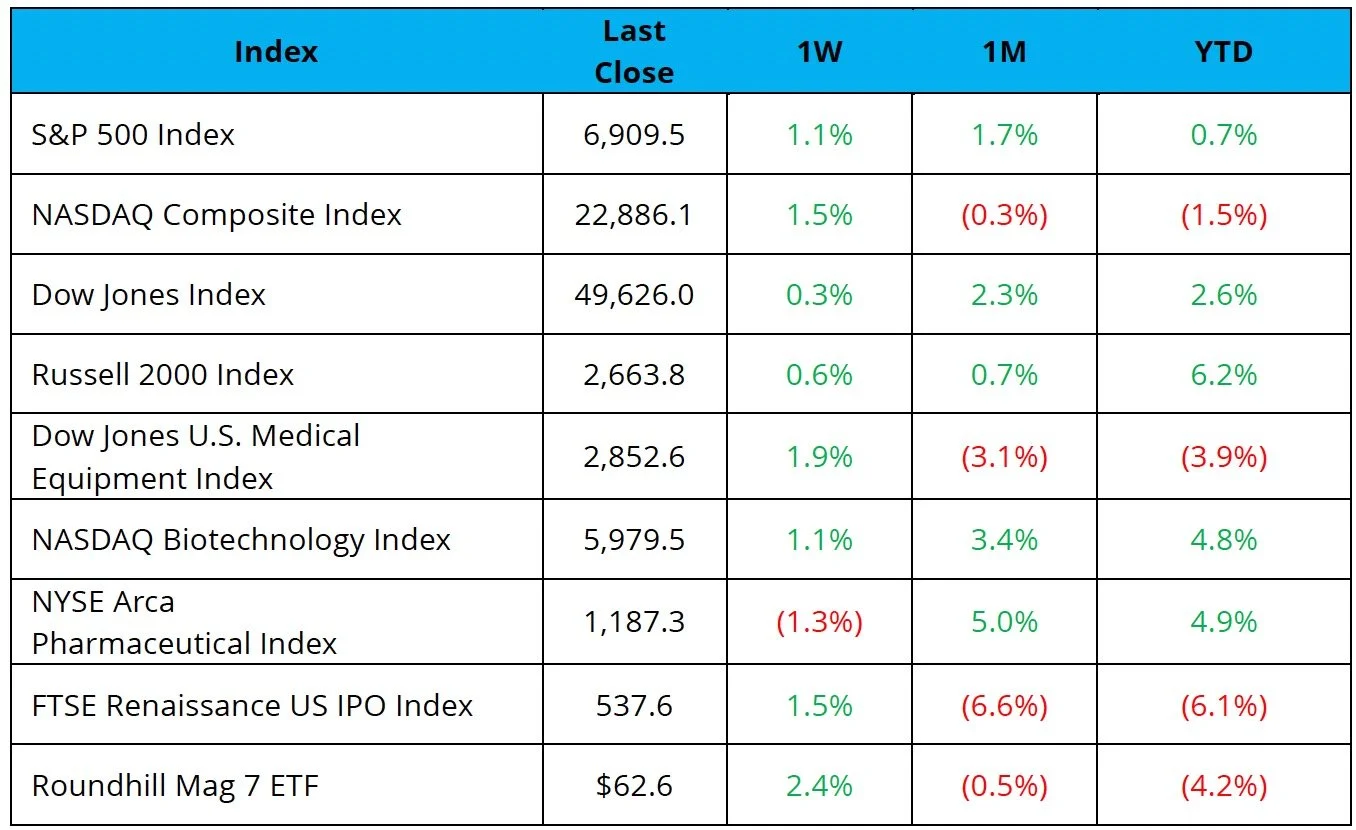

The S&P 500, Nasdaq, and Dow were up 1.1%, 1.5%, and 0.3%, respectively

The Supreme Court’s ruling on tariffs drove market returns for the week

The NBI was up 1.1%, while the NYSE Pharma Index was down 1.3% on the week

Notable changes in share price:

Compass Pathways (NASDAQ: CMPS): Shares were up 33.3% on the week after the Company reported positive Phase 3 results in treatment-resistant depression with their synthetic formulation of psilocybin

Sources: Pitchbook, Biomedtracker, and CapIQ

Equity Markets

Source: CapIQ

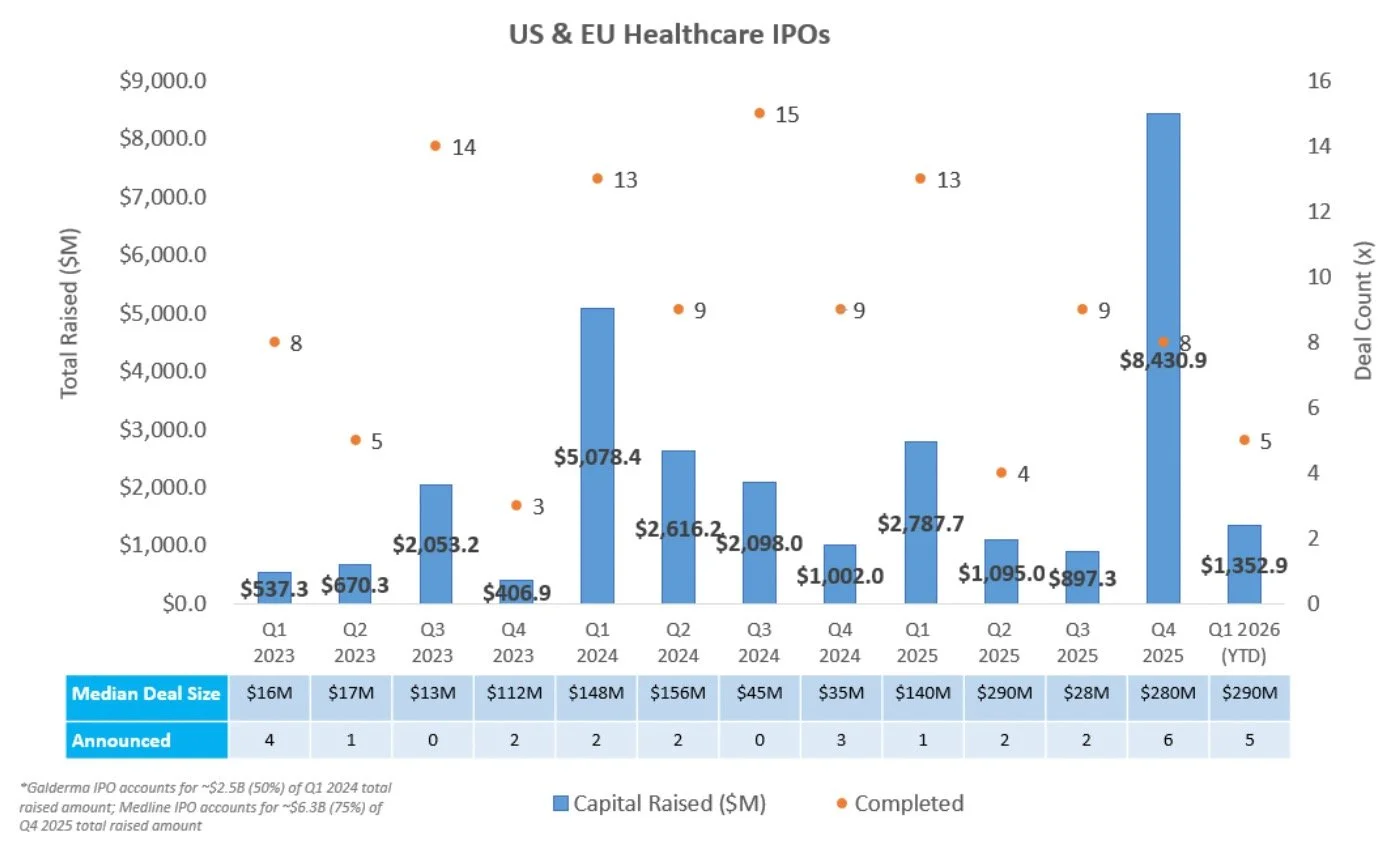

IPO Markets:

No companies completed an IPO last week

No companies filed an S1 intending to raise more than ~$100M

Generate Biomedicines is the only company in the queue targeting a raise at or above ~$100M; the remaining 24 additional companies in the IPO queue are pursuing raises below $40M

IPOs priced in 2025 and 2026 have generated a median and average return of 0.0% and 20.5% YTD, respectively - suggesting overall performance has been skewed by a small number of outsized winners. Notably, ~44% of newly public companies are trading above their offer price

After-Market Performance by Stage

Clinical-stage after-market performance (N=14): 42.1% (average), 31.6% (median)

Commercial-stage after-market performance (N=24): 14.5% (average), (6.7%) (median)

After-Market Performance by Sector

Biopharma (N=16): 24.8% (average), 5.1% (median)

MedTech (N=23): 17.9% (average), (6.4%) (median)

Source: CapIQ

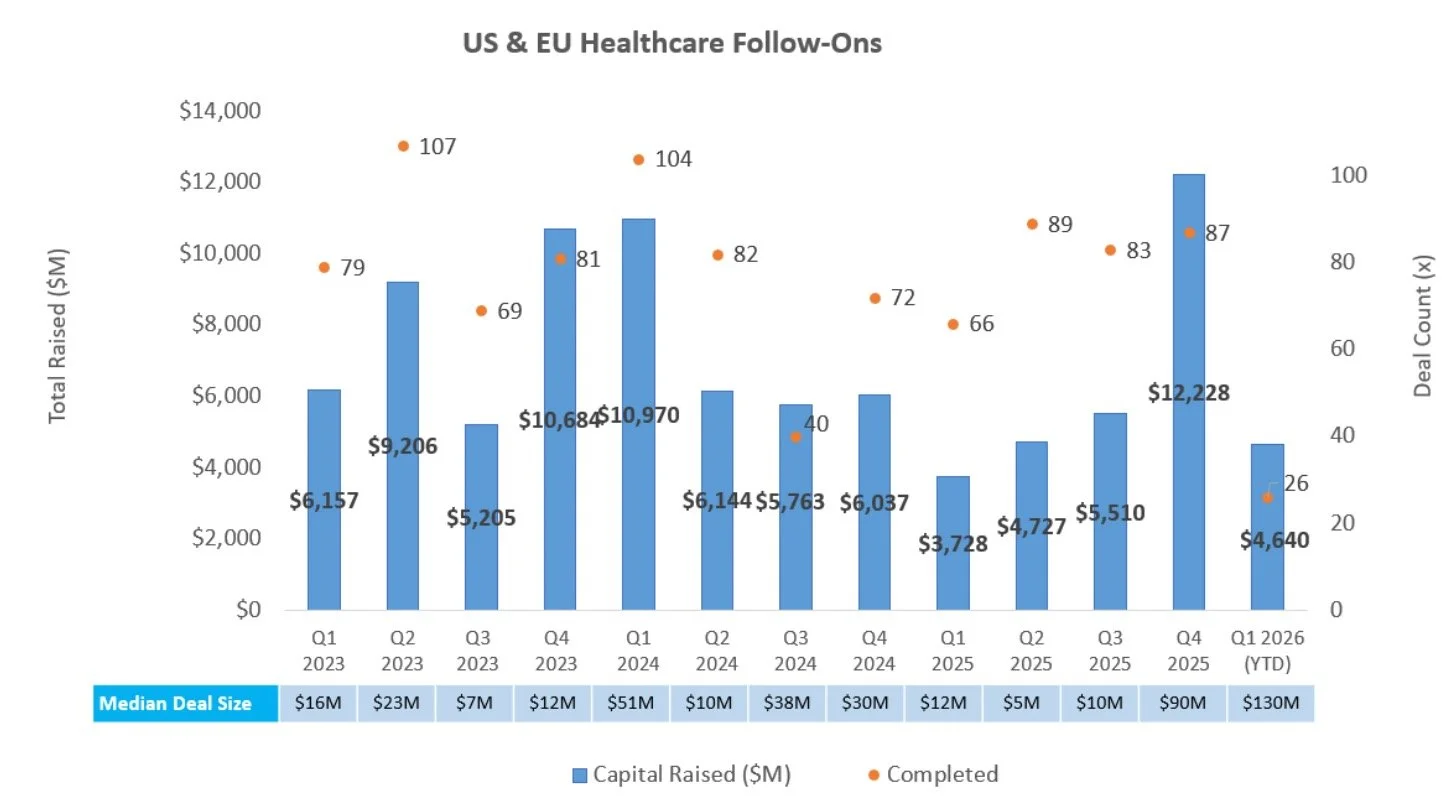

Follow-On Offering Markets:

There were two follow-on equity offerings totaling $140.0M last week, including:

Candel Therapeutics, Inc. (NASDAQ: CADL) raised $100.0M to support pre-commercialization and launch readiness for its multimodal biological immunotherapy platform, including aglatimagene besadenovec (CAN-2409) in localized prostate cancer (BLA-stage) and non-small cell lung cancer (Phase 3)

TriSalus Life Sciences, Inc. (NASDAQ: TLSI) raised $40.0M to support commercialization and clinical advancement of its oncology-focused drug delivery and immunotherapy platform, including the TriNav Infusion System for hepatic arterial infusion of liver tumors, the Pancreatic Retrograde Venous Infusion System for pancreatic tumors, and nelitolimod (TLR9 agonist) in uveal melanoma, cholangiocarcinoma, hepatocellular carcinoma, and pancreatic cancer (Phase 1)

Source: Biomedtracker

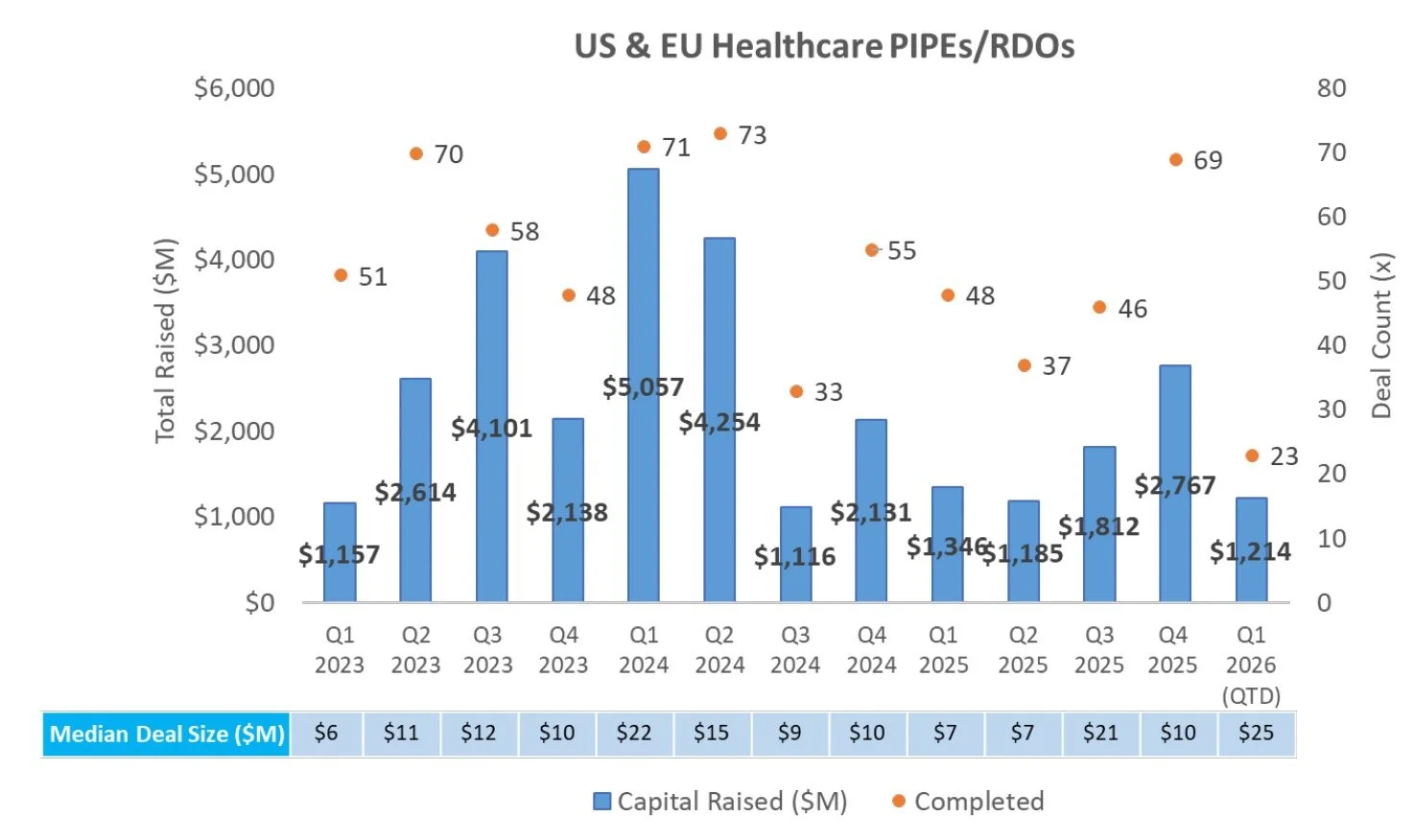

PIPE/RDO Markets:

There were five PIPEs/RDOs last week that raised an aggregate of $273.6M, including:

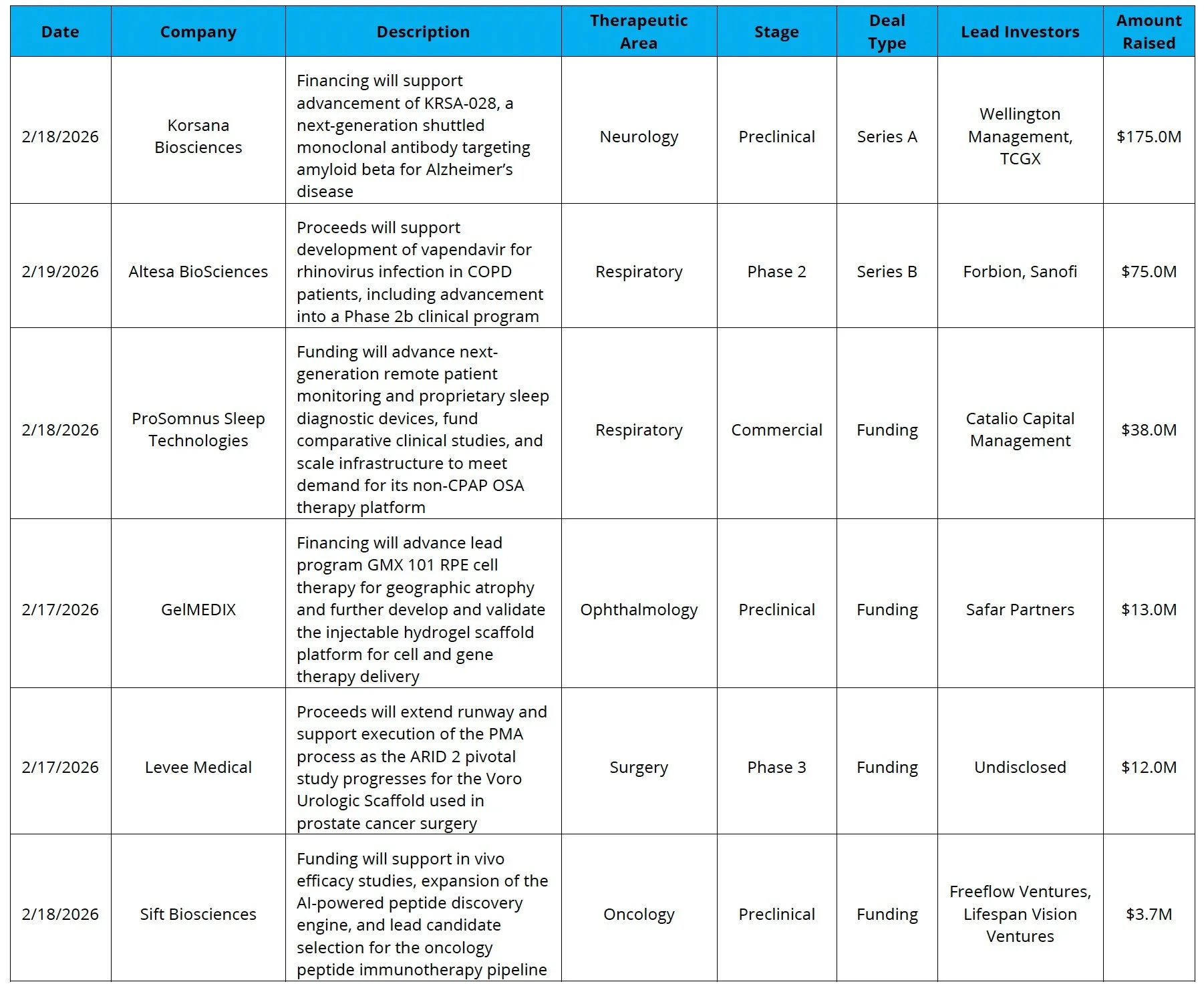

Sensei Biotherapeutics (NASDAQ: SNSE) raised $200.0M alongside its acquisition of Faeth Therapeutics. Proceeds will fund advancement of Faeth’s lead asset, PIKTOR, including Phase 2 topline data in second-line advanced endometrial cancer, and initiation of a Phase 1b study in HR+/HER2- advanced breast cancer. The round was supported by specialist biotech investors including Fairmount, RA Capital, and Vivo Capital

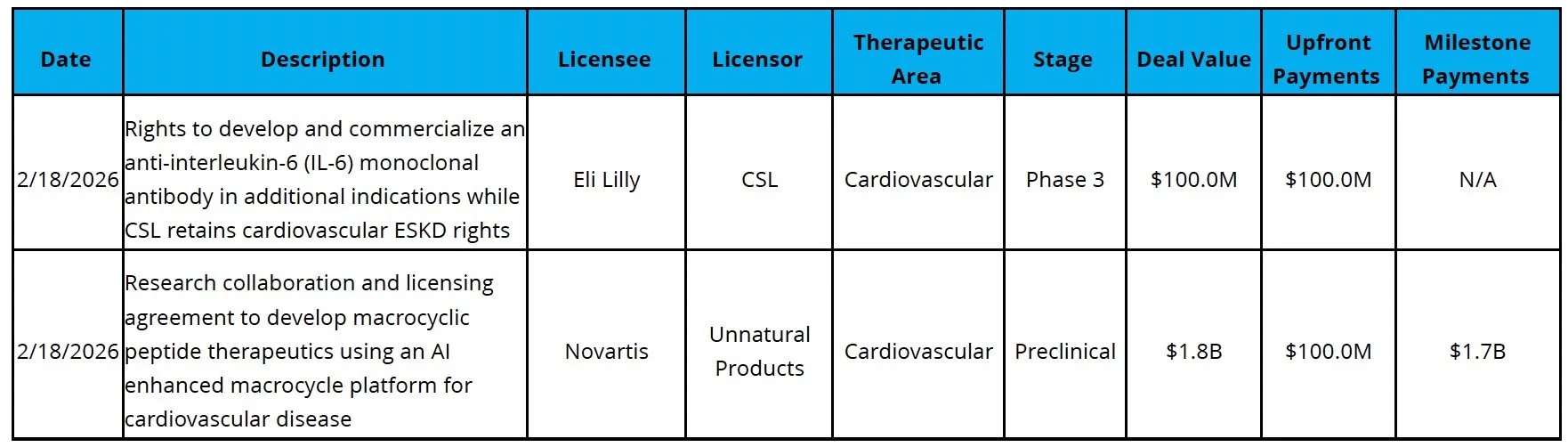

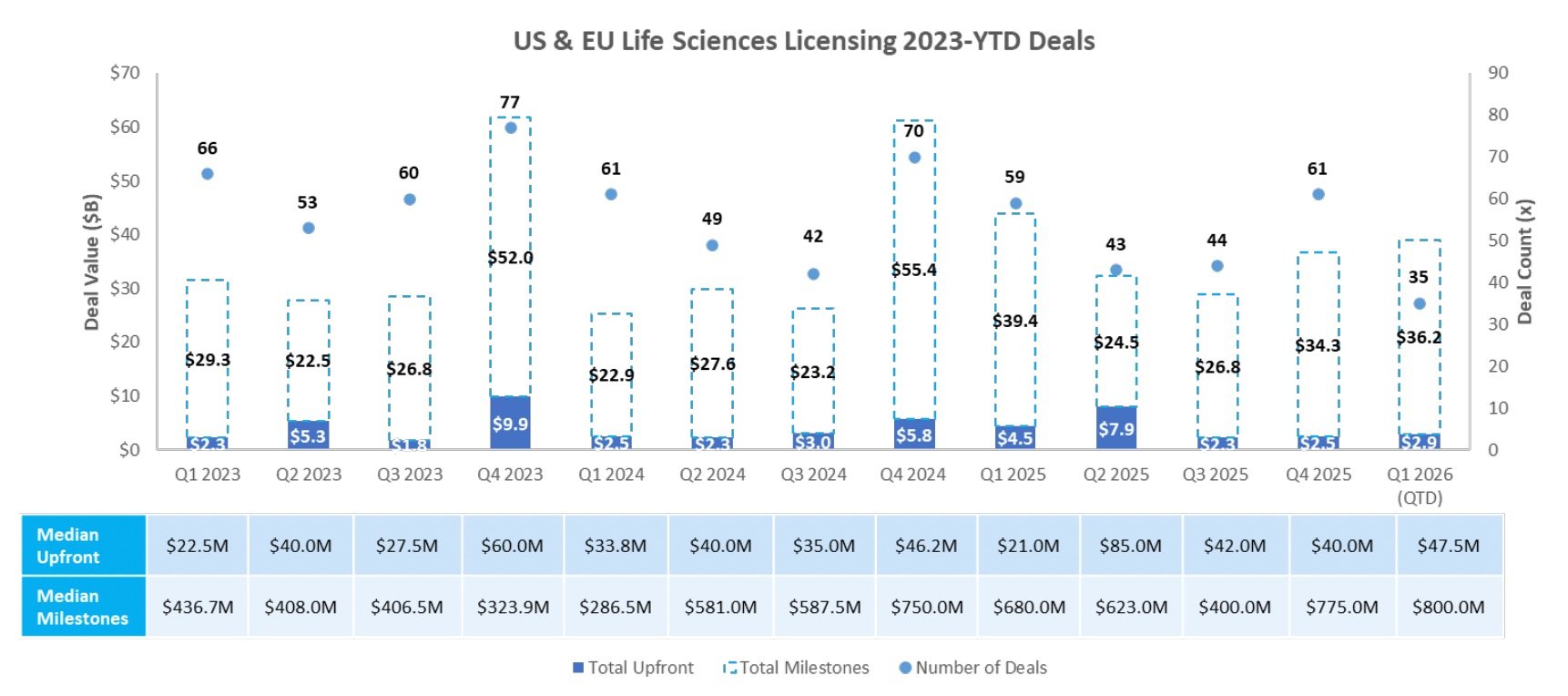

Licensing

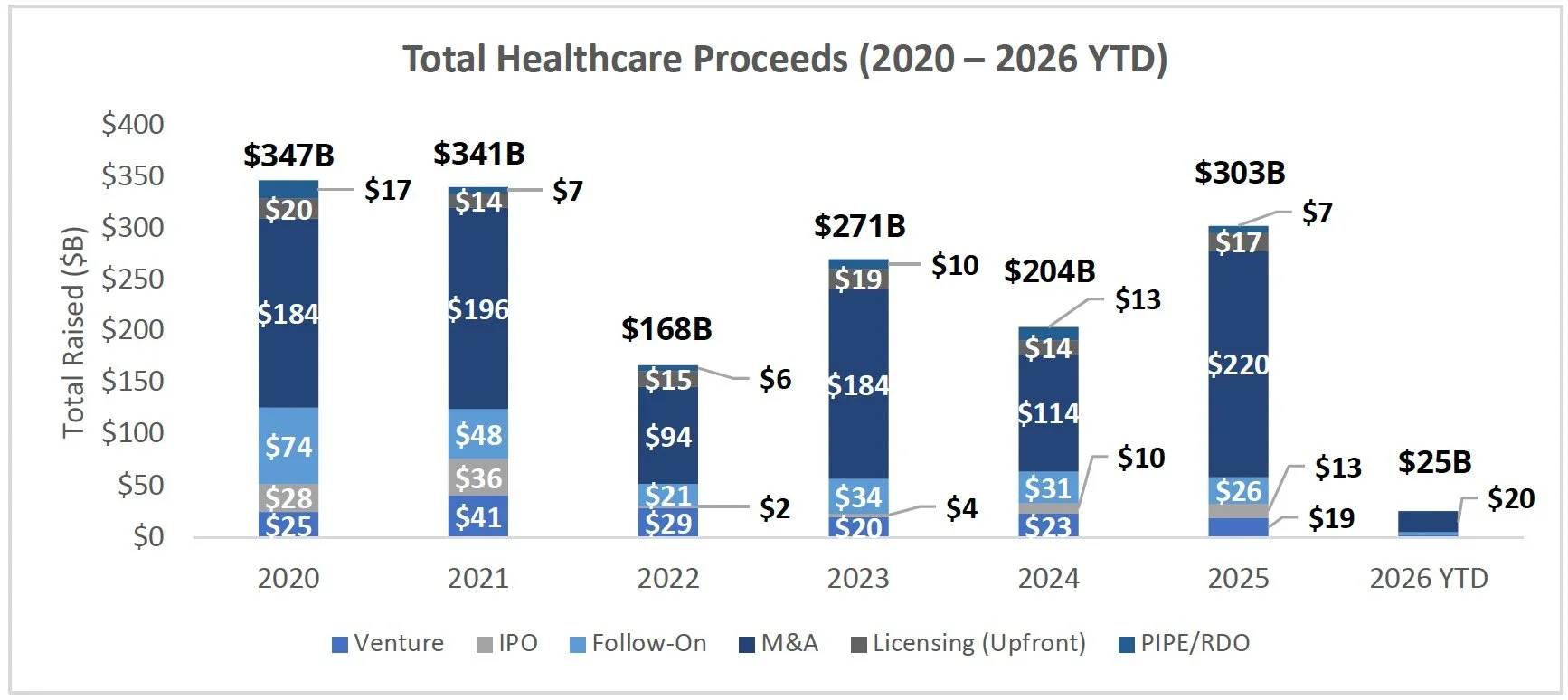

Sources: Pitchbook, Biomedtracker, and CapIQ

Sources: Pitchbook, Biomedtracker, and CapIQ

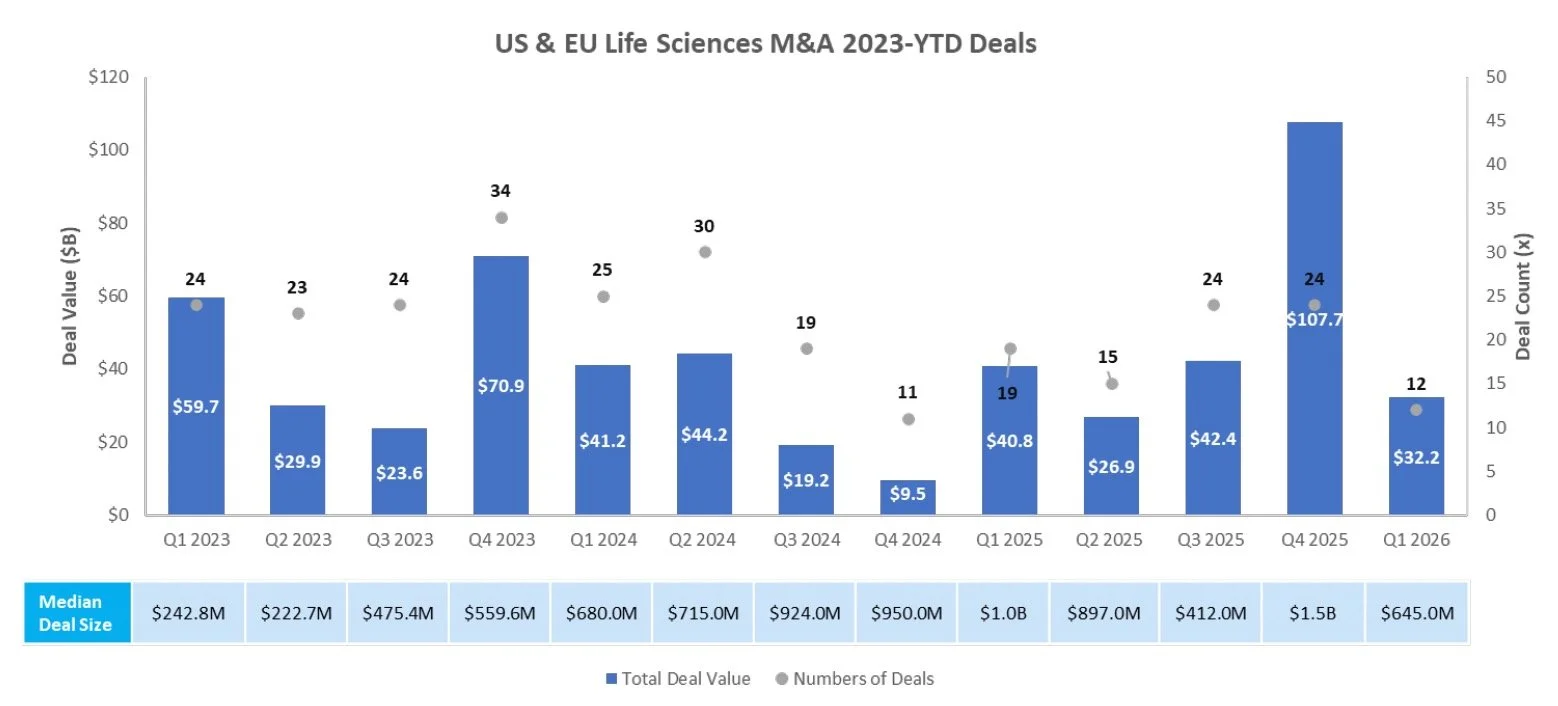

M & A

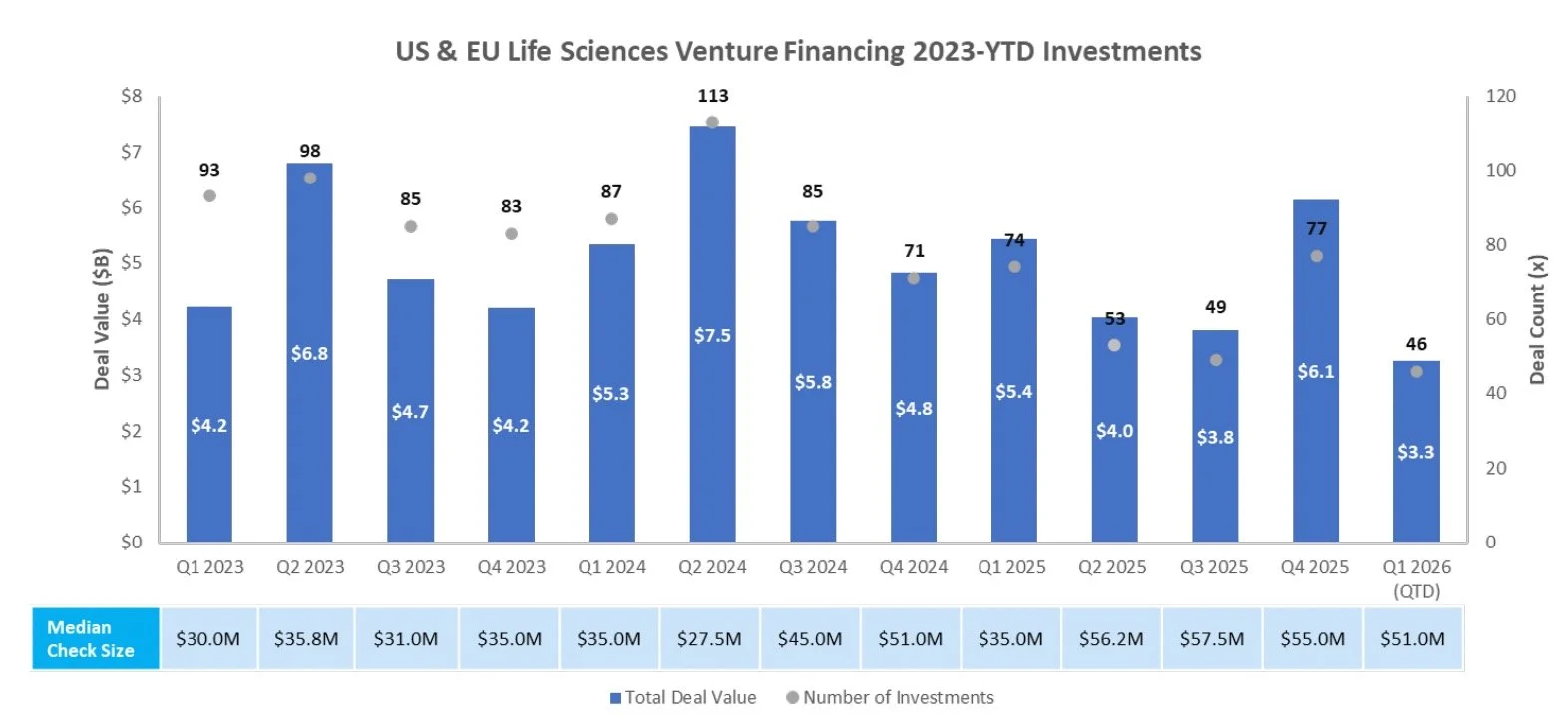

Venture Financing

Sources: Pitchbook, Biomedtracker, and CapIQ

Nordic-American Healthcare Conference

Registration is open for our annual healthcare equity conference, the Nordic-American Healthcare Conference (NAHC). This event brings together large and mid-cap public and private, IPO-ready life science companies from both the US and Nordic regions, along with US institutional investors. Participating companies will present their equity stories and showcase leading products that offer significant advancements in patient care, making them highly attractive investment opportunities.

Announcing our 2026 keynote speakers:

Day One: Scott Gottlieb, MD, former commissioner, US Food and Drug Administration

Day Two: Katrina Armstrong, Chief Executive Officer, Columbia University Irving Medical Center, Executive Vice President for Health and Biomedical Sciences for Columbia University

Nordic-American Healthcare Conference

March 25-26, 2026, New York City

A MAP to the Future of Targeted Oncology

The latest in our series of healthcare analyst reports focuses on the mitogen-activated protein kinase (MAPK) pathway, one of the most commonly perturbed signaling pathways in human cancer. Flowing from RAS to RAF to MEK to EKR, the pathway is a master regulator of cell growth and survival. Therefore, the amplification of proteins or mutation of key signaling domains are a common hallmark of cancer.

HEALTHCARE MARKET REPORTS ARCHIVE

About DNB Carnegie | Back Bay

DNB Carnegie | Back Bay drives global healthcare growth and innovation by providing a full range of strategic advisory and financing capabilities along the continuum of life science and healthcare company development. The DNB Carnegie | Back Bay Partnership is a marketing term referring to a strategic agreement between DNB Markets, Inc. and Back Bay Life Science Advisors. More information about the DNB Carnegie | Back Bay Partnership can be found here.

Securities products and services are offered in the U.S. through DNB Carnegie, Inc., a US-registered broker-dealer and a separately incorporated subsidiary of DNB Bank ASA. DNB Carnegie, Inc. is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Securities products and services are offered in the European Economic Area through DNB Carnegie.